For companies raising capital in the coming year, news of rising interest rates, market volatility and falling valuations paints a daunting picture.

Understandably, founders are eager to understand how current public market conditions may impact fundraising in the private markets. The good news is, in the context of history, periods of market correction are common –– and great companies are still poised to thrive.

In more favorable market conditions, using performance data to articulate a clear story about your company’s potential is a best practice. But in the current volatile environment, using data to tell your story is imperative. Whether looking to raise equity or debt, investors pay even closer attention to a company’s performance and projections in order to manage their own investment risk.

Good news: in the context of history, periods of market correction are common, and great companies are still poised to thrive.

As a former venture capitalist, I tell all founders that confidence in their data will have major implications on their company’s valuation and deal terms when raising capital.

Unfortunately, many companies lack an efficient way to gather, synthesize and interpret data into real-time insights, resulting in the default reliance on static, Excel-based samplings that may not capture the full picture of your company’s potential.

With all this friction, it can be challenging for entrepreneurs to even know where to begin. For founders and startup teams looking to become more data-driven in their approach to fundraising, the following steps are a good place to start.

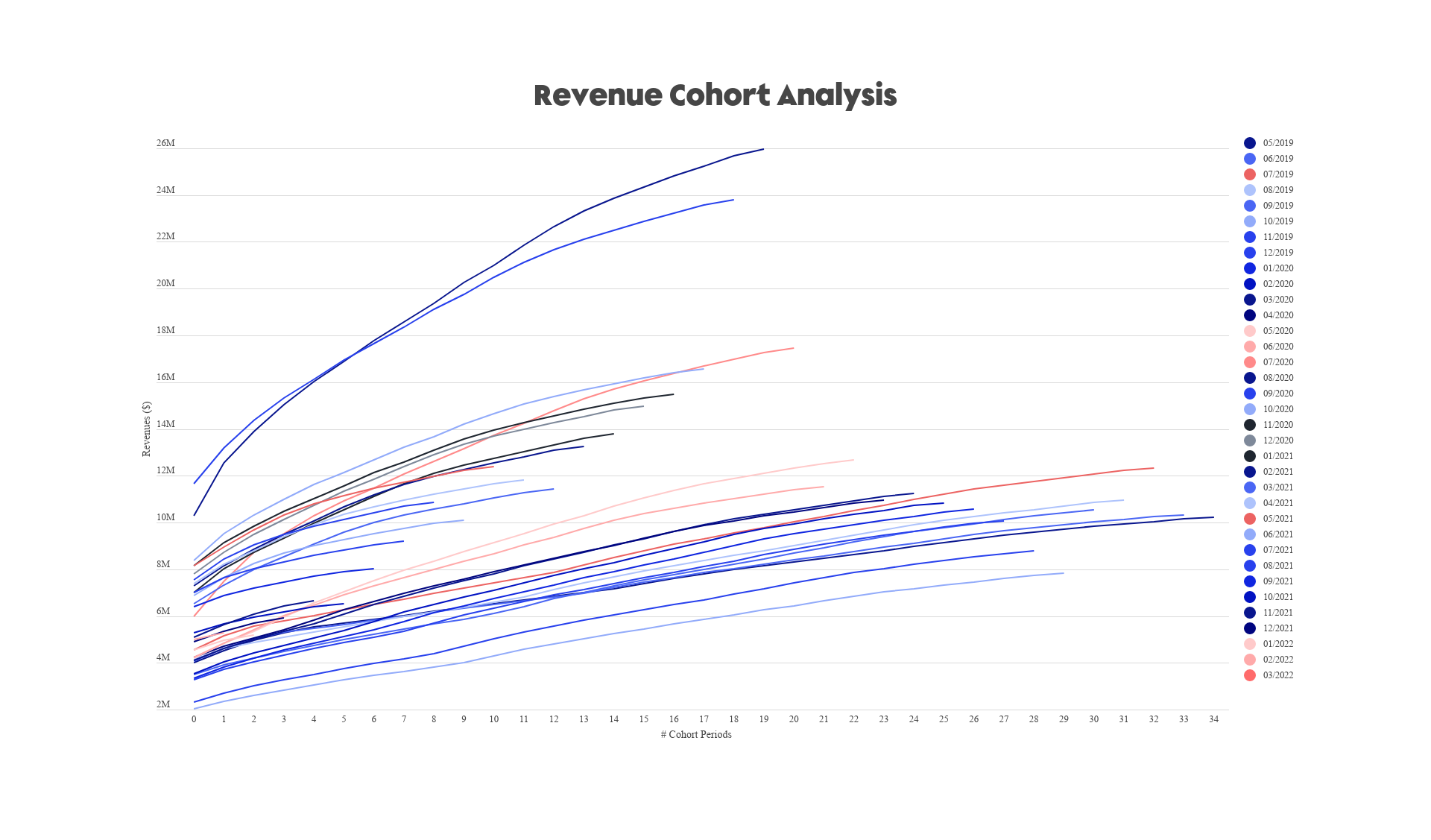

Start with revenue cohort analysis

A cohort analysis looks at different groups of customers, whether that be users over certain periods of time or segmented by region or size, and allows investors to see how they individually perform. Investors love to see into the future because they know that the value of a business is the present value of its future cash flows.

By decomposing the drivers of revenue growth via cohort analysis, you can raise investors’ confidence in your cash flow projections, resulting in a higher valuation or more favorable loan terms.

Revenue cohort analysis, May 2019 to March 2022. Image Credits: Hum Capital

Take the above graph as an example. The cohort analysis shows that newer groups of customers are larger and more retentive than ever before. This indicates to investors that there is a trend toward higher customer lifetime value, which ultimately instills confidence in your company’s future growth.

Companies that can tie the same cohort performance to improving sales and marketing efficiency will help demonstrate that the business’ growth is not just a function of increased spending on customer acquisition and retention. In other words, this is a company that is compounding value and thus even more valuable to investors.

Investors are looking to see a range of positive scenarios that align with historical performance and demonstrate a track record of producing efficient LTV/CAC. The more work a company can do to demonstrate these strengths on the front-end, the easier it is to stand out from the pack.

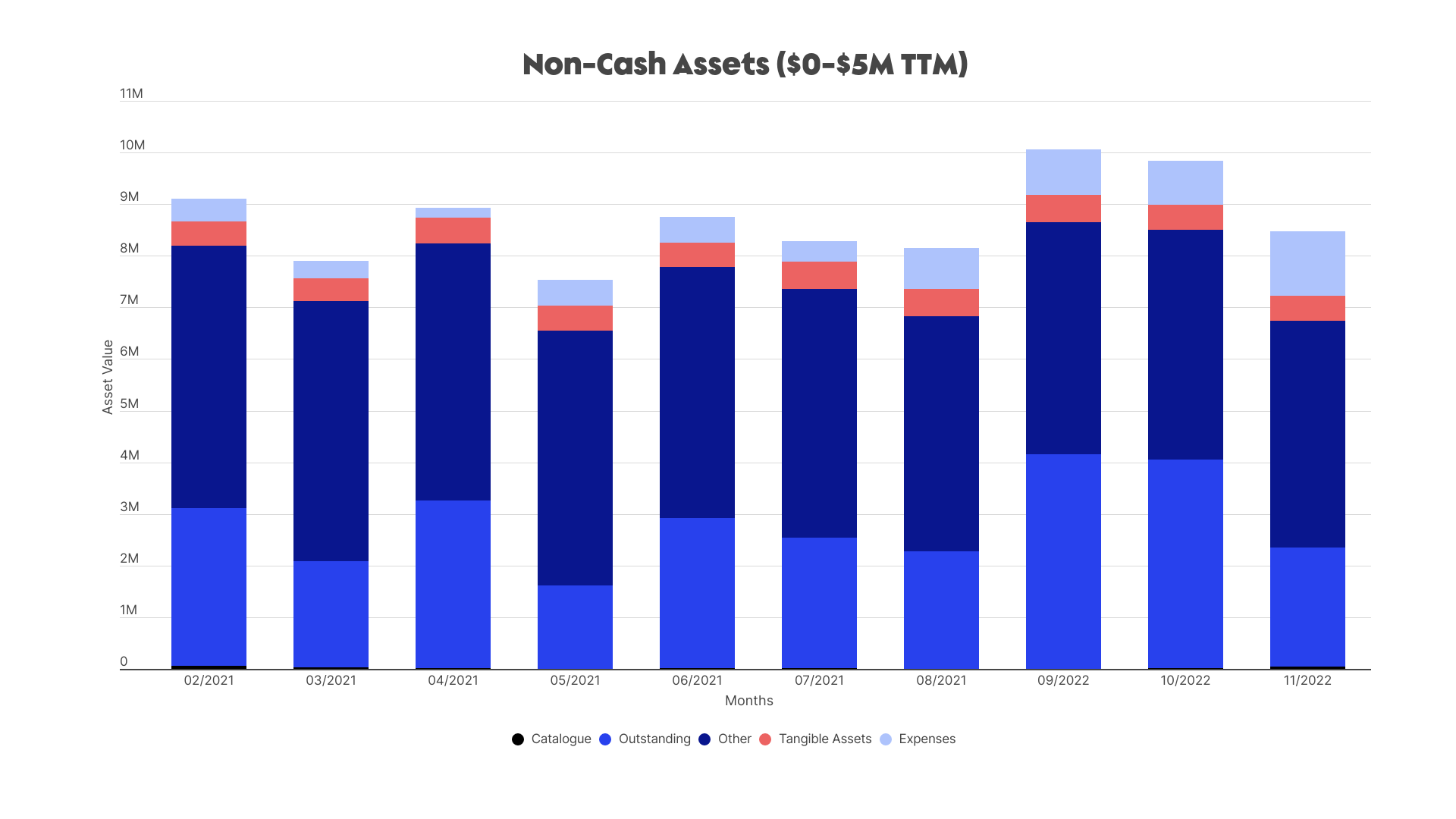

Leverage balance sheet assets regardless of performance

While seed-stage fundraising often involves selling a dream, after Series A and beyond, companies need to rely on their data to prove performance and attract investors. This means that in reality, the picture-perfect cohort analysis (like the above example) is hard to come by.

If the cohort-based LTV/CAC curves show a value of < 1.0 at the 12-month mark, an equally viable financing path involves using valuable assets on the balance sheet. These can be borrowed against or sold (called factoring) generally without regard for how the business is performing –– which can also be a useful lever to buy more runway and prove enhanced business metrics ahead of an equity raise. Another bonus? This helps companies avoid unnecessary dilution.

To rely on the path of leveraging balance sheet assets, companies must have two data assets. The first is a clean balance sheet that accurately articulates the assets and liabilities of the company; the second is backup material (often contracts) that proves the ownership and obligations listed in the balance sheet. It is critical that these source documents and the balance sheet tightly reconcile. In fact, failing to reconcile this carefully is one of the most common reasons why a company fails a diligence process post-term sheet.

Non-cash assets, $0-$5M TTM: Image Credits: Hum Capital

Ultimately, companies that are both aware of the avenues that will tell their story most effectively and have invested in the ability to tap into those resources are poised for success in early funding rounds.

Invest in forecasting

Forecasting is essential for developing and subsequently demonstrating your company’s outlook and strategy for success. Yet, one of the most common (and significant) barriers to data-driven fundraising is the inability to effectively forecast. Companies that fail to forecast using a defensible methodology are missing the critical assets needed to pitch their story in a data-driven way and may end up being overlooked or undervalued by investors.

The advantage of investing in stronger forecasting is simple: Because a company’s value is the present value of its future cash flows, the more confident a company can be in its future cash flows, the more credit it gets for them. To articulate cash flows in “present value format,” they are discounted –– or, in other words, divided by a number that quantifies uncertainty. If cash flows are discounted at 3% rather than 25%, there ends up being very different present value numbers.

In today’s dynamic between investors and companies, investors tend to hold all of the cards because they have the human resources to invest in quantitative and qualitative forecasting. To level the playing field, companies should invest in the tools that will allow them to understand their company’s outlook from the same vantage point as investors. Simultaneously, companies that spend the time providing the insights and analysis most relevant to investors are also signaling a level of understanding that can set the stage for a more efficient fundraising process.

The end result? A data-driven pitch.

In a down or uncertain market, investors will seek to de-risk their decisions based on hard evidence of success. The result is an additional layer of scrutiny in pitch meetings around performance and financial projections, and an overall lengthier due diligence process. Coupled with reports of burnout among VCs, the obstacles for companies looking to fundraise through traditional channels are building.

Good storytelling about your company, backed by strong data and robust financial models, is always a powerful tool in fundraising, and in the current environment, it can make or break a company’s successful outcome. Leading with data is a critical step to diversifying the companies that have access to funding: Where you are, who you know or how well you pitch should not be a barrier to fundraising if you have strong business metrics backing you up. That means approaching fundraising the way investors do, data in hand, can unlock new levels of opportunities for today’s entrepreneurs.