The Yuga Labs investor deck from February is a fascinating document, bringing together gaming, a new currency, and an ever-growing pool of digital assets that can be bought and sold by fans of Yuga’s well-known NFT project Bored Ape Yacht Club.

I ran through the deck last night and again this morning to get a better grip on the company’s financials, expectations, and business promise. But we can’t really get into those matters until we talk about what the company has in mind — recall that Yuga raised $450 million at a $4 billion valuation, a deal that it announced earlier this week.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

No one is having more fun than the web3 folks today as they find themselves in the nearly unique position of seeing their current fascination (blockchain-based assets and related applications) also become the object of ample investor interest and consumer demand. That doesn’t happen too often.

With popular NFT projects under its belt, and some evidence of ability to use one collection of digital assets to grow another, Yuga has ambitious plans for the coming years. It also has a fresh half-billion in capital to help power its vision. This morning, let’s talk about what it wants to build, and how the economics shake out.

With popular NFT projects under its belt, and some evidence of ability to use one collection of digital assets to grow another, Yuga has ambitious plans for the coming years. It also has a fresh half-billion in capital to help power its vision. This morning, let’s talk about what it wants to build, and how the economics shake out.

If things go according to plan, Yuga is about to make a lot of money.

Universe of the Bored Apes

Yuga wants to build something that “expands the universe” of Bored Ape Yacht Club, but “invites the larger NFT community” at the same time. More simply, the company wants to build atop its early success while making room for wider participation. That’s pretty reasonable.

Yuga is not big on present-day efforts to build metaverses. Missing in today’s metaverse efforts, per the company, are things like “purpose,” “shared goals,” and “real stakes,” along with “connections,” “decisions,” and a “story.” It sums up its view by noting that a simple social hub set in a virtual world is not enough to command consumer attention over a longer time horizon.

That’s true enough, or Second Life would have become the metaverse years ago and we’d all be living within its digital borders.

Given its complaints about current metaverse products, Yuga says it is not building a metaverse. Instead, it’s going to build an “interoperable gaming metaverse,” or “MetaRPG.” This, its deck says, will bring together “storytelling, pop culture, taste, and fun in just the right amounts.”

How does the company do that? It “unifies everyone” by building something “truly decentralized and interoperable.” That doesn’t actually answer the question, so we’ll have to dig a little more.

Happily, Yuga gives us a little more detail in a later slide, saying that it is creating a “brand new gaming experience where money is real, you actually own your land and resources, everyone can bring their own NFT character, and anyone can create in-game assets.”

The Second Life parallels at this point are inescapable, as you could do things like own land in the game, and make stuff and sell it. But what Yuga is building won’t be a single game, it appears, but instead a collection of games, both “mini” and “rich.”

From here, we get into the money side of things.

Money with a capital ‘M’

APECoin, recently launched, features prominently in the Yuga pitch. The company calls APECoin a “unifying” digital asset that will “power [its] app store like marketplace.”

Yuga has planned quite the catalyst event to kick things off in the its gaming metaverse world. This appears to be a story in which the universe comes into being, leading to pure-energy, interdimensional beings (“celestials”) getting tired, and resting. Resting celestials become stars and other things that we see in the universe today. One “race” of celestial remains, the “Kodas.” The Kodas have enough “remaining cosmic energy” to birth one more “microverse.” This involves bringing Bored Apes and other “interoperable” NFTs into a new metaverse.

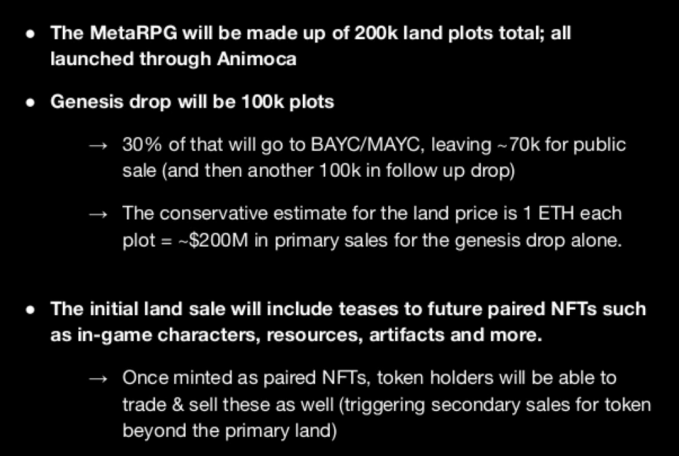

To kick off the “MetaRPG,” Yuga is going to host a huge digital land sale, with individual plots that “correspond” to “real land” in its game.

Digital land is worth something, and the market has signaled so through projects like Decentraland. So why not sell some? We’ve finally reached the way Yuga expects to make lots of money in 2022:

The plots will be akin to other NFT groups, generated and possibly containing something that makes them rarer. In the case of the land sales, a Koda could be present. A total of 10,000 Kodas will be in the land parcels. They are also generated bits of art, like the original Bored Apes, if smaller.

What next, after the land sale? Per Yuga, “after the land sale, the game economy will begin with owners taking stock of what they have[, and] beginning to trade, horde, buy, and sell.”

It’s fair to say that economy simulators are a big market. I don’t know if the econ sim fanbase is what Yuga is aiming at, but it sounds like a lot of the MetaRPG is a way to create more digital assets to sell, and collect fees from secondary transactions. Indeed, despite a roadmap of things to come — APE Fest, games, merch, and other NFTs — Yuga expects to generate a little more than 66% of its 2022 revenues from land sales.

The company’s financial presentation is a little non-traditional, but shakes out as follows for last year:

- 2021 revenue: $137.58 million

- 2021 gross margin: 95.5%

- 2021 net income (described as “net revenue”): $127.11 million

And for its 2022 goals:

- 2022 revenue forecast: $539.30 million

- 2022 gross margin forecast: 98.8%

- 2022 net income forecast (described as “net revenue”): $455.20 million

In short, Yuga labs is going to sell a lot of digital assets this year, and expects to make a bunch of money doing so.

How much is it worth, though?

Multi-billion-dollar startups are nothing new in 2022. But it’s interesting that Yuga Labs pitch reveals revenue irregularity. The company’s monthly forecast for top line varies wildly based on the month, with March and August 2022 expected to bring in just under $370 million as a pair, and no other month doing more than $20.7 million.

This matters. After all, if Yuga actually manages to grow its revenues from around $138 million to around $539 million this year, it will have posted one of the fastest rates of top-line expansion of any company in the history of startups. But, the income is not recurring — leaving secondary asset sales and cuts thereof aside — which means that Yuga is being valued like a gaming company, and not an enterprise software concern.

Historically, gaming companies were viewed skeptically by venture capitalists, as they had hit-driven economics, and lacked the sort of revenue regularity that makes for stable investment value. This means that the revenue multiples for gaming companies are far lower than for, say, enterprise SaaS.

This is perhaps why Yuga is valued at around 8x its expected 2022 revenues. That might feel cheap, but if the company’s land sales aren’t repeatable in later years, it may not be. So it’s hard to really vet what Yuga is worth per se, apart from knowing its 2021 results and what investors paid for it this year.

All told, the Yuga deck is a lot. It’s a big vision, now backed by a huge check. And it plans on selling lots of stuff in the coming year to folks who are similarly stoked about NFTs and the blockchain market more broadly.