The plan is simple: First, we create a knockoff of a popular digital service. Second, we cry political persecution. Third, we raise a bunch of money with a SPAC. And then, to cap it off, we take on AWS.

Got it?

What’s actually funny is that I am not kidding. That is not only a real plan, but one that we’ve now seen twice.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

We first got wind of the method of raising capital with the Trump SPAC deal taking a collection of ideas and very little product public. And then we got another dose yesterday with online video hosting portal Rumble’s SPAC plan. Both have long-term ambitions, or at least teasers, to take on the incumbent cloud players.

Good luck? That goal, about a hundred billion dollars, and 15 years might get you to quaternary status in the vicinity of where the big public clouds play.

Good luck? That goal, about a hundred billion dollars, and 15 years might get you to quaternary status in the vicinity of where the big public clouds play.

So let’s take a look at the Rumble scheme to conquer the digital world. After all, startups are designed to make big plans. Rumble’s plot to take on the combined heft of Amazon, Microsoft and Google is, if nothing else, not a small endeavor.

Surely *this* is peak SPAC?

Rumble, a self-described “neutral video platform,” is merging with CF Acquisition Corp. VI. The transaction is expected to close in the second quarter of 2022, per the companies. Here are the financial terms of the deal (modestly condensed):

The transaction values Rumble at an initial enterprise value of $2.1 billion, with current Rumble shareholders having the ability to earn additional shares of the combined company if the stock reaches price hurdles of $15.00 and $17.50 per share. The transaction is expected to provide approximately $400 million in proceeds to Rumble, including a fully committed PIPE of $100 million at $10.00 per share and $300 million of cash held in the trust account of CFVI.

You are correct in being surprised that Rumble is worth $2.1 billion, or will be next year when it combines with the blank-check company. After all, we don’t really know that much about it.

Crunchbase data has a single funding event on record for the company, a May 2021 round with capital arriving from Peter Thiel and J.D. Vance. At the time, the company was worth around $500 million, per The Wall Street Journal. The Journal also notes that Rumble was founded in 2013, but only recently found more mainstream popularity after right-wing figures began to promote the service as “a more welcoming, free-speech alternative” to video offerings from major platform players like Meta and Alphabet.

I remain curious how long Peter Thiel can support candidates — J.D. Vance’s current electoral efforts are a recipient of his largesse — that bash Facebook, where he sits on the board. That question is amplified by his support of a platform that directly trashes Facebook in its SPAC investor presentation. Wild times.

Regardless, before we get into just what Rumble thinks of Facebook and other major internet players, let’s talk money. Here’s what we learned regarding the company’s revenue and profitability history from Rumble’s SPAC deck:

And here’s what we found out regarding revenues from a host of SEC filings that we searched through this morning:

Right, so not much.

That leaves us with vision, I suppose. So let’s talk big plans.

The future

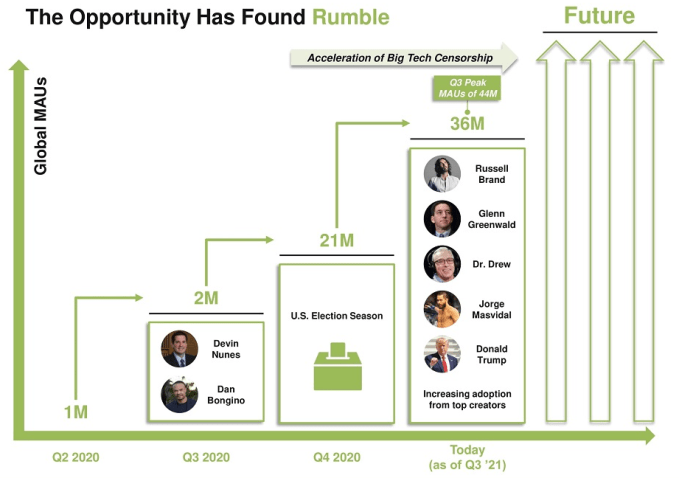

That Rumble’s growth from unknown entity to right-wing content powerhouse is not merely our framing of the company’s history. It’s its own, too.

From its SPAC deck, here’s how Rumble talks about its growth from irrelevance to prominence on one part of the American political spectrum:

Image Credits: Rumble SPAC presentation

I believe this is the first time that I have seen Glenn Greenwald on a SPAC deck. Or a shirtless man. Or former U.S. President Donald Trump’s little fist. What a time to be alive.

The political point matters, not only to understand where Rumble’s content and audience come from, but also in terms of how the company views its market:

Image Credits: Rumble SPAC presentation

This chart, apart from being spit-out-your-coffee funny — honestly, thank you, Peter, for this entire presentation — is also bass-ackwards.

The idea that major corporations must host content that they do not want to would be a wild abrogation of First Amendment rights; to argue that companies exercising speech as evidence of censorship is funny; to add that it is partisan to do so is hilarious. Recall that in the U.S., the banning of books is coming from the same part of the political spectrum that is calling for major companies to platform their speech.

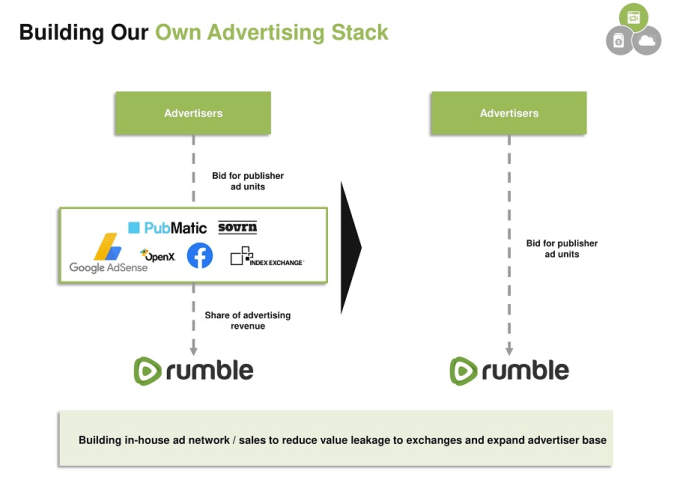

Pernicious irony aside, here’s how Rumble expects to make lots of money:

Image Credits: Rumble SPAC presentation

There’s some logic to this. If Rumble can reach, and hold onto, the scale required to entice advertisers to its own, in-house advertising service, then it would be able to extract more value from its audience. But I am not entirely sure how much I trust Rumble to manage the effort given that the company was unable to center the beige box’s text in its presentation. If PowerPoint is too much, I am skeptical that they’ll be able to fashion a real-time bidding service for online video.

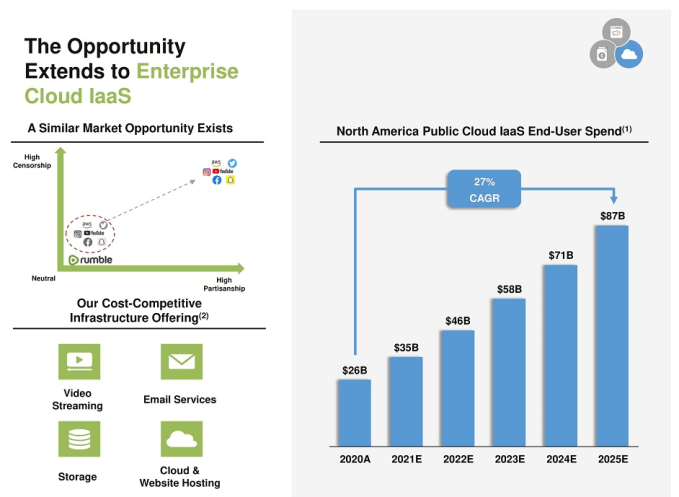

And how much more will it take to challenge three trillion-dollar companies? Observe the following bit of fancy:

Image Credits: Rumble SPAC presentation

The company does allow that the four “offerings” noted in the lower-left quadrant of the above image are “currently in development.” Cool.

Should we have confidence in Rumble taking on major IaaS players?

I am going to go out on a huge limb and say maybe not.

Not only because many larger, better-funded, and more competent companies have tried and failed. But because when it comes to SPACs looking to take on the IaaS and PaaS market, the early track record is not great.

Recall that Trump Media & Technology Group is going public via a SPAC and also noted a long-term “opportunity” to take on major cloud platforms. And, since that particular combination was announced, how are things going? In chronological order:

And:

So perhaps AWS won’t suffer from new competitive drag anytime soon.