With capital aplenty for startups over the last few years, the balance of power between investors and founders has been tilting toward the latter. This manifests itself in several ways along a startup’s lifecycle, from more favorable early-stage term sheets to founder-friendlier public listing terms.

There’s an area that remains untouched, though: The anonymity of a fund’s limited partners (LPs). Rarely if ever do VCs fully disclose who their LPs are, even to founders they invested in.

Both LPs and VCs have reasons to want to keep their involvement confidential. But when these reasons aren’t solid enough, my prediction is that this will change.

The main driver, in my opinion, will be founder pressure.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

With increased competition for the hottest deals, VCs increasingly have to sell themselves to founders they are hoping to back. In this context, the old model in which founders have to undergo thorough due diligence while not getting to ask a single question seems outdated. Now, when entrepreneurs get the chance to start prodding, odds are they’ll ask about LPs.

Stealth-mode general partner Lolita Taub echoed founders’ concerns when she asked her Twitter followers if it was possible to look up the LPs of a fund. Unfortunately, the answer is no. Some actors such as public pension funds and nonprofits might be open about their investments, but most of the remaining data is partial and only available on closed platforms such as PitchBook and Preqin.

Stealth-mode general partner Lolita Taub echoed founders’ concerns when she asked her Twitter followers if it was possible to look up the LPs of a fund. Unfortunately, the answer is no. Some actors such as public pension funds and nonprofits might be open about their investments, but most of the remaining data is partial and only available on closed platforms such as PitchBook and Preqin.

Taub followed up with a series of tweets and retweets reminding us of an important fact: Tech doesn’t exist in a bubble. “There should be a public investor background check site that lets us know who we’re taking money from,” she tweeted.

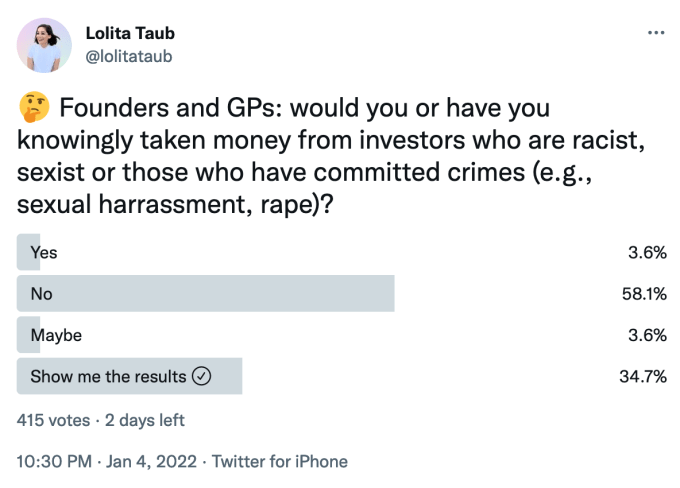

In the era of “know your customer” and offender registries, founders and general partners (GPs) too might want to know who they are dealing with. According to a quick survey from Taub, this information would influence their decision on whether to accept an investment.

Image Credits: Twitter

Taub’s survey is small and likely sample-biased, but it still shows that some people care.

Could the responses be mere lip service when money is involved? Maybe not. For instance, talent agency Endeavor famously returned a $400 million investment from Saudi Arabia in the wake of Jamal Khashoggi’s murder. And capital isn’t exactly scarce right now; it’s more a matter of choosing one’s investors than leaving money on the table.

This takes us back to our problem: How do you know whose money you are accepting when they are one step removed?

As a millennial, I remember when all we did was warn each other to stay away from so-and-so. And as a journalist, I also tend to know when a misbehaving VC or founder soft-landed behind the scenes as a board member or LP. But not everybody has access to whisper networks, so maybe it’s time for secrecy to fade.

Less secrecy around LPs would be helpful for new GPs as well. Raising a fund is a huge task for a solo VC, especially if they are not already part of wealthy circles, and it would help level the playing field if information on prospective investors wasn’t only shared between the happy few.

Founders and GPs aside, LPs themselves could benefit from more transparency. There are definitely pros and cons for them, and that explains why most of the resistance to sharing this information comes from their side.

Sometimes, LPs would rather stay in the shadows for good reason. For example, high-net-worth individuals and family offices may be wary of publicity that could expose them to security risks, such as kidnapping, a concern I sometimes heard about in Latin America.

But LPs come in various forms, and some of them have more to gain than to lose from letting themselves be known. In a Twitter thread earlier today, Sapphire Ventures’ Elizabeth “Beezer” Clarkson shared insights on the LP perspective for 2022. “Sharing the LP perspective” is the mission of #OpenLP, a crowdsourced effort launched by Sapphire Partners in 2015 and spearheaded by Clarkson.

“VCs and entrepreneurs are hungry for the LP voice, which has historically been relatively opaque. The interest in hearing more from LPs has been clear, and along with it, the #OpenLP movement has grown significantly,” Sapphire wrote last August in a blog post.

More LP transparency can take various forms, and high-level comment is one of them. “Venture investors and entrepreneurs want and deserve to know how ‘the money behind the money’ thinks and operates,” Clarkson wrote.

As for putting a face on LPs, it is already happening behind the scenes. For instance, many venture capital funds hold an annual LP Day. I helped organize one of these events in a former role, and the format was similar to a Demo Day, except that it was even more strictly invite-only. Portfolio founders would pitch for a few minutes, and LPs who chose to attend could ask questions at the end.

Taking this one step further, I wouldn’t be surprised to see more startups request LP Day invites even before closing a deal with a VC. More generally, we expect founders to take advantage of this moment and inquire about LPs as part of investor due diligence.