It’s not a secret that the restaurant industry was a late adopter of technology, a move that unfortunately left many restaurants unprepared when online ordering and delivery became the norm during the global pandemic.

Those that did embrace delivery found out quickly that the fees tacked on by food delivery companies were difficult to maintain for restaurants, which traditionally have thin profit margins. That’s where Lunchbox comes in.

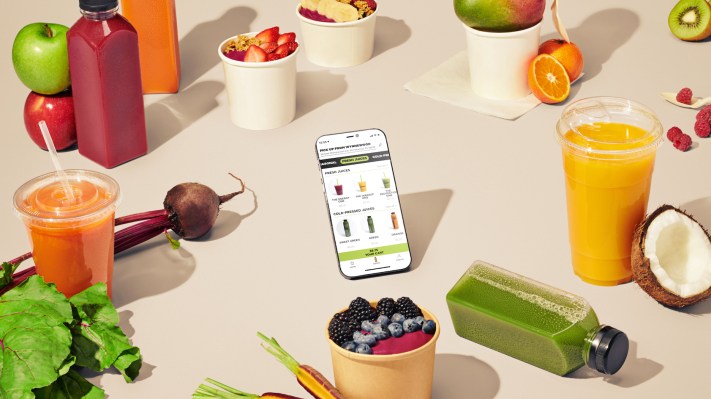

The New York-based company is developing online ordering tools for enterprise restaurant chains and ghost kitchens to act as a restaurant’s entire digital tech stack for everything from managing orders to apps to loyalty programs, so the experience is not only frictionless, but also increases sales and customer engagement.

“When COVID began, all restaurants were required to have some relationship with technology in order to survive, but the importance of this relationship has been greatly enhanced by the rise of the Omicron variant,” Nabeel Alamgir, co-founder and CEO of Lunchbox, said via email. “This is the most difficult struggle restaurants have ever faced in recent memory.”

We previously reported on Lunchbox back in October 2020 when the company announced $20 million Series A funding, led by Coatue. At the time, Alamgir and his co-founders, Andrew Boryk and Hadi Rashid, were focused on the demand from restaurants and trying to lower the on-boarding process time to get customers up-and-running.

Coatue is doubling down on its investment, leading a $50 million Series B capital infusion into Lunchbox, with other existing investors, Primary VC and 645 Ventures, joining in, with individual investments from a group of executives from the likes of DoorDash, Sweetgreen and &pizza. The new capital gives the company just over $72 million in total funding. Alamgir said he wasn’t disclosing the company’s valuation at the time.

The new investment comes on the heels of some big news from the company, including bringing on former General Assembly COO Kieran Luke to serve in the same role at Lunchbox. Last year, it acquired Spread, an online marketplace that connects restaurants with diners, and fulfilled its goal from the Series A to create a digital food hall, with C3, that enables restaurant groups to create an experience where guests can order from multiple brands in one cart.

This round was part of Lunchbox’s structure of planning, Alamgir said.

“We want to ensure our vision for how to support restaurants and as more continue to grow, we have the ability to put restaurants first in our decision making,” he added. “Since announcing our Series A in October of 2020, we’ve seen more players get involved in building ghost kitchens which is expected to be a $1 trillion opportunity in the next decade. In an effort to continue to apply innovative thinking and evolution for restaurants, we have raised a Series B to continue to support and empower their visions. We’re going to continue seeing so much innovation in the restaurant space.”

Over the past two years, the company has grown significantly, including going from 51 employees to 250 across the U.S., Canada and the United Kingdom. It processed over $3 million in orders in 2021 from more than 970,000 guests.

The company’s primary focus for a while will be on expanding into mid-market, enterprises and ghost kitchens, and as such will invest the new funds into product R&D and bringing on new talent across departments.

“The last three years have been very exciting for Lunchbox,” said Rahul Kishore, senior managing director of Coatue, in a written statement. “We have been following them since 2019 and we have been continually impressed by Nabeel’s far-reaching vision. We believe that the key differentiating factor between Lunchbox and other companies is its ability to create engaging and long-lasting relationships between brands.”

Brad Svrluga, general partner and co-founder of Primary VC, noted Lunchbox’s ability to gain early traction by partnering with restaurant customers.

“While other delivery platforms take a pound of flesh with delivery fees and gatekeep valuable customer data, Lunchbox’s flat monthly fees and transparent data sharing, analysis and remarketing tools truly help restaurants grow their profits, not just their top line,” he added. “We knew this was special back when the team was just six people; we never in a million years could have predicted how COVID-19 would create the urgent need for this exceptional product nor how consumers would become so accustomed to getting fast, frictionless delivery.”