Airtel said on Monday it is launching a credit card, the latest attempt from the Google-backed Indian telecom operator to make inroads with financial services as it looks to expand its offerings in the world’s second-largest internet market.

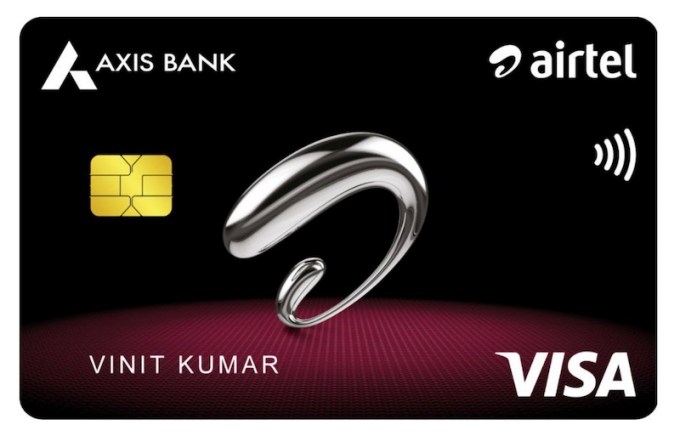

The network, managed by billionaire Sunil Mittal, said it has inked a strategic partnership with Axis Bank, the nation’s third-largest private sector bank, to co-launch what they are describing as “a first-of-its-kind” credit card.

The Airtel Axis Bank Credit Card will provide customers with pre-approved instant loans and buy now, pay later offerings and reward them for paying Airtel services’ bills and making transactions on Airtel’s app, the two said.

The card, which will only be made available to Airtel subscribers, is aimed at reaching customers in smaller Indian cities and towns, they said. Airtel has amassed over 340 million subscribers in India.

As part of the partnership, Axis Bank will begin to use Airtel’s C-PaaS platform – the telco’s suite that includes services such as streaming, call masking and contact center solutions – as well as “various” cybersecurity services. The two will also explore collaborating across cloud and data center services, they said.

This isn’t the first time Airtel is attempting to make a push into financial services, a fast-growing sector that has also attracted the attention of rival billionaire Mukesh Ambani’s Jio Platforms — and yielded a similar level of success.

Airtel operates a digital payments bank, which has been struggling to make a dent in the market. The firm, which has also pushed to expand its premium offerings in recent years to improve its ARPU (revenue per user), approached Paytm two years ago to explore offloading the payments business, according to three sources familiar with the matter.

India’s credit card market is severely underserved; there are fewer than 30 million Indians with a credit card even as nearly a billion bank accounts exist in the country.

Scores of startups, including Tiger Global-backed Slice and Sequoia Capital India-backed OneCard, are attempting to bring credit card features to more Indians. Many large firms, including Flipkart and Amazon, as well as ride-hailing startup Ola, have also launched co-branded credit cards for their respective customers. (OneCard is in talks to raise capital from Singapore’s Temasek in a round that is likely to value the Pune-headquartered startup at over $1 billion, TechCrunch reported last month.)

“Joint credit-card deals like this are fundamentally about leveraging distribution of the partner, which in this case, is Airtel. Airtel has a large premium base of users, which has become even more stronger due to Vi’s loss in market share,” said Himanshu Gupta, a veteran fintech executive.

“If a user, after taking card, makes this their primary mode of payment for most of their shopping elsewhere, there is an opportunity to make revenue from interchange and late fees as well. So one can expect this to be a successful joint card.”

But that success, he said, will require addressing several challenges.

“The challenge for bank partnership credit cards like Airtel-Axis’ is that banks’ credit card stacks are relatively old and are not very flexible for the younger generation needs. And while Airtel does have a large userbase, it has very limited surface area in the lives of a user since most users probably come to Airtel Thanks app once in 3 months to do their prepaid recharges.

“So in reality, Airtel gets only a limited opportunity to cross-sell any such products. Newer fintech card startups today are able to build more consumer need-driven products, and use smarter marketing to acquire users which generally banks or telcos are not great at.”

Monday’s announcement follows Google disclosing earlier this year that it will invest as much as $1 billion in Airtel and work with the carrier to develop “innovative affordability programs” to explore partnerships with smartphone makers to produce affordable handsets.

“Airtel is building a formidable financial services portfolio as part of its endeavor to offer world-class digital services to its customers,” Gopal Vittal, managing director and chief executive of Bharti Airtel India and South Asia, said in a statement.

“We are delighted to join forces with Axis Bank in this exciting journey. Through this win-win telco-bank partnership, Airtel customers will get access to Axis Bank’s world-class financial services portfolio and exclusive benefits, while Axis Bank will benefit from Airtel’s strong digital capabilities and deep distribution reach.”