Raising a Series A is a different ball game from raising a seed round, and for Akilesh Bapu, CEO and co-founder of AI-powered medical transcription platform DeepScribe, giving prospective investors a hard deadline while leaning on early investors for support and guidance made all the difference.

“We were at this trajectory as a company where we had a semblance of product-market fit,” said Bapu, reflecting on the summer of 2021. “We had proven our product. We had about 200 live customers on the platform… We were excited about bringing DeepScribe to more customers and looking for the best partners to us there — not just in the short term but also in the long term. We had a long-term vision… and wanted a partner that bought into that vision.”

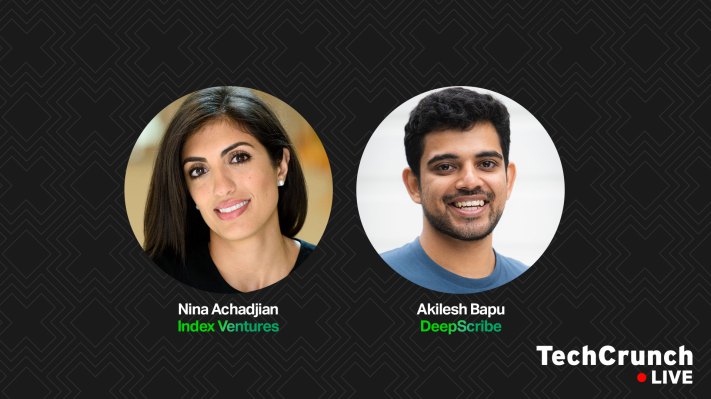

Eventually, the company closed a $30 million Series A round led by Index Ventures partner Nina Achadjian, as the duo discussed on the latest episode of TechCrunch Live, our weekly program featuring entrepreneurs, developers and investors. The entire episode is available below, along with a portion of DeepScribe’s Series A pitch deck.

If not for the fact that Bapu and his team had set deadlines for the funding round, he said DeepScribe might have not partnered with Index — Achadjian was on vacation when she read their pitch and tried to push the meeting to the following week, but Bapu said the process was moving fast. They met the following day.

Afterwards, Achadjian was sold. “When I walked out of the meeting, I went immediately to one of my partners, and was like, ‘Finally, I found the company that is following the right approach,” she said.

When I walked out of the meeting, I went immediately to one of my partners, and was like, ‘Finally, I found the company that is following the right approach.’ Nina Achadjian

She added that this was a critical win for DeepScribe, as it’s essential to leave potential investors fired up and armed with a few bullet points, including on the team and market.

Prepare for due diligence

Since Index was interested in DeepScribe, the firm started conducting due diligence.

Achadjian said founders can expedite the process by anticipating questions, especially on market size and competitive landscape. Companies can also provide investment firms with summaries of customer call notes.

“Then we come up with a list of key questions we want to go deep on,” Achadjian said. “What’s the business model? How do you scale? References. I actually called one of Akilesh’s Berkeley professors. We do a lot of customer calls and check references on the entrepreneurs. Then, honestly, we like to spend time with the team and see them in different environments.”

Before the pandemic, Achadjian explained, they would spend a day with the founders in their office and watch their interactions with staff and how they run a meeting. For DeepScribe’s raise in 2021, they met for coffee.

Part of Index’s due diligence was reviewing the competitive landscape. “In addition to all of that, we refresh all of our competitive diligence. So because I met a lot of DeepScribe’s competitors, I went back and looked at the decks I’d seen and tried to follow up with other investors to see how they were doing — I wanted to back the right horse in the race.”

“And finally, just be prepared,” she said. “Make sure you have your numbers in order. Make sure you have a planned use for the capital. It doesn’t have to be super detailed.”

Leverage investor support and experience

Akilesh had raised funds before, but only seed-stage funds for DeepScribe. For its Series A, DeepScribe’s seed investors proved to be critical partners, especially when it came to preparing its pitch deck (embedded below).

“The biggest help in raising this round came from our current investors, Bee Partners and Stage 2 Capital. Those two were awesome and helped us prepare,” he said.

It’s common for current investors to throw their resources and knowledge behind a company looking for more capital, as it’s in their best interest if the company spurs a fundraising event. Including helping with its Series A pitch, DeepScribe’s investors supported the company in getting its financials in order.

“The primary thing was helping with the pitch deck,” Bapu said. “You want to make sure you nail it. We started with just a raw story session where the investors poked holes in our oral history of DeepScribe. They would be, ‘Alright, these two things don’t add up,’ and ‘Let’s elaborate more on that,’ and ‘Get more specific about there.'”

Bapu’s investors made him pull back from the day-to-day and explore the company’s five-year vision. This exercise helped the company establish the first few slides in its pitch deck by clearly defining its mission.

Ultimately, DeepScribe paid an outside firm $300 to produce its slide deck. It was still a lot of work, though.

“Working with pitch deck designers isn’t as easy as just giving framework and having them design it,” he said. “You have to go through a bunch of iterations. We were up at midnight, just going back and forth, saying, ‘We want this circle moved a few inches to the right and different colors here.'”

Paying for a pitch deck is an easy win for Achadjian, as, to her, decks make the first impression. She says it’s about the value of a person’s time, but there’s another option, too: Don’t make a slide deck.

Instead of a pitch deck, some founders use an investment memo-type document similar to an S-1 in content. These summaries present the same information as a slide deck and can be better suited for detailed financials because of their formatting.

TechCrunch Live: Nina Achadjian (Index Ventures) + Akilesh Bapu (DeepScribe)

DeepScribe’s Series A pitch deck

Partially redacted