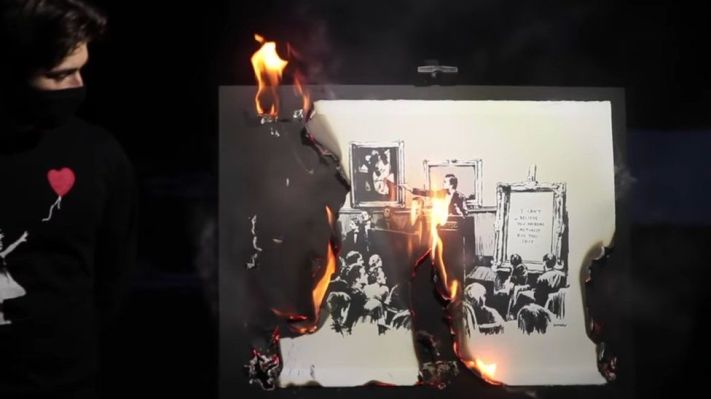

Burnt Finance is a crypto startup which, as a stunt, burnt a Banksy artwork and but then the NFT they’d minted for it for $400,000, double what it cost on the ‘normal’ open art market.

Based on the idea that auctions for NFTs could be improved, it went on to raise $3 million for a decentralized auction protocol built on the Solana blockchain. That round was led by led by Multicoin and Alameda Research and was incubated by Injective Labs, the core contributors to the multi-chain network Injective Protocol.

It’s now getting more serious.

Burnt Finance has now raised an $8M Series A round led by Animoca Brands, which develops and publishes a broad portfolio of blockchain games, traditional games, and other products.

Also participating was Multicoin Capital, Alameda Research, DeFiance, Valor Capital Group, Figment, Spartan Capital, Tribe Capital, Play Ventures, HashKey, Mechanism Capital, DeFi Alliance, Terra, and others.

Of those investors, Multicoin is perhaps among the best known, as it’s been investing in the blockchain space since 2017, and has invested in Solana, NEAR, MobileCoin (used for P2P payments in Signal), and several other significant projects.

Burnt Finance will now launch its own NFT marketplace, which will feature English, Dutch, and Buy Now auctions, aiming to be a hub for NFTs by integrating DeFi functionality, such a NFT lending, liquidity mining with staking incentives, fractionalization, and GameFi.

This will provide permissionless access to NFTs and claims to have low fees and fast speeds, with “160,000 users” on its waitlist. It also claims to have processed over $100 million of trading volume in 7 days on its Spark testnet.

It also plans to expand to additional blockchains including Terra and other EVM compatible layer one protocols.

Yat Siu, the executive chairman and co-founder of Animoca Brands, commented: “Minting and trading assets in a permissionless ecosystem is crucially important to the economic groundwork of the open metaverse.”

The global market for non-fungible tokens hit around $22B in 2021 according to DappRadar. Traditional auction houses Christie’s and Sotheby’s have also expanded into the NFT space.

Burnt Finance is pushing at an open door. NFT sales topped $4b in December 2021 alone.

Competitors include, at various levels of course, OpenSea, SuperRare, Rarible and NiftyGateway. However, although Burnt is clearly still very early, it’s attempting to outpace larger players by using Solana and going for the DeFi space.