As more people moved to remote work over the past few years, there was also an uptick in people choosing freelance or contract work, leaving companies to figure out how to manage that worker segment.

If you are one of those having to find work and manage payments, tax filings and invoices, there’s help from a number of startups — for example, Bill.com and Deel that are business-facing and freelancer-focused ones AfriBlocks, Malt, Worksome, Meaningful Gigs, SteadyPay and Contra — that have developed different approaches to making this easier.

The latest to receive funding to continue developing its financial infrastructure for the freelance economy is Archie, which raised $4.5 million in funding from B Capital Group, Mac Ventures, Worklife Ventures, Hof VC, Dash Fund, Day One Ventures, Behance founder Scott Belsky and other company founders from the likes of Cameo, Blank Street, Ramp, BloomTech and Eight Sleep.

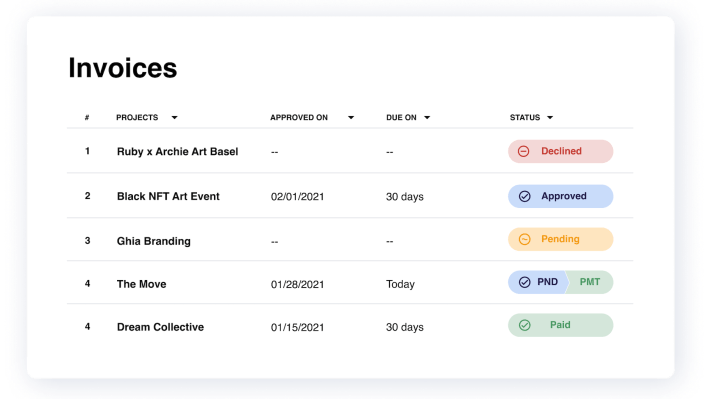

Co-founders Yunas Reguero, Cassandra Aaron and Dylan Hattem started Archie last April and officially launched three months later. What they’ve developed is a collaboration hub for businesses working with freelancers to manage all that comes with it — onboarding, contracts, payments, accounting and tax filings — with the ability to pay freelancers in one click.

Archie co-founders Cassandra Aaron and Yunas Reguero. Image Credits: Archie

Aaron and Reguero, who have been friends for years, saw the trend of over half of the working population shifting to freelance, with that number likely to surpass 90 million by 2028. Despite that opportunity, they thought freelancers still lacked access to financial services and were at the mercy of companies treating them like vendors and paying them in 30 days or longer for completed work.

“We are on a mission to ‘unfuck’ the freelance economy,” she told TechCrunch. Aaron estimates that Archie is saving its customers hours of time that they can now use to focus on growth-related opportunities.

Their approach is catching on. Since last April, Archie is seeing $15 million in payment volume run-rate, up eight times since July 2021 alone. In addition, their growth is driven in large part by word of mouth — freelancers taking Archie with them to new employers as their preferred method of doing business with clients.

The new funding enables the company to boost its engineering team and technology development as it starts to amp up its efforts on the growth side, Reguero said.

Their plan going forward includes leveraging its structured knowledge about payments to underwrite products and build additional financial services for freelancers, including banking, savings, credit and income verification.

“We will continue to focus on growth, building out different layers of the platform,” Reguero added. “That includes providing ways for contracts and other forms to get signed before someone comes on, as well as investing in international payments so businesses have the ability to pay contractors in other countries. Ultimately, we want to make this as seamless as possible.”