Late-stage SaaS startups may be in the most trouble when it comes to changing valuation marks among technology companies, new data indicates.

A report from Silicon Valley Bank (SVB) exploring first-quarter software startup trends details that late-stage SaaS valuations in the United States scaled the most rapidly in 2021, closing out the year with the highest revenue multiples of their peer set.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It’s well-known that the rapid inflation of the value of software stocks in the wake of the pandemic’s onset in 2020 and through much of 2021 provided rocket fuel to late-stage startup valuations. But just how much damage late-stage SaaS startups may have ahead of them is only now coming clear.

Recall that the market is already seeing an uptick in layoffs and some unicorns are looking to re-price their equity for employee retention purposes.

Is it ironic that the startups whose valuation rose the most appear set to endure the largest correction? No. It’s causal. Let’s talk about why.

Is it ironic that the startups whose valuation rose the most appear set to endure the largest correction? No. It’s causal. Let’s talk about why.

What goes up

We’re on the precipice of first-quarter venture capital data, which means that it’s nearly time to retire 2021 results as temporally pertinent.

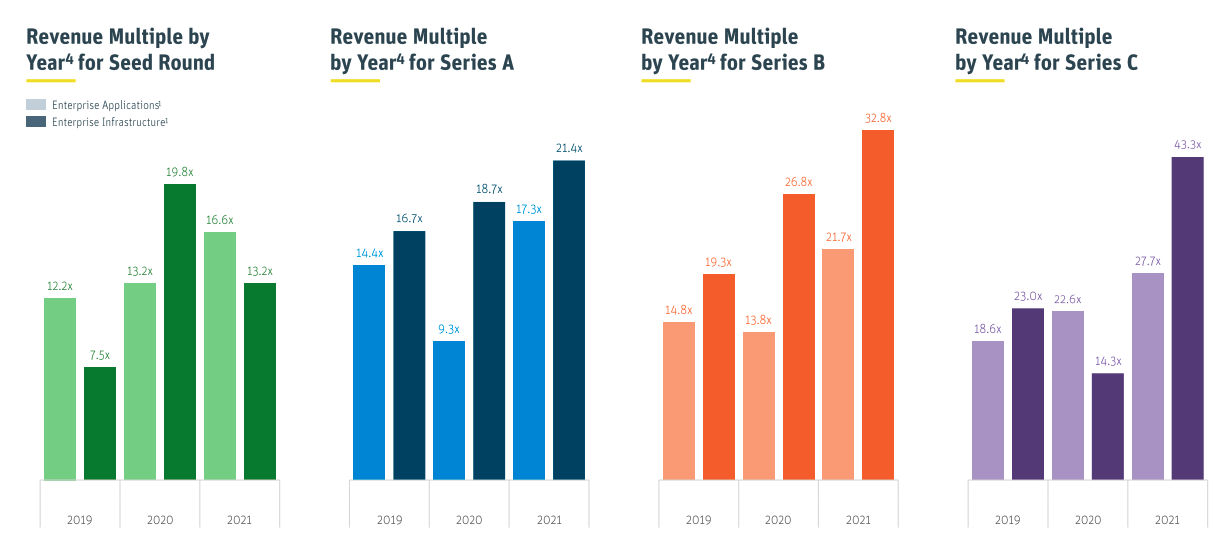

But under the deadline, observe how SVB details how revenue multiples scaled for two subsets of the United States’ SaaS market — enterprise apps (lighter colors) and enterprise infrastructure (darker colors):

Image Credits: Silicon Valley Bank. Used with permission.

From Series A through C, there’s a clear trend of rising multiples. In 2021, for example, SaaS startups building enterprise applications were worth 17.3x revenues at Series A, 21.7x at Series B, and 27.7x at Series C. For enterprise infra startups, the SaaS multiples awarded in 2021 were even steeper, coming at 21.4x for Series A, 32.8x for Series B, and 43.3x for Series C.

But SVB considers Series C not late-stage, so we have a little more work to do. Our question at this juncture is whether we can see an indication that later-stage valuations for SaaS startups scaling along similar lines to Series C startups during 2021.

We can:

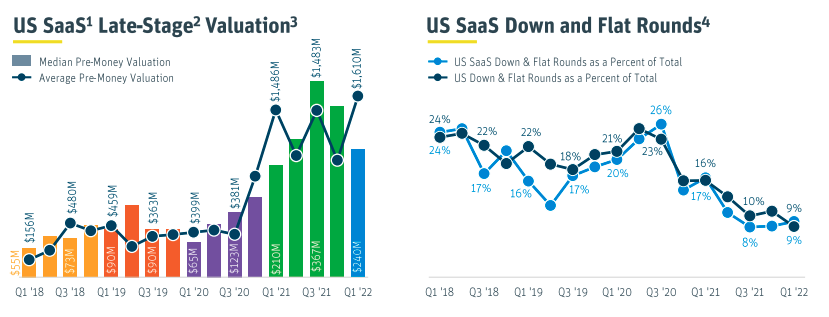

Image Credits: Silicon Valley Bank. Used with permission.

The chart on the left is the dataset we care about. Observe how from Q1 2020 through Q3 2021 the median late-stage valuation for U.S.-based SaaS startups — a large fraction of the aggregate domestic and international startup cohort — went up every single quarter, peaking at $367 million on a pre-money basis.

From there it’s been downhill, with Q1 2022 only counting data through the end of February. But what is clear despite the paucity of data is that from a peak, things are coming back to Earth. The declines in late-stage SaaS valuations closely track stock market declines over the same time period.

So what?

Consider the trend we saw from Series A through Series C in 2021 data, with revenue multiples scaling into the stratosphere the later we went. Now, combine that pattern — the later-stage a SaaS startup was last year, the more expensive it was — with our second chart and you can quite literally feel the tension that the most mature software unicorns are enduring.

But we’re not seeing too much damage. Not yet at least. The flat and down-round counter remains at or near historical lows, as we can see above. How far that chart changes in the coming quarters will prove a good indicator of how many late-stage SaaS startups are actually struggling to raise more capital. That it hasn’t moved much, yet, feels more calm-before-the-storm than an indication of an all-clear.

TechCrunch is currently trying to square the circle between exuberant early-stage valuations, especially at the seed stage — this week’s Y Combinator startup pricing is a good data point — and increasingly conservative late-stage valuations. For startups looking to raise later-stage capital, it could be a harder lift to raise more at an attractive price this year.

But for late-stage startups stuck between a frozen IPO market and the above dynamics in late-stage SaaS pricing, we may see more appetite for venture debt and similar instruments as unicorns look for ways to snag more capital without taking a valuation cut. Some will just bite the bullet and get the pain over with.

Let’s see what happens in Q2, but the storm clouds do appear to be gathering.