Here in the United States, we’re counting down to the Nubank and HashiCorp IPOs that should touch down in mere days. But those are not the only technology offerings to keep eyes on at the moment. SenseTime, a Chinese AI company, is also listing this week, providing a new window into the value of the country’s upstart tech companies under a changed regulatory regime.

As Didi looks to delist from U.S. markets amid hubbub that Alibaba could do the same, it’s not a surprise that SenseTime will list in Hong Kong and not the Nasdaq or NYSE.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Despite listing close to home, however, SenseTime is not having the best time possible in its public-market debut. The company’s IPO, according to the South China Morning Post, “plans to raise as much as HK$5.99 billion (US$768 million) by selling 1.5 billion shares at HK$3.85 to HK$3.99 each.” Raising three-quarters of a billion dollars is nothing to sneeze at, but at the same time is a far cry from the $2 billion that SenseTime wanted to raise.

The company’s offering is expected to begin tomorrow, so expect to hear more about its listing over the coming day.

SenseTime could command a valuation of as much as $17 billion in its IPO, depending on its final price. Is that figure strong? And what can we learn from comparing the company’s miniaturized IPO to its operating results? Let’s dive into the numbers and see what we can find out.

Fast, expensive growth

SenseTime builds AI products. Or as it puts it in its IPO prospectus, it has “built a first-of-its-kind universal AI infrastructure to achieve mass production of a diverse and growing portfolio of AI models with rich functionality and superior accuracy.” Normally we wouldn’t quote something as self-serving as that particular riff, but the breadth implied by the comment was noteworthy.

Why? Because it undergirds SenseTime’s claims that it has “leading market positions” in AI areas as far afield as “smart” cities, manufacturing, apps and healthcare. The company, then, has a very wide market lens for its software products.

The company’s business model isn’t hard to parse. SenseTime notes that it “primarily” generates revenues from selling software licenses, along with “AI software-embedded hardware and related services.” The company’s model includes the “license of software installed on customers’ devices or on-premise at customers’ servers,” along with hardware-software combinations including physical products made by SenseTime and other companies. SenseTime also provides an “AI-as-a-service offering to customers for customized model production.”

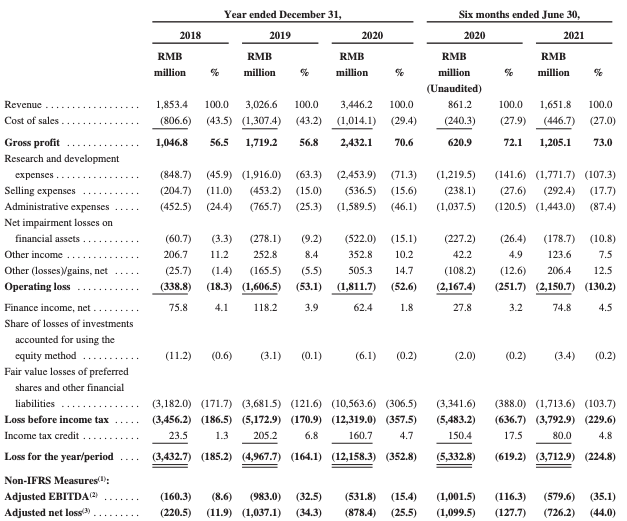

All that rolls into a single revenue line item at the company, which you can see in the following income statement:

Image Credits: SenseTime IPO prospectus

Time flows left to right in the above, with the most recent data coming in the final two columns. Note that we are discussing millions of yuan, also known as renminbi (RMB). For reference, 1 million RMB is worth $156,819 this morning, per a Google currency conversion. So, divide given numbers by roughly six to get their equivalent in U.S. dollars.

But don’t worry, we don’t expect you to do the math yourself. That’s why you have us! Keeping in mind that currency conversions fluctuate, here are the converted results for SenseTime’s H1 2021, compared to H1 2020:

- SenseTime H1 2021 revenue: $259,011,907.35

- SenseTime H1 2021 revenue growth: 92%

- SenseTime H1 2021 gross margin: 73.0%, up from 72.1% in H1 2020

- SenseTime H1 2021 operating loss: $337,195,501.81, effectively flat year over year

- SenseTime H1 2021 net loss: $582,190,028.98, a 30% improvement.

There’s lots to like and lots to not like in the above. Seeing a company grow at more than 90% when north of nine figures of revenue is very impressive. To do so while adding a few bips of gross margin is downright lovely.

Sadly, however, you can see that SenseTime has spent far in advance of its rising gross profits, leading to sticky operating losses of well in excess of 100% of its revenues. The company’s net losses are inclusive of “fair value losses of preferred shares” that are a bit tricky to unpack and not entirely worth our time. We can keep focused on the company’s operating results.

And those are, as we have seen, intensely negative. That fact will make the SenseTime debut illustrative. If it winds up trading well after it prices, the company’s IPO could help smooth the paths for other high-loss tech concerns considering a Hong Kong listing. That the company had to lower its sights regarding its IPO raise, however, doesn’t indicate that demand is piping hot for SenseTime equity.

The larger context for SenseTime’s debut is that it is going public after the Chinese government cracked down on a number of major technology companies and sectors in the country. As such, precisely how much room there is for tech companies to accrete huge incomes to themselves is unknown; furthermore, in sensitive areas of the tech market — AI, for example — there are even more uncertainties to stomach.

So, let’s see how the company trades. More noise will be made on U.S. shores about the Nubank and Hashicorp IPOs because they are domestic, but the SenseTime debut will be just as interesting and clarifying.