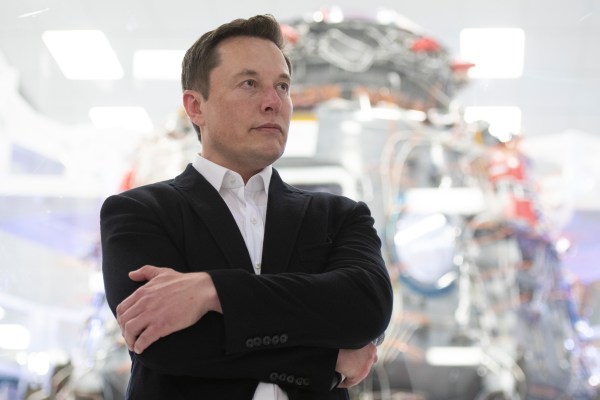

U.S. securities regulators on Tuesday said they have authority to subpoena Tesla CEO Elon Musk about his tweets and urged a federal judge not to let the executive get away with tweeting with abandon.

Musk has called the actions of the U.S. Securities and Exchange Commission, which in 2018 required Musk to get pre-approval for certain Tesla-related public communications, i.e. wild tweets that could affect stock price and shareholder value, “harassment” and “unjustified action.”

Musk had agreed to settle with the SEC back then, but last year came under fire again when he asked his followers on Twitter if he should sell 10% of his stake in Tesla, resulting in Tesla’s shares decreasing sharply. Musk has since sold around $16 billion worth of stock. Shortly thereafter, in November, the SEC issued a subpoena to determine if Musk was complying with the previous settlement.

In response to the SEC’s probes, Musk has tried to terminate or modify the 2018 consent decree, as well as quash a subpoena requesting records concerning the November Twitter poll.

“In 2018, to settle the SEC’s action against him, Musk agreed to comply with Tesla’s mandatory procedures requiring pre-approval of certain of his Tesla-related public communications,” wrote SEC regulator Melissa Armstrong in a filing in the federal court of Manhattan. “Musk cannot now cast off the Amended Final Judgment simply because he has found complying with Tesla’s procedures to be less convenient than he had hoped, or because he wishes the SEC would not investigate whether Tesla’s disclosure controls and procedures are actually being maintained and followed.”

The dispute with the SEC stems from an August 2018 tweet from Musk that he had “funding secured” to take Tesla private, but in reality the buyout was not close and “subject to numerous contingencies,” according to the SEC. U.S. regulators said that Tesla’s claims constituted fraud because they were “false and misleading” – Musk hadn’t discussed deal terms or price with any potential financing partners, and his tweets caused Tesla’s stock price to jump by over 6%, leading to significant market disruption, said the regulators.

In the settlement, Tesla and Musk each paid a $20 million civil fine, and Musk stepped down as Tesla’s chairperson.

Musk has since accused the SEC of punishing him for criticizing the government and exercising his constitutional right to free speech under the First Amendment, complaining about the “sheer number of demands” by the SEC from 2018 to present.

“But Musk’s own chronology of alleged demands is both underwhelming and reflects legitimate inquiries as to new potentially violative conduct by Tesla and Musk – including the conduct that gave rise to the SEC’s 2018 enforcement actions,” wrote Armstrong in the court filing.

Doubling down, the regulator said that modifying the 2018 final judgement wouldn’t free Musk from scrutiny over his Tesla-related tweets because as an officer of the company, “Musk would still be subject to Tesla’s disclosure controls and procedures.”

“So long as Musk and Tesla use Musk’s Twitter account to disclose information to investors, the SEC may legitimately investigate matters relating to Tesla’s disclosure controls and procedures, including Musk’s tweets about Tesla, as well as the accuracy of Tesla’s public statements about its controls and procedures,” said Armstrong.