In the last one decade, a $1 billion jobs market — microwork — has emerged around technologies that split activities into piecemeal tasks to be completed by many people over the internet, mostly using mobile devices.

The allure of microwork opportunities has grown to capture the interest of Africa’s youth, who stand to earn up to $7 per day, against a daily urban income rate of $4.35 urban earning average for low-income groups, according to a study conducted in Kenya by Mercy Corps Ventures (MCV), the impact investing arm of global development agency Mercy Corps.

Microwork has the potential to create jobs for gig workers of any skill level and boost employment for Africa’s booming youth population, with 10 million to 12 million youth entering the workforce in Africa each year, according to the African Development Bank.

However, the MCV study notes that the costs incurred in payment collection, as well as other barriers, have limited the uptake of microwork in Africa, where a turnaround could be achieved using crypto-payment options. Cryptocurrency payment cuts down the transaction fees by 93% regardless of the size of payment, according to the pilot which was conducted in Nairobi, Kenya to test whether digital stablecoins and mobile wallets could ease frictions and reduce costs in cross-border payments.

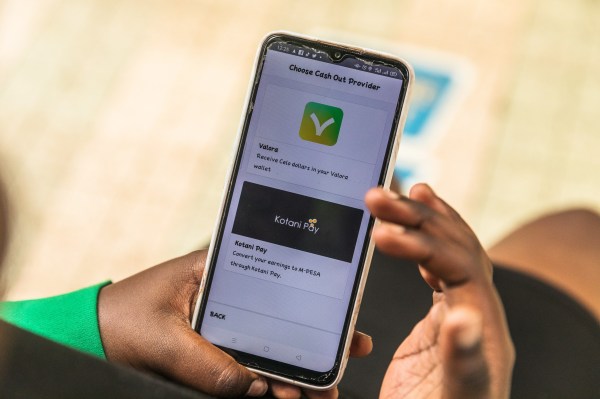

Other partners in the study were Celo, a mobile-first DeFi platform; Kotani Pay, a technology stack that enables blockchain protocols; Appen, a publicly traded data company, and NairoBits, a Kenyan non-profit that uses ICT to empower disadvantaged youth.

“We trained 200 Kenyan youth to access digital microwork from global platforms using a mobile app and integrated Valora digital wallet, which is built on Celo. Our pilot tested how a stablecoin could reduce the costs and challenges of sending and receiving cross-border micropayments over a three-month period,” said Mercy Corps Ventures Senior Managing Director, Scott Onder.

The outcome of the study, according to Celo partner Will Le, confirmed that, “by reducing financial frictions, we introduced a new model for tapping talent across borders, which was not previously possible with traditional financial infrastructure. Cryptocurrency, and specifically stablecoins, could hugely reduce the cost of remittances and foster cross-border commerce.”

In the trial, participants were paid a few seconds after task-completion, using Celo dollars (cUSD), a Celo-native stablecoin that tracks the value of the US dollar, with fees at approximately $0.01. The payments were temporarily stored in Celo’s digital wallet, Valora, and could be cashed-out at any time to Kenya’s mobile money platform, M-Pesa, with the conversion enabled by Kotani Pay’s off-ramp technologies.

In 2021, remittances, including payments for online jobs, made over 3.5% of Kenya’s GDP, at a value of $3.7 billion. With the global weighted average remittance costs at 4.71%, Kenyans receiving remittances are potentially losing out on nearly $100 million per year.

“Given that the average cost of remittances to the value of $200 is significantly higher than the global average (8.72 percent in sub-Saharan Africa versus 6.30 globally), the savings are potentially even greater. If all those transactions only cost the 2.02% enabled during the pilot, the total potential impact to the Kenyan economy could be over $200 million, or 0.22% over Kenya’s overall GDP,” said MCV, in a statement.

Overall, the online jobs market in Kenya is on a consistent growth path due to an increase in internet penetration – nearly 90% of the country’s urban population is aware of mobile internet. According to this study, at least 1.2 million Kenyans currently work online, earning an average of $182per month, in a country where 36 percent of its 2.6 million salaried workers (about 1 million people) earn between $176 – $274 per month.

Among the commonly used options for international online jobs are PayPal, Skrill and Payoneer, some of which have policies for withholding payments without explanation and higher charges for lower payouts.

“High transaction fees, especially for lower payouts, mean that microworkers often forfeit a significant portion of earnings (with a global weighted average cost of 4.71% but in some cases up to 30% of gross earnings), said MCV, adding that these barriers can be overcome using cryptocurrency.