The beauty and wellness industry, annually worth some $4 trillion, is underpinned by tens of thousands of businesses and millions of professionals carrying out haircuts, treatments and workouts. Today, a company called Fresha, which provides a software stack to help them run those operations, is announcing new funding of $52.5 million to continue building out its own business.

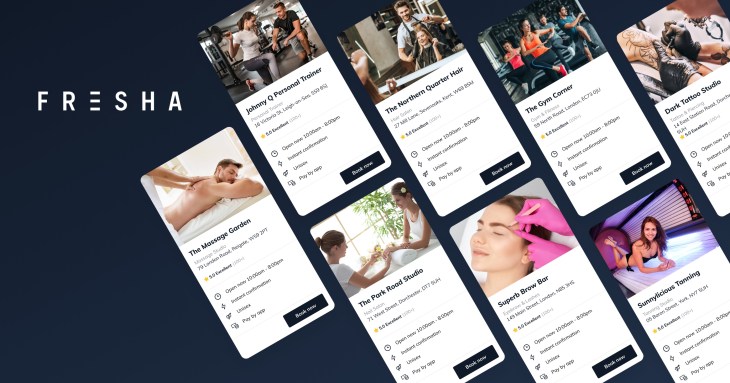

Fresha got its start, and is best known among its 60,000 customers, for its booking software, which it provides on a subscription-free basis, charging instead based on taking a cut on payments, or first-time bookings and marketing messages (if a customer chooses those latter two options). But its ambitions, co-founder and CEO William Zeqiri said in an interview, are to be the go-to destination for any digital tool that a salon or independent professional might need to run a business: like Shopify, LinkedIn, Wix, Square or QuickBooks, but tailored for the specific demands of beauty and wellness professionals.

“Stylists [and other beauty and wellness professionals] are not really trained in business management,” he said. “Our goal is to free that up and automate all aspects of their business.”

Michael Lahyani and BECO Capital co-led the round, with previous backers General Atlantic, Partech, Target Global and FMZ Ventures also participating. Fresha has raised $182 million overall.

This latest funding is coming in the form of a Series C extension — Fresha raised the first $100 million in June of this year — and with it, the startup’s valuation has shot up to over $640 million. For context, the company previously had not disclosed its valuation, but Zeqiri confirmed that it increased significantly in the extension due to the company’s own growth in the last six months.

Beauty and wellness had a mixed bag of luck as the pandemic took hold across the world. People overall were going out a lot less, or not at all, and thus spending significantly more on products to treat themselves at home. But on the other hand, COVID-19 led to a lot of municipalities shutting down salons to help curb the spread of the virus; and in cases where they were open, they had to follow more restrictive protocols for the customers who did show up.

That presented an obvious challenge to a company like Fresha, built around the premise of providing appointment booking and payments for in-person, very physical businesses. However, like other tech companies that have carved out a niche for themselves in providing tools specifically catering to and mastering the needs of a specific service-industry vertical — Toast being on strong example — Fresha’s focus helped it identify the opportunity inherent in that challenge.

Today, Fresha’s tools include booking and point-of-sale payment software — used in some 120 countries with its biggest markets the U.S., the U.K., Canada, Australia, New Zealand and Europe, where it sees tens of millions of appointments booked monthly and has processed $15 billion in transactions to date.

But Zeqiri said that with the big shift among Fresha’s customers to move more interactions and services online in the wake of COVID-19, Fresha has built a “Shopify” for beauty and wellness websites to sell goods and services (this is launching in the coming days). It’s now in the process of finishing up its “Wix” for designing sites.

“We want to build the Amazon of the beauty and wellness industry, with a full suite of services that compete at every level, and in all markets,” he said. That will include marketing, and marketing automation tools, and more down the line, he said. It will in the meantime face a pretty big army of competitors, from Square through to Booksy, Phorest, Treatwell, SalonIQ and many others.

There has also been an interesting shift in the business models around beauty and wellness that has also played into Fresha’s hand, said Nick Miller, the company’s other co-founder and chief product officer.

Specifically, the pressures of the pandemic forced a lot of salons and brick and mortar businesses to downsize; or sometimes shut down altogether and “go mobile” where pros paid people home visits to carry out services.

Or, in cases where they were willing to stick it out and continue paying rent on premises, increasingly there was a move to models where pros were no longer directly employed by salons and spas, but rather hired out space within them to serve their own client lists; or some variation on that theme, for example staying on the books as contractors and sharing a common appointment book, but still “renting” the space to carry out work.

All of this presents a complex mix of new use cases, and customers, to sign on to a platform like Fresha’s, Miller noted.

“That’s been one of the COVID effects,” he said. And because its users are not tech-interested in the main, the idea of using multiple services for different aspects of running their businesses, and “jumping to different platforms,” in his words, they appealed to Fresha to bring in the functionality that they wanted to have. “It was great timing for us,” Miller said.

Sadly, one of the other consequences of the pandemic has been the closure of a lot of small and independent businesses. Zeqiri noted that Fresha has had multiple offers from its customers to buy them up, but that’s not the core of how the startup sees itself growing: its aim is instead to build tools to make those businesses viable again, he said.

“Fresha has positioned itself as a major player in the beauty and wellness industry with a large and loyal customer base,” said Aaron Goldman, global co-head of financial services and MD of General Atlantic, in a statement. “We strongly believe in Fresha’s balanced strategy of providing one of the best products in the market at no cost to salons and then driving monetization via payments and value-added services.”