Kicking off 2022 may feel like we’re stuck the third round of 2020, but things have actually changed quite a lot in Technology Land, even if the pandemic is still with us.

Crypto has become far more established in the intervening period, for example, with more investors, startups and fundraising to be found in the space. Another change from the pre-pandemic days is the value of software revenues.

That may sound a little esoteric, but given that much of the startup world builds and sells software, the value of those incomes is incredibly important. If the value of software revenue rises, the value of software startups rises as well. That lowers investing risk. In turn, the climate for investing in software startups — which is most of them, mind — warms as risk decreases.

I won’t bore you with the mechanics of changing startup risk in a market rife with rising revenue multiples. What matters for our purposes today is to note that software became more valuable since the onset of the pandemic, inducing investors to fight over startup deals and preempt private rounds more often than was previously the norm.

The result? Rising startup prices.

The fact that startups have become more expensive, measured by comparing their valuations to their revenues, is reasonable. However, the H2 2020 software valuation boom tapered last year as SaaS and cloud stocks closed 2021 down a fraction from where they started the year.

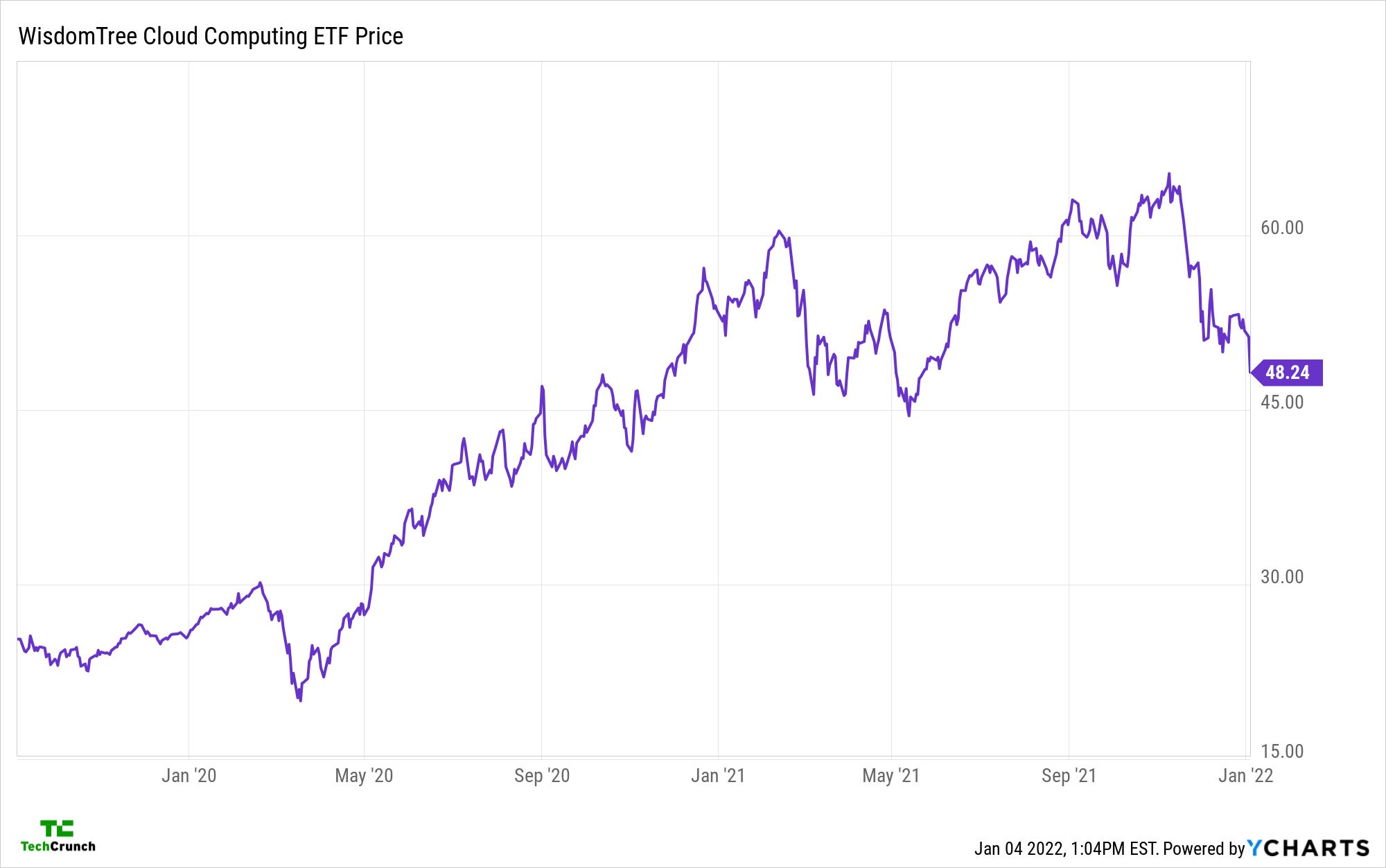

Even more, 2022 is starting off downright nasty for software stocks. The Bessemer Cloud Index (trackable as the $WCLD ETF), a basket of public software stocks, has lost ample ground thus far in 2022 (the following chart has a five-day range, so mind the dates):

Image Credits: YCharts

The index is off around 5.8% today as I write to you.

Zooming out, observe how the same basket of software and cloud stocks has lost ground since the start of 2021:

Image Credits: YCharts

Now normally this would not be an issue. Stocks go up and stocks go down. It’s what they are best at.

But there are second-order effects to consider. If the value of software stocks is on the ascent, startups benchmarking their present and future worth have rich comps to leverage. If those same software stocks lose ground, the startup comps start to make less sense. Thus the connection between public company prices and the value of startups.

As software stocks went up in 2020, tech investor willingness to pay more for less startup revenue rose. And it appeared to keep rising last year, even as software stocks struggled to hold onto their 2020 gains. But from a late 2021 peak, those same stocks have given back all their recent gains, and more.

Notably, this pretty sharp decline in value doesn’t appear to be hitting the private markets in the same way:

For context, I heard about companies with six-digit ARR last year landing fat Series A deals. What Stebbings — an investor and podcaster — is noting here is something even more extreme. If those 2021 Series A deals were stretched but still attached to something akin to old-fashioned valuation concepts, the above deals are not.

A $1 billion valuation attached to a company with $1 million in ARR is to affix a 1,000x revenue multiple to that startup. Which looks more like a millstone than a medal from where I am standing, if we consider that startup’s neck.

There are other forces at play. Startup valuations did not merely grow thanks to public markets repricing software stocks. Nor did they only rise due to larger venture fund sizes changing the dynamics of that particular investing class. Both contributed. As did the fact that startups did pretty well during the pandemic, thanks to burgeoning demand for their digital wares.

Today, parts of the logic that led to valuation gains by software startups more generally are deflating.

We’ve seen high-growth public tech companies announce earnings that failed to excite. We’re seeing software stocks go from flat to down. We’ve seen analyst downgrades. It feels a bit different from where we were back at those recent highs.

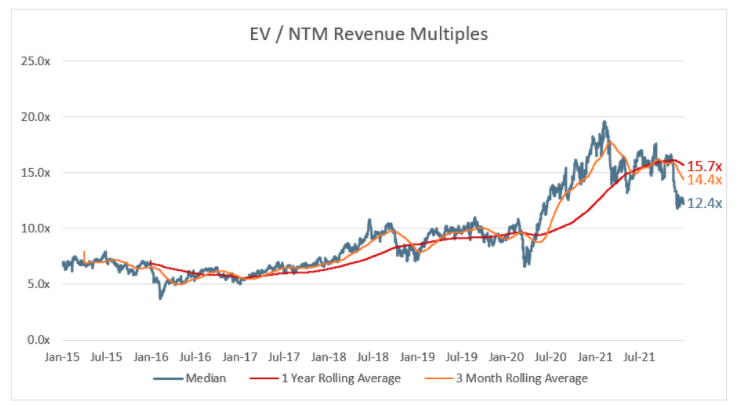

Indeed, former venture capitalist and present-day Altimeter Capital investor Jamin Ball notes on his blog that things really have changed in recent weeks (from his December 31, 2021, update):

EV stands for “enterprise value,” while NTM stands for “next 12 months.” Image Credits: Clouded Judgement; shared with permission.

The declines are even sharper for the fastest-growing software companies, those that accrued the most lofty gains and valuations:

EV stands for “enterprise value,” while NTM stands for “next 12 months.” Image Credits: Clouded Judgement; shared with permission.

Median multiples are going down. Top-tier valuations are going down. And we’re hearing about 1,000x ARR multiples from the private markets. A divergence, then, is forming between the private markets and public markets.

Startups had best hope that private investors are right to index heavily on nascent growth rates over other traditional private-market metrics. If not, everyone is going to be left holding some part of the bag when later rounds don’t consummate at higher prices.

Nothing in this post should be read as alarm — yet. But another few bad trading days and the decline in public software valuations could start to change the private-market conversation. Or if we do see public software valuations keep dipping while private-market software valuations stay extreme, someone is going to be very wrong. We just won’t know for a little while who it was.