The number of startups building buy now, pay later (BNPL) services is long. Just this year we’ve seen French BNPL startup Alma raise a $130 million equity round, BillEase raise $11 million for BNPL in the Philippines, Lipa Later raise $12 million for the same effort in Kenya, and ThankUCash raise $5.3 million for fintech infra in Africa that appears to include BNPL services.

There were other funding events and product launches, but that’s enough of a sample for us to understand that private-market investors around the world are investing in the consumer checkout-and-credit capability, even after industry incumbents Affirm went public and Klarna has grown to massive scale with global reach. The $29 billion Block-Afterpay deal was also good for startup BNPL volume, we reckon.

Until some recent turbulence, there’s been good reason to consider BNPL startup investments sensible bets. After all, public-market investors had pushed Affirm’s stock to over $175 per share in late 2021 from an IPO price of $49 per share. And Klarna raised $639 million at a valuation of nearly $46 billion in mid-2021. With momentum like that, why not power up a host of BNPL services targeted at particular geographies around the world?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

All the warm and fuzzy of the above paragraph comes with a huge caveat, namely that the value of Affirm has eroded sharply in the public markets. After trading to just over $81 per share this week, an early tweet containing earnings data sent shares of Affirm sharply lower yesterday. The company’s full results and earnings call failed to stanch the bleeding. Exclusive of yesterday’s declines of more than 20%, shares of Affirm are off another roughly 15% today as of the time of writing, worth just $49.70 per share.

That’s peanuts more than the company’s IPO price. Sadly, we don’t have Q4 data from Klarna to dredge up in comparison; the company most recently shared its Q3 data. So we’ll have to try to unspool the change in the value of Affirm by itself. What we need to understand is why Affirm’s earnings were so deleterious to its value, and if other companies are at similar risk. More simply: Should the myriad well-funded BNPL startups see Affirm’s descent as a warning concerning their own efforts or something more company-specific to the U.S. fintech?

Affirm’s calendar Q4

Affirm’s corporate calendar is the same as Microsoft’s, it appears, with its calendar Q4 2021 being the second quarter of its fiscal 2022. This means that some of the language below will be slightly tortured as we discuss time periods. Not much we can do about it, frankly; the finance world isn’t really set up for us to enjoy smooth phrasing. Onward.

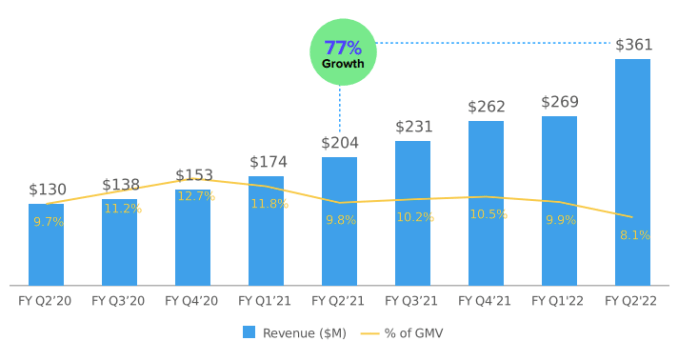

In its Q2 fiscal 2022, Affirm reported GMV of $4.5 billion (+115% YoY), revenues of $361.0 million (+77% YoY), revenues minus transaction costs of $183.6 million (+93% YoY), an operating loss of $196.2 million (+632% YoY), and an adjusted operating loss of $7.9 million, a few million worse than its $3.1 million adjusted operating loss from its Q2 fiscal 2021.

Helping drive the rapid GMV and revenue gains were Affirm’s new agreements with Amazon and Shopify.

There’s good and bad in there. GMV growth was strong, revenue growth solid, and revenue ex-transaction costs even better. Even more, Affirm crushed revenue expectations, which were $328.8 million for the quarter. So what went wrong?

Guidance, take-rate

For its Q3 fiscal 2022, or calendar Q1 2022 by our reckoning, Affirm anticipates $325 million to $335 million worth of revenues. Barrons has Wall Street expectations at $335.5 million for the current quarter, so the company’s guidance is a miss by that benchmark.

There were other data points that were less than investor-exciting. Observe the following chart, from Affirm’s set of investor materials:

Image Credit: Affirm investor presentation

Follow the yellow line, and consider its direction over time: It’s heading down. Investors don’t love that, as it implies that rising sales volumes are resulting in less revenue over time. This, in effect, is why Affirm’s GMV growth in its most recent quarter (+115%, as noted above), was so much greater than its revenue growth (+77%, as noted previously).

Investors weren’t stoked about the decline in revenue as a percentage of GMV. It came up during the company’s earnings call. From a transcript of the company’s investor chat post-earnings, here’s how Michael Linford, Affirm’s CFO, described the drop:

Revenue as a percentage of GMV contracted 170 basis points to 8%, driven by product mix. Split Pay grew over four times year on year and accounted for more than 20% of GMV in the second quarter from just 11% last year. In our earnings supplement posted to our investor relations website, you will see that merchant revenue take rates have remained relatively constant for each of our offerings. On the expense side, we continue to grow revenue faster than transaction costs, delivering real leverage.

What’s described above is mix-shift, what happens when the makeup of a company’s incomes changes from one category to another; as different Affirm GMV generation methods have different margin profiles, mix-shift inside of aggregate GMV can yield lower-than-anticipated revenue results.

There’s a lot of nuance I could drag you through, including differing revenue recognition weighting from different forms of Affirm checkout solutions. But what matters is that the same things that are driving lots of growth for Affirm — active consumer count, active merchant count, total GMV — may not have the same economics as some of its other efforts. Which means that GMV growth will scale ahead of revenues, and investors on the public market might have to endure slower-than-anticipated top-line growth.

Given that Affirm is very unprofitable on a GAAP basis (inclusive of all costs), and modestly unprofitable on an adjusted basis (exclusive of certain costs), slower growth is pretty bad; the company doesn’t have a bed of profits to lean back on when growth slows.

So what about startups?

There are a few lessons. First, any startup that was hoping Affirm’s public-market value would stay as hot as it did in Q4 2021 (calendar), making private-market fundraising stronger and easier, is set for disappointment. Forsaking all nuance, seeing the leading public company in the BNPL sector shed more than two-thirds of its value in a few months is more than a little deleterious to the potential exit value of startups in the same space, which will harm early- and late-stage valuations in the sector.

Second, partnerships aren’t a panacea. Affirm has done yeoman’s work getting its technology into more and major online venues. And yet, the results are not quite what investors hoped. You can argue that the stock market is being overly censorious toward Affirm, but that’s you arguing with the world — not us. For startups hoping that a big partnership will provide not only the growth in volume (GMV) but also revenue expansion would do well to digest Affirm’s recent results and make sure that their own anticipations are valid.

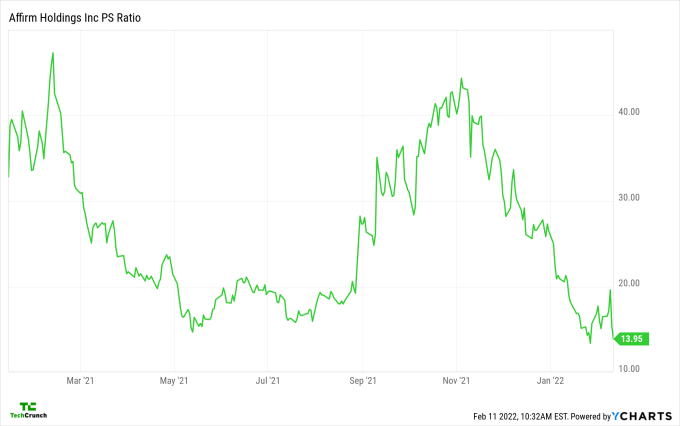

Third, BNPL startups should grok that multiples for their revenues are probably going to settle in the single-digit range. Observe the company’s trailing price/sales multiple:

Image Credits: YCharts

If we calculate the company’s price/sales ratio using its Q2 fiscal 2022 revenue on an annualized basis, we get a number just under 10. If Affirm, which is tied up with Amazon and Shopify and is posting >100% GMV growth at scale, is worth around 10x its current run rate, startups are going to struggle to do much better in the long term.

The Affirm results are a warning that despite private-market investor hype, BNPL results are no business-model cure-all, and partnerships have costs that should be considered. Is the startup BNPL game in trouble? No, but I do think that expectations for exit values set during Affirm’s valuation boom are likely in decline following its valuation swoon. How that will show up in funding rounds we’ll have to see, but the news is hardly great.