Investment in climate tech is heating up almost as fast as climate change itself. In 2021, climate tech startups received $40+ billion across more than 600 deals. That’s more than double the capital investment made in 2020.

As S&P Global recently reported, corporate sustainability efforts are under increasing scrutiny from investors, regulators and the public at large — placing corporations in the spotlight to actually behave differently. As a result, many corporate venture capital firms — particularly those with strong Environmental Social Governance (ESG) policies — are increasingly interested in startups focused on climate change tech.

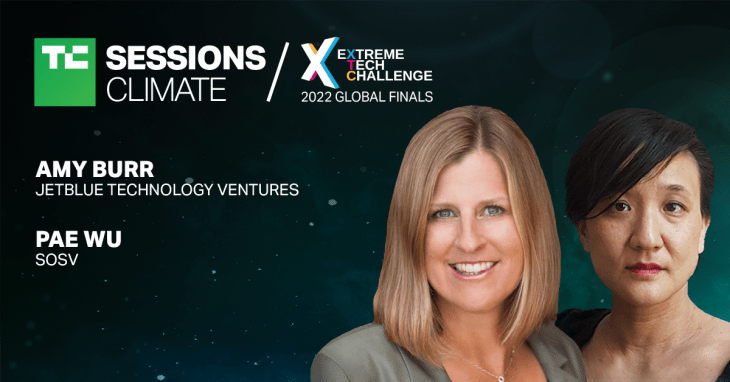

Our existential climate crisis, the climate tech that could mitigate it and the VCs committed to funding it will intersect in two different presentations at TC Sessions: Climate 2022 (presented by Extreme Tech Challenge) in Berkeley, California on June 14.

We’re thrilled to announce that Amy Burr, president of JetBlue Technology Ventures (JTV), and Pae Wu, partner at SOSV and CTO at IndieBio, will helm two different panels addressing climate tech investment, corporate social responsibility (CSR) and ESG.

Burr leads JTV at a time when JetBlue has increased its measurable steps to reduce its effects on climate change and to achieve net zero carbon emissions by 2040. Among other efforts, and a first for JetBlue, the company now ties ESG targets to bonuses for its senior leaders.

As president, Burr shapes the strategic venture investment direction of JetBlue and facilitates integration of successful startup programs into the airline’s overall corporate innovation initiatives. A sample of JTV’s portfolio companies include Joby (trading publicly), Lacuna, Turnkey (acquired) and Universal Hydrogen.

Prior to joining JTV, Burr — one of the original founders of Virgin America — served at VX in various executive roles and led the merger integration with Alaska Airlines.

At both SOSV and IndieBio, Wu is responsible for portfolio management and technical oversight. She’s focused on funding early-stage climate startups, along with tracking the trends and timing of hot, climate-specific industries. A sample of SOVO portfolio companies include Apix, New Age Meats, Perfect Day and Re-Nuble.

Prior to joining IndieBio, Wu served as the scientific director of Alpha, Telefónica’s Barcelona-based moonshot factory. Her earlier career includes stints as science director at the U.S. Office of Naval Research (Global) and as a technical consultant at the Defense Advanced Research Projects Agency (DARPA).

Don’t miss this opportunity to hear from JTV’s Amy Burr and SOSV’s Pae Wu. You’ll gain a deeper understanding of how investors think when it comes to investing in climate tech, and you’ll learn how to — and why you should — build ESG policies into your startup from day one.

TC Sessions: Climate 2022 is all about the growing wave of startups, technologies, scientists and engineers dedicated to saving our planet and, of course, the investors who finance them. Join us in-person on June 14 at UC Berkeley’s Zellerbach Auditorium. Register now and save $200.