The market for non-fungible tokens, or NFTs, may be slowing after NFT activity grew sharply in 2021 and into the new year.

The health of the NFT market is itself a fascinating data project. The historical volatility of the price of crypto tokens and other blockchain-based assets is high, which means that you might be fooled into calling a trend early, only for the markets to reverse and make you look silly.

In the crypto world, it’s good sense to never say never.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

And yet, we’re content to highlight a number of data points that indicate that the NFT market is slowing along a number of axes, indicating, at a minimum, that growth in the hot sector has come to a halt. This is not merely an academic point; there are a host of startups in the NFT space, meaning that there is an ocean of venture capital and illiquid private-market equity floating in projects directly or indirectly tied to non-fungible token demand.

The startup point is what we care the most about, of course, and there are more players in the space than merely OpenSea.

So let’s comb data from the Dune platform – more on that company and its recent fundraise below – and other sources to get a handle on NFT activity. We’ll also loop in Coinbase NFT comments from its latest earnings call and try to reach something of a conclusion for where the NFT market is today — and what that means for upstart tech companies hoping to surf singular blockchain assets all the way to the public markets.

What does the data say?

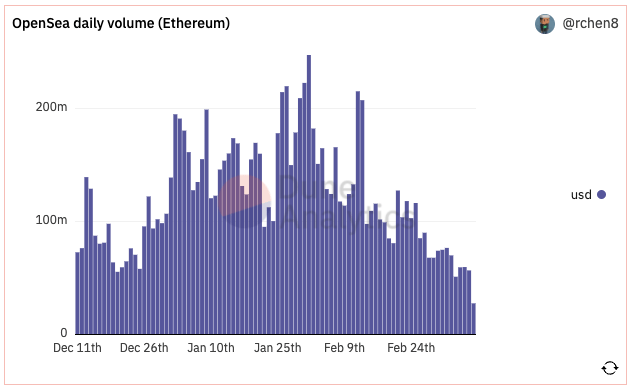

When we consider NFT volume, the leading indicator is OpenSea. The well-funded unicorn startup has proved an early leader in the NFT market, with a commanding market share. So when we look at OpenSea data, it can give us a strong, if imperfect, indication of where the NFT market is itself.

We’re largely leaning on Dune data today. Dune is also a unicorn startup, having raised a $69.42 million round earlier this year. That funding event gave Dune a $1 billion valuation. In short, Dune is an analytics platform for blockchain data offering both free services and paid accounts. It has risen to prominence in the crypto community for its data depth, as well as the fact that its information is easily queryable and saveable in publicly available dashboards created by its community.

One such dashboard was compiled by Richard Chen, an investor at crypto venture group 1confirmation, which centers on OpenSea data, allowing us a look into the platform’s volume. For example, observe the following:

Image Credits: Dune/@RChen8

We won’t be cross if NFT bulls view the above declines as merely a blip in the road to eventual non-fungible nirvana. But the declines matter more than merely as an indicator for slumping NFT trading activity. Recall that OpenSea’s business model is very easy to grok — the company charges a fee for trades it executes, so daily volume numbers in trading terms correlate directly to revenues at the popular NFT marketplace.

If NFT trading volume is falling, so too is revenue at OpenSea, a company worth some $13.3 billion; recall that Coinbase, which has a similar model, is worth $44 billion, per Yahoo Finance, and saw revenues of $7.84 billion last year, leading to net income of $3.62 billion. If we consider Coinbase an OpenSea comp – more on Coinbase’s NFT plans below – it has an interesting path ahead of it to raise more capital at a higher price.

Therefore, the chart of NFT data above is akin to an early-warning signal that OpenSea’s valuation isn’t likely climbing at the moment.

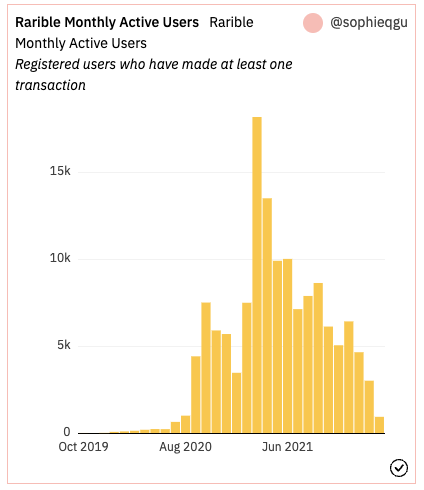

What about other NFT marketplaces? What does the data say? Dune user “sophieqgu” compiled a fascinating dashboard of NFT marketplace data that looks further afield than just OpenSea results.

The dataset indicates that monthly active users at NFT market SuperRare have been in decline for most months in the last half-year, to start. Monthly active users at Rarible appear to be in even steeper decline:

Image Credits: Dune/Sophieqgu

And in the wake of its move to offer governance tokens to users for platform use, LooksRare’s daily volume, once far above OpenSea’s due to suspected widespread wash trading, has fallen dramatically since its highs earlier in the year.

The NFT market is fragmented between platforms, chains and more. So it’s nearly impossible to get a single, perfect number to point to and say here, look! That said, enough activity charts from enough exchanges are trending negatively that we are content to say that, for now, NFT volume is in decline.

There are other pieces of data to consider. Google Trends, everyone’s favorite priors-confirmer, has consumer interest in the term “NFT” in steady decline from mid-January highs, for example. Like with other data concerning crypto, interest in the economic varietal is highly volatile, so we’re not trying to argue anything more than a near-term correction; what happens in a quarter, or four, is beyond our ken.

As a final data point, play-to-earn game Axie Infinity, which has NFTs as part of its core gaming mechanics, has seen new account creation decline sharply since highs set last year, and transactions have also fallen to a comparatively low plateau when contrasted with the game’s August 2021 highs.

The startup angle

OpenSea is perhaps the best-known NFT startup, given its prominence in the larger non-fungible token economy, but it’s hardly the only player to have raised capital.

Picking from TechCrunch coverage from this year, we can see that Pearpop got into NFTs; BreederDAO, which appears to provide NFT infra tooling, raised from a16z; NFT music team Royal raised $55 million; Pixel Vault raised $100 million; Burnt Finance’s DeFi NFT marketplace raised new capital; and POAP, whose tokens provide proof of attendance, loosely, raised $10 million for its NFT work.

The startup bet on NFTs not only becoming big deals, but staying that way, is enormous. Even companies set apart from crypto are getting their feet wet. Consumer equities trading service Public recently bought Otis, a startup that, among other things, fractionalizes high-priced NFTs so that consumers can trade in the asset class.

NFT exchanges are similar in terms of investor enthusiasm. FTX, which has raised tectonic sums, is in the NFT game. As are companies we noted above, like LooksRare, Rarible and others. And, of course, Coinbase is poised to get into the NFT game as well.

Coinbase, the U.S. crypto trading giant, could have an outsized impact on the NFT market not only because it has a deep consumer mind and market share, but also because it has a particular angle on non-fungibles that could make them a bit more fun.

Coinbase looming

Coinbase is the elephant in the NFT room. The heavyweight crypto exchange made no mystery of its plans to launch an NFT trading platform, but it hasn’t happened yet. It is definitely coming, though: There’s already a significant user waitlist, and the company also recently restated its goal alongside a rough ETA.

“We definitely have expectations to launch an NFT marketplace in 2022,” CFO Alesia Haas said in the analyst call that followed Coinbase’s Q4 2021 earnings report.

Having a competitor like Coinbase is obviously Richard Chen, an investor at crypto venture group 1Confirmation news for OpenSea and others, right? Well, maybe not. Coinbase, at least, wouldn’t frame it this way, as it became clear in its earnings call.

“We’re huge fans of OpenSea and in fact we’ve been investors [in] their platform as members of Coinbase Ventures,” president and COO Emilie Choi reminded the audience. “It’s not really about beating OpenSea,” CEO Brian Armstrong chimed in. “I think this is a new market. There’s going [to] be a lot of winners.”

Is Coinbase just being diplomatic? Again, maybe not. After all, Coinbase is arguably a lot more mainstream than its NFT counterparts. When it does venture into NFTs, it also plans to focus on simplicity and user experience.

“Our NFT product is intended to be a much more social experience, bringing the community together around various NFT collections, and having much more seamless connection to the ability to then buy-sell, transfer that money back to fiat, et cetera,” Haas said.

Coinbase’s take on NFTs could expand the TAM of NFTs, at least in terms of connected wallets. Will that result in sustained high transaction volumes in the long term? That’s a question for another day.

But before Coinbase can provide any sort of shot in the arm for NFTs, the overall asset category may have to endure its current decline for a while. How long the downturn may last is not clear, but will prove a fascinating signal to watch in the coming months.