The sidewalks along University Avenue in Palo Alto used to be a great place to do business.

For decades, there were several blocks where angels and VC partners camped out at café tables, taking pitches between lattes. The pandemic put a stop to that, however.

These days, when you have an opportunity to sell an investor on your idea, it will likely be via a video call, not over a croissant or a shawarma.

Considering how many calls investors take on a daily basis, “this new pitching model presents a new problem for founders,” says Flint Capital partner Andrew Gershfeld, whose firm reviews approximately “1,500 online pitches per year.”

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

To cut through the noise, he recommends that founders create a “teaser trailer” to share with their network before they begin approaching angels and VCs. Not a complete deck, but an embellished elevator pitch meant to whet investors’ appetites before you serve them the full meal.

Says Gershfeld, “since we’re not getting the same in-person meeting opportunities, this is how founders can hook investors’ attention.”

His post identifies the essential elements of a teaser trailer and includes a template for how to structure the presentation “for the best impact.” It’s remarkably detailed.

I empathize with Palo Alto café owners, but remote pitching is a skill every founder needs, and it’s an effective way to level the playing field when it comes to fundraising. Start here.

Have a great weekend,

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

April 5 Twitter Space: “How to Pitch Me” with Arvind Gupta

On Tuesday, April 5 at 2:30 p.m. PT, I’m hosting a Twitter Space with Arvin Gupta, a partner at Mayfield Fund.

We’ll discuss general pitching strategies and talk about what he’s looking for at the moment before we take questions from the audience, so please click here to set a reminder so you can join the conversation.

5 things first-time founders must remember when working with VCs

Image Credits: Carol Yepes (opens in a new window) / Getty Images

Nothing beats experience like experience, which is why we were happy to run this article written by Zach DeWitt, winner of the 2013 TechCrunch Meetup and Pitch-off.

DeWitt, who became a VC after selling Drop, Inc. to Snapchat in 2016, shares five essential lessons for first-time founders wandering in the wilderness in search of an investor who’ll be “a true partner.”

There’s an inherent power imbalance when asking a stranger for money, but “VCs should work to earn your trust,” writes DeWitt.

“In many ways, it’s like finding the right spouse.”

Why Nigeria leads the way in YC’s participation in Africa

Image Credits: TechCrunch

With 18 of the 24 African startups in Y Combinator’s Winter 2022 batch hailing from Nigeria, the country is showing the depth and breadth of its technical talent.

In a well-researched report, Tage Kene-Okafor examines how factors such as YC going remote, increased investor interest, and relationships with previous Nigerian YC graduates helped this bustling ecosystem direct more companies into the accelerator than many other tech markets this year.

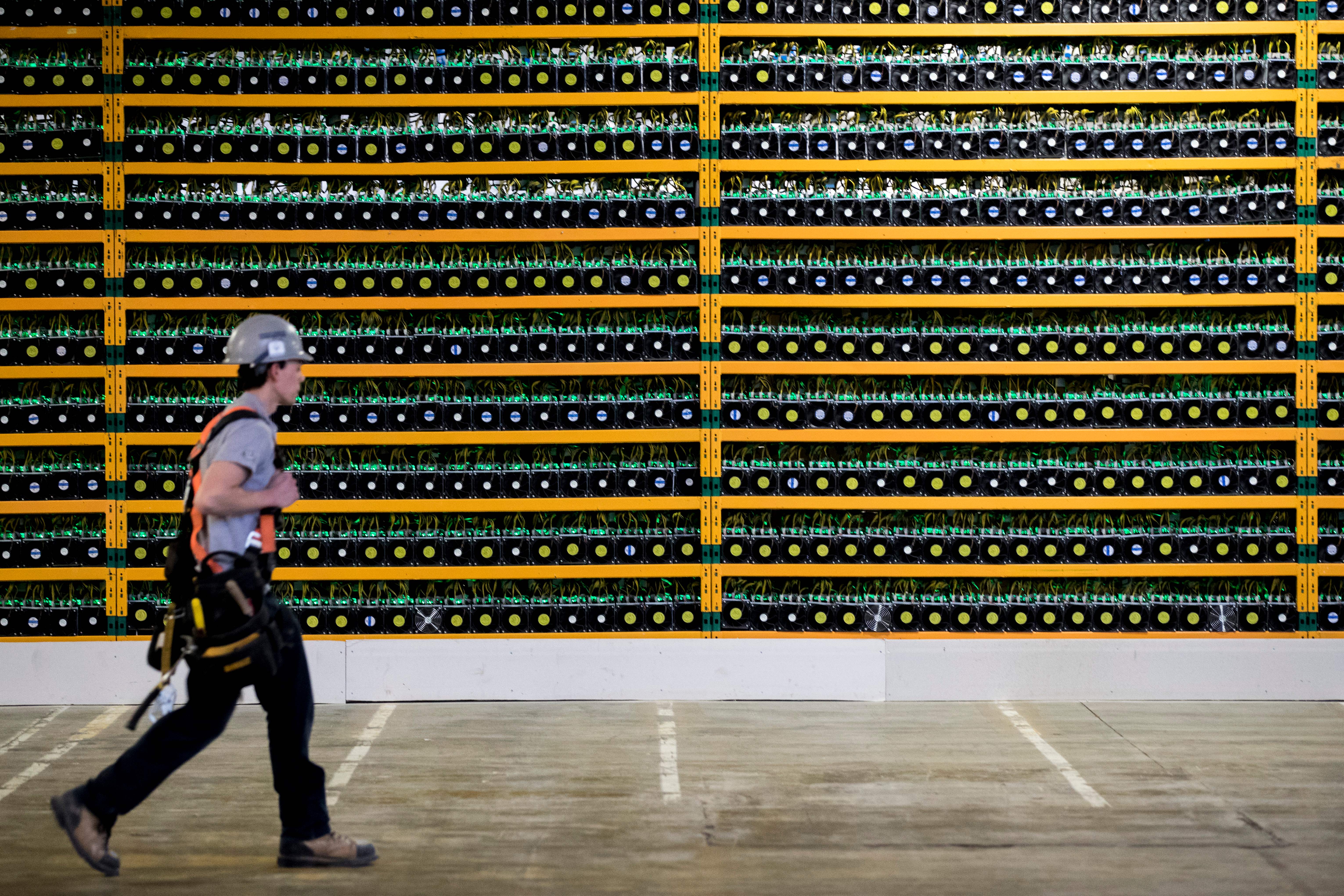

Bitcoin miners are dusting off Kentucky coal towns, spurred by state crypto tax incentives

Image Credits: LARS HAGBERG/AFP (opens in a new window) / Getty Images

To extract fuel buried hundreds of feet below, the coal industry reshaped Kentucky’s landscape, flattening entire mountaintops and using the waste material to fill in creeks and valleys.

But now that demand for coal is dropping as utilities shift to cleaner energy sources, the state is using incentives to attract Bitcoin miners, reports Jacquelyn Melinek.

In 2022, Kentucky represents “18.7% of the United States’ total Bitcoin hashrate,” she writes.

Today, Bitcoin miners are setting up shop in abandoned factories, warehouses and sure, former coal mines around Kentucky to use coal-generated power to run their rigs.

“Bitcoin miners are buyers of last resort for energy,” said Nick Hansen, CEO of Bitcoin hashrate management platform Luxor.

“They’ll buy any energy up to a certain price and they can do it anywhere the internet is available.”

Our favorite startups from YC’s Winter 2022 Demo Day, part 1

Image Credits: TechCrunch/Bryce Durbin

Y Combinator’s Winter 2022 Demo Day this year featured 414 startups from 42 countries across over 80 sectors.

That’s a lot of companies to consider, but in keeping with TechCrunch tradition, Alex Wilhelm, Natasha Mascarenhas, Devin Coldewey, Christine Hall and Mary Ann Azevedo list their favorite startups from day one.

Our favorite startups from YC’s Winter 2022 Demo Day, part 2

Image Credits: TechCrunch/Bryce Durbin

Day two of Y Combinator’s W22 uncovered a few trends: many startups are building for the Southeast Asian market, fintech is still a winner, Nigerian startups are hitting it out of the park, and India was again well-represented.

To wrap up our coverage, Christine Hall, Alex Wilhelm, Devin Coldewey and Mary Ann Azevedo selected a few companies to watch from the startups that presented on day two.

Despite tooling limitations, DAO optimists see new use cases for a democratic, token-based future

Image Credits: Boris Zhitkov (opens in a new window) / Getty Images

Many online communities are looking to decentralized autonomous organizations (DAO) to raise funds so they can bring their ideas to life, but without tools and software to make it easier for people to participate, adoption has been slow.

However, some investors and consumers are hopeful that as tooling develops, DAOs will generate more use cases than individuals pooling their resources to buy NFTs or objects of popular interest, reports Jacquelyn Melinek.

“There will be a lot of evolution [for DAOs] as we start to fit the technology into human behavior,” Sarah Wood, head of operations at Upstream, said. “I see a world where you can use a DAO for your book club, or whatever you want.”

Dear Sophie: What can we do to help employees who are Ukrainian citizens?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

We have several employees who are Ukrainian citizens; one is on OPT and the other is on STEM OPT. We want to make sure they can continue to live and work in the United States.

Our most immediate concern is for the F-1 student whose OPT status is expiring in June. We registered her in this year’s H-1B lottery and are hoping she’s selected this week to apply.

In the meantime, we heard that Ukrainians are eligible for TPS. Does that include F-1 students on OPT? Should our other Ukrainian employees also apply for TPS even though their work visas are good for a few more years?

What is the process for applying for TPS?

— Strong Supporter

Goldman Sachs’ OTC Bitcoin options trade can pave way for more institutional involvement

Image Credits: Richard Drew/AP

Goldman Sachs has been active in crypto for a while now, but its Bitcoin options trade last week may have paved the way for more institutional investment firms to begin exploring the cryptocurrency ecosystem, pending regulatory clarity, reports Jacquelyn Melinek.

“The trade itself doesn’t mean much, but the fact that it happened and opens the ability for Goldman Sachs to trade this risk is massively significant, and this is just the beginning,” said Tim Grant, head of Europe at Galaxy Digital.

“As soon as you get into that part, that set of hurdles, you’re intellectually and operationally free to do other things. It’s not the trade itself, it’s that this will allow us to go in a multitude of directions.”

The how and why of raising OT security capital

Image Credits: SOPA Images (opens in a new window) / Getty Images

Operational technology, which allows critical infrastructure to operate 24×7, is one area facing significant cybersecurity risk, and with the U.S. government taking steps to mitigate the threat, security firms addressing this area stand to benefit the most, writes Matt Gatto, a managing director at Insight Partners.

In a guest post for TC+, he explains how recent attacks on critical infrastructure, pending regulation, and rising concerns over Russian cyberattacks are creating new opportunities in OT.

“It’s a good time for OT security providers to seek funding,” says Gatto. “The combination of increasing OT cyberattacks and the emergence of government regulations is fueling a funding frenzy.”

Co-founders of Ukrainian startup Delfast discuss navigating through a crisis

Image Credits: Bryce Durbin

Founded in 2014, e-bike startup Delfast has offices in Los Angeles and Kiev.

But after Russia invaded Ukraine, co-founders Daniel Tonkopi and Serhiy Denysenko started relocating family members and employees, finding ways to support their country’s defense, and, “running a startup during a war,” reports Rebecca Bellan.

Daniel Tonkopi:

We all work now in two shifts. The first shift is our usual work and the second shift is our voluntary work. In Kyiv, half of our engineers are at war now. They are in the Territorial Defense Forces, which is like an official civilian army.