Amid this long-lasting startup era, 2021 may go down as the peak venture capital year.

When The Exchange looked at global data for venture capital activity in 2021, we used words like “bonkers” and “record-setting.” Those might have been a little modest when we compare just how much the venture asset class has grown from comparatively humble beginnings. To put it into perspective, per CB Insights 2021 data, venture capital activity around the world was up around 4x since 2016, and 2021 more than doubled 2020’s record-setting result of just under $300 billion in total activity. Last year saw more than $620 billion invested in venture rounds, the data provider reports.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Given how large the European venture capital scene has grown, it’s not surprising that its 2021 was similarly remarkable. But just how good?

Pulling from CB Insights, EY and PitchBook, today we’re exploring a year of superlatives in the European startup scene, both from a regional perspective and, in a number of cases, from a per-country view.

Today our goal is simply to get our heads around just how much money European startups raised last year, and how big an aberration those results are in historical terms.

Today our goal is simply to get our heads around just how much money European startups raised last year, and how big an aberration those results are in historical terms.

Later in the week, we’ll explore what’s ahead for startups in the region. In short, we want to know how recent market gyrations may or may not impact how VCs fundraise and how capital disbursement may shift in 2022 as public-market valuations slip and the IPO window seems to be closing amid market volatility giving companies jitters about making a big debut.

Can the good times continue? Before we can answer that, we need to know just how great the last four quarters were for European startups. Let’s talk about it.

Europe’s 2021 in VC

Europe had a monster 2021. Capital invested reached all-time highs. Deal volume reached all-time highs. Exits reached all-time highs. The market was firing on all cylinders.

Per PitchBook’s European data set, there were 10,583 venture deals in Europe last year worth €102.9 billion. Of those, some 2,865 deals were first-time venture financings worth €9.9 billion. Those figures were up from €3.6 billion and 2,457 deals in 2020.

Follow-on rounds took up the rest of the capital and deal volume, but we highlight the first-financing number as indicative of venture investment in Europe’s future unicorns and IPOs; the capital invested on the continent today is not merely going to super late-stage rounds.

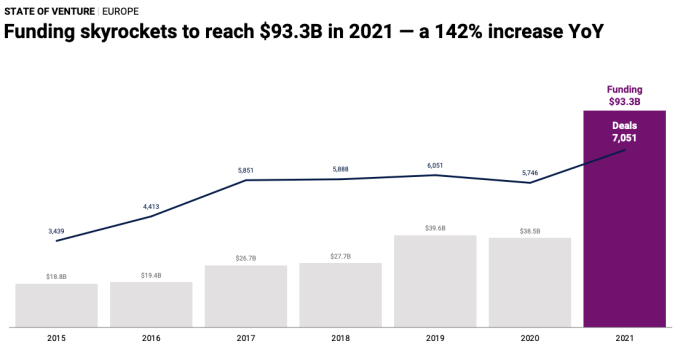

CB Insights reports similar results, with some $93.3 billion invested across 7,051 deals in 2021. For Europe, that is an all-time high for deal value and deal volume. In short, no matter how you count, last year was Europe’s best-ever for raising venture capital. (Note that PitchBook counts Israel in its European data, so the two reports are not directly comparable; what we care about is their directional movements, and both pegged 2021 as the best year in history for European venture activity.)

Image Credits: CB Insights. Shared with permission.

In good news for the capital sources pouring money into European-based startups, the money out was ample. We joke that venture investors are excellent at creating unicorns, but terrible at finding liquidity points for those investments. Europe’s 2021 pushed back against the trend by posting some incredible exit data.

For example, PitchBook data pegs last year’s venture-backed exit activity at 1,241 deals (up from roughly 600 to 700 per year from 2014 to 2020) worth €142.5 billion, nearly triple the prior record (€42.0 billion, 2018) and a massive multiple of the 2020 results (€23.6 billion).

CB Insights backs up the PitchBook data, reporting 3,701 M&A deals in Europe last year (up from 2,372 in 2020) and 185 IPOs (up from 85 in 2020). Up and to the right goes the European startup exit cadence, as has the money backing those companies.

Therefore, we are starting off 2022 on highs by nearly every metric we can summon. The gains are perhaps even more evident when we consider per-country data.

Leading countries

Looking at recent headlines, you’d expect that France had a simply incredible venture capital year. That’s true; the data confirms it. But notably, the same data reveals that the U.K. and Germany had, arguably, even better results in 2021. How so? In terms of venture capital raised, France was behind both countries in terms of total capital invested and year-on-year growth.

Every data provider has a slightly different method for counting venture capital activity. Still, the trends are the same across data sets. EY reports that U.K. startups attracted €15.36 billion in VC and €17 billion in growth equity – €32.4 billion in total, a 155% year-on-year increase compared to 2020. CB Insights data is similar, reporting a $29 billion equity tally.

In both cases, the U.K. outraised Germany, which saw €16.2 billion, per EY, a 209% increase, or $17.5 billion, according to CB Insights. France managed just €11.6 billion, per EY, up 115% compared to 2020, or $12.2 billion, per CB Insights.

That the U.K. is still on the first step of the podium is interesting. Brexit was completed at the end of January 2020, but a previously anticipated negative impact on venture capital remains to be seen. Based on PitchBook’s data, the share of VC deal value and deal count flowing into European subregions stayed relatively stable since 2019.

This may be due to PitchBook’s groupings, with the U.K. and Ireland combined, and France reported jointly with Benelux, but we suspect the impact of the combinations is modest.

In an interview on French TV channel BFM Business, EY’s Franck Sebag suggested that the explanation might be lag. Since funds being raised pre-Brexit are still being deployed, the impact of the U.K. leaving the European Union and whether it helps France catch up might only become visible in the next cycle.

Aside from these three leaders, all of Europe saw plenty of deals. For instance, the largest funding round of the year went to a Swedish startup, EY reports: Battery manufacturer Northvolt, which raised a whopping $2.75 billion. But these mega-deals don’t hide any contradictory trends; Swedish startups raised more money from the same number of operations in 2020, some 300.

What’s next?

It’s well and good to note record numbers and talk all-time highs. But what’s ahead matters more.

How much fear is leaking from the public markets into private-market investing? When will the IPO market become welcoming again? Are venture investors pulling back? Are they considering it?

From record highs, where next? More later this week.