Software businesses are setting new heights for fundraising nearly every day. Transmit Security broke records last summer with their $543 million Series A, and in Q3 2021, $26.4 billion was invested in North American early-stage startups, compared with $12.1 billion a year earlier. There have been warnings that these landmark fundraises are driven by too much capital available and a highly competitive venture market.

However, despite the twofold growth in dollars invested, the number of companies receiving funding has grown by less than 30% compared with Q3 2020. Furthermore, recent benchmarks data shows that the businesses garnering these high valuations in 2021 exhibit metrics that significantly outperform their peers from 2018-2020. Simply put, 2021 has seen startups raise the bar for what a good company looks like, and investors have been willing to pay a high price for a piece of the pie.

Key takeaways

Recent benchmark data shows that qualifying for the top quartiles in key SaaS metrics was harder in 2021 than ever before, particularly when you consider the growth and net dollar retention metrics.

- From 2018-2020, growing at 140% would put business in the top quartile as a Series A company — growth expectations have risen to +193% in 2021.

- Beyond growth, formerly impressive metrics like 110% net dollar retention no longer make the cut — to be considered one of the best businesses raising a Series B, +125% NDR is required.

Taking a closer look at each of these early rounds highlights that investors might not be going crazy with their recent investments as startups redefine what “good” looks like.

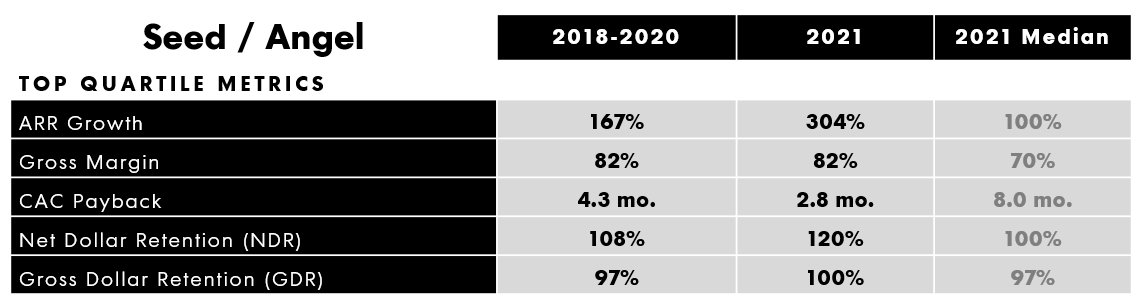

Seed/angel

Image Credits: OpenView Venture Partners

Seed and angel investing has seen a lot of newcomers, particularly from investors who have traditionally stuck to later rounds. While businesses at this stage are mostly valued on their team and addressable market, metrics do matter.

Growth expectations at the seed stage are much higher than they have been in the past. The median post-revenue business raising a seed or angel investment is growing ARR at 100%, but to be in the top quartile, growth needs to exceed 300% (versus 167% in previous years).

CAC payback for the top quartile was less than three months (versus 4.33 months in previous years). This is partially due to businesses continuing to leverage product-led growth to go to market compared with building a traditional sales team early on. The ARR threshold where sales and marketing spend surpasses product and engineering spend continues to shift upward ($2.5 million in 2019, $10 million in 2020 and $20 million in 2021).

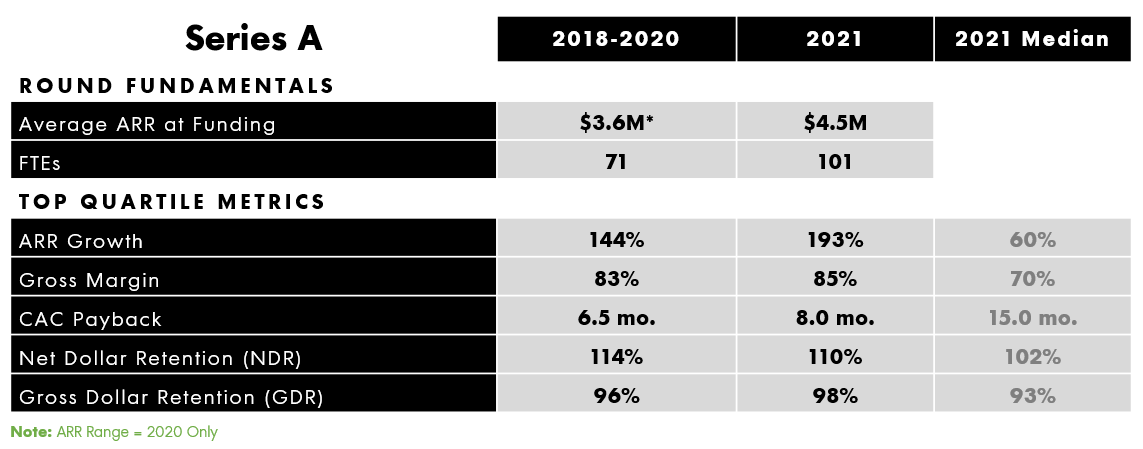

Series A

Image Credits: OpenView Venture Partners

On average, Series A rounds are happening at increasingly high levels of ARR. In 2021, businesses were raising Series As at the $4.5 million ARR mark, relative to $3.6 million in 2020. Additionally, the amount they are raising rose significantly to $18 million in 2021 versus $13 million in 2020.

Despite this, funding hasn’t just gone to just any startup, and the best-in-class startups from 2018-2020 likely wouldn’t have achieved these rounds. To be in the top quartile on ARR growth in 2021, businesses had to be growing at nearly 200% versus 144% historically. Most other best-in-class metrics stayed stable over this time frame as investors focused. Gross margin, CAC payback and gross/net retention were all roughly the same as they were in 2021.

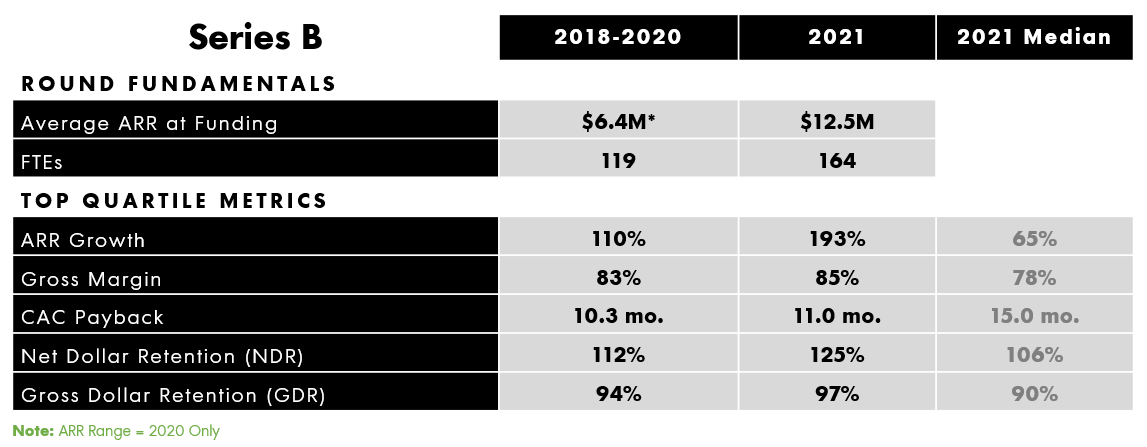

Series B

Image Credits: OpenView Venture Partners

While growing faster is still a theme in Series Bs (121% in 2021 versus 110% in 2018-20), a different metric saw the largest increase. Net dollar retention expectations continue to climb to new heights as +125% NDR is the new cut off to be in the top three-fourths of Series B startups. 110% NDR used to put you in the top quartile; now, 110% NDR would put you just above the 2021 median of 106%.

It makes sense that investors are focused on high net dollar retention given what it says about your product’s value and how it can fuel long-term growth at a much lower cost. This may also be due to increased applications of usage-based pricing, where customer retention and expansion become more critical than new logo growth.

What’s next

2021 has undoubtedly seen record-setting fundraises, and on an aggregate level, the amount of dollars flowing to early stage startups continues to rise. There are no signs that this will slow down as VCs continue to reload with new funds. By the end of Q3 2021, VCs had already passed 2020’s record of $85 billion in fundraising and are likely to cross $100 billion for the first time ever. However, don’t expect that this money will flow to just any startup. Expectations around 300% growth early on and 125% retention at $10 million ARR are likely to stay, if not increase, in 2022.