Every marketplace or platform startup has to decide how much they should charge for transactions on their platform, known as the “take rate.”

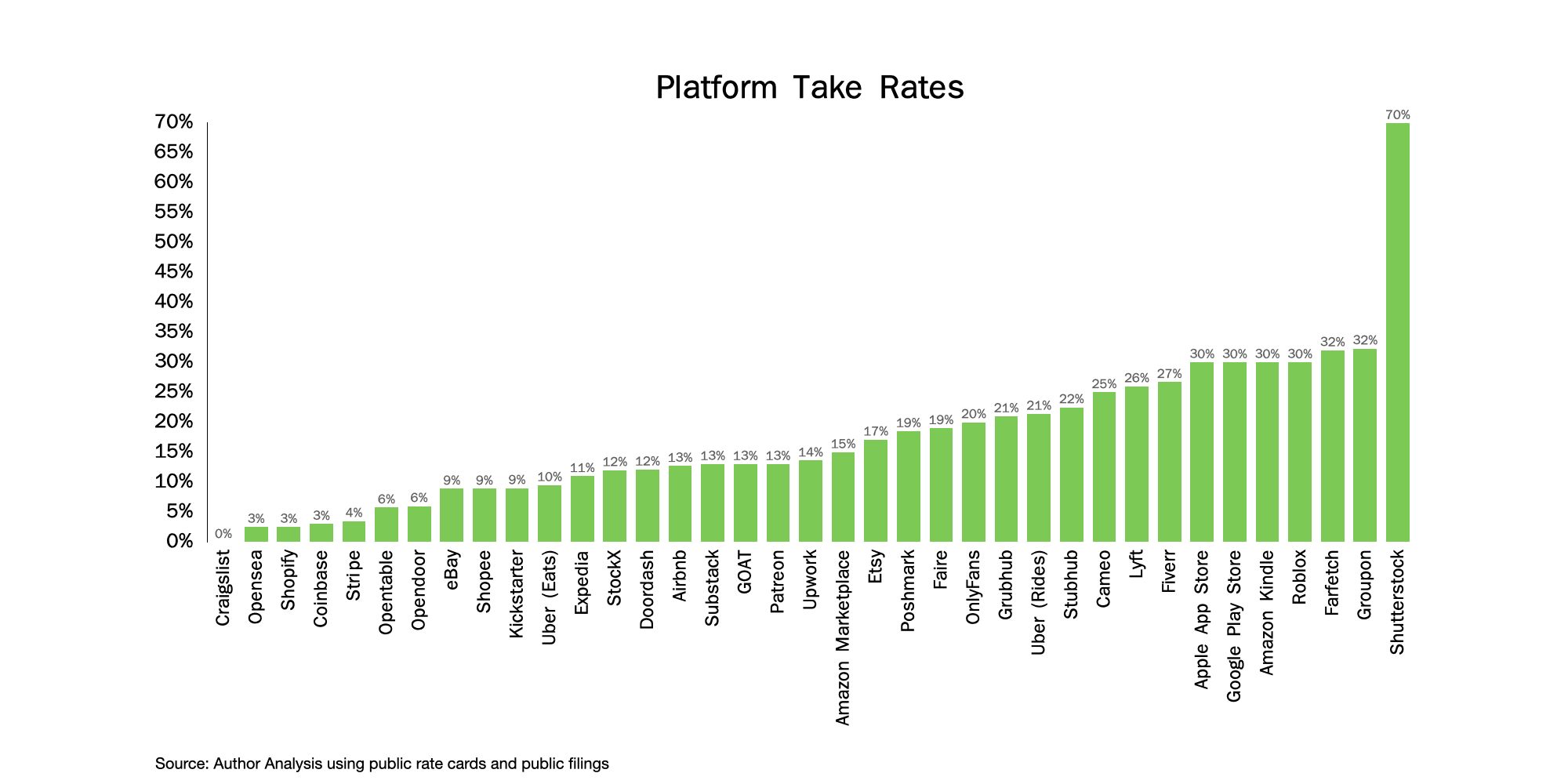

While there is no formula set in stone, I’ve analyzed the take rates of over 25 private and public marketplaces below. I’ll use these to help shed light on some considerations for founders to guide their decision.

Note that the definition of “take rate” used in this piece will be a percentage, which is calculated by dividing the revenue made on the transaction by the platform by the total value of the transaction.

Maximizing take rate isn’t the goal

It’s important for founders to remember that maximizing the take rate of the platform is not the goal.

A higher take rate typically leads to lower transaction volume, and depending on the stage a company is in, it may be advantageous to charge a lower take rate than what you can sustain to gain a strategic advantage.

Image Credits: Tanay Jaipuria

You can see startups do this when they are going after relatively nascent markets that they are trying to grow. A great example of this is OpenSea, which charges a 2.5% fee on transactions, which is quite low compared to other marketplaces. However, given that NFTs were relatively nascent, their low fees helped reduce friction to trading and grow the size of the market.

This also happens in markets that are extremely competitive and have some winner-take-all dynamics of economies of scale. Here, a marketplace could start with lower take rates to try to grab share or achieve scale.

The more value a marketplace provides via value-added services, the higher the take rate it can charge.

A general rule of thumb to remember is that the goal is to maximize long-term profit: (take rate x average transaction value – variable cost) x (number of transactions).

Note that:

- The take rate and number of transactions will often trade off with each other.

- A lower take rate in the short term can lead to better outcomes in the long term.

- Charging lower take rates than what you can “get away with” may lead to higher retention and value creation in the long run.

Understand the nature of your market

Referring to the chart above, it’s clear that take rates are extremely variable, even within industries. However, certain market-driven factors play a role in determining the ranges in which you can operate.

For instance, certain companies such as Uber have to charge very different take rates in delivery (~10%) versus ride-sharing (~20%).

When trying to understand the nature of the market, founders should consider:

Is the product being sold digital or physical, and how much margin is available?

Digital products are infinitely reproducible, so marketplaces that deal with them can charge higher take rates, because the venture has zero production cost.

On the other hand, marketplaces involved in physical products with lower gross margins can charge less, as their suppliers make lower margins on the products. Many digital marketplaces tend to cluster in the 30% range, while those selling physical products tend to be in the 15% to 20% range.

Competition

Founders should also think about what the next best alternative to not using their marketplace is — what is the competition and what it looks like — when studying their market. Sometimes, competition can come in the form of direct competitors or the use of broker intermediaries (i.e., an offline process today).

Understanding the take rate charged by the competition relative to the experience they provide is a good exercise.

The concentration of suppliers on the platform

The more fragmented suppliers on the platform are, the more marketplaces can reasonably charge, since the bargaining power of any individual supplier is lower.

For example, travel marketplaces can only charge airlines 3% to 5%, as there are only about five key suppliers. However, on the hotel side, where there is more fragmentation, they can charge 15% to 20%.

The concentration of buyers on the platform

In general, consumer marketplaces cater to individual customers, which, by definition, makes the buyer side very fragmented. However, in cases where there are a concentrated set of buyers, the take rate the marketplace can charge tends to be lower, at least for those buyers.

One example of this is Affirm, for which Peloton represents >20% of customer volume. While Affirm doesn’t break out its take rate by customer, it’s very likely they have negotiated better rates for themselves, which also reduces the overall take rate Affirm has.

Distribution is king (and can be charged for)

One of the most critical factors that influence the take rate you can charge is whether you are driving distribution for the suppliers on your platform.

In other words: Do your suppliers believe they are making incremental sales simply due to their presence on your platform? Or do they end up having to do all the marketing work themselves?

Suppliers typically are willing to pay only 2% to 5% to platforms that are not involved in distribution much and just offer transaction processing or infrastructure. Companies like Shopify only charge a take rate of about 2%, since they only provide infrastructure to operate a store. In contrast, Amazon charges 15%, since it has aggregated customer demand and can therefore drive incremental distribution.

Suppliers can be willing to pay as much as 50% to 60% of their gross margins on sales that are truly incremental.

While most marketplaces charge a blended take rate that takes into account their ability to drive incremental demand, some platforms have even gone further and set different take rates based on different distribution methods. For example, Udemy charges a 3% take rate if the instructor using Udemy sells the course themselves, but charges a 50% take rate if Udemy sells the course on behalf of the instructor.

Growing take rates through value-added services

The more value a marketplace provides via value-added services, the higher the take rate it can charge. Additionally, take rates aren’t set in stone and can be grown over time by introducing more value-added services.

Below are some key value-added services with rough estimates of how much incremental value they provide:

Payments

Most marketplaces provide payment and transaction processing, which allows them to charge an incremental 3%-5% take rate. Note that the bulk of this typically goes to processing fees.

Quality control and authentication

Marketplaces that can help create trust by verifying items and managing quality can typically charge 2%-5% extra. One example of this is GOAT, which charges 14% on sneaker sales partly because it verifies the products’ authenticity itself. eBay, on the other hand, is more unmanaged and charges 9%.

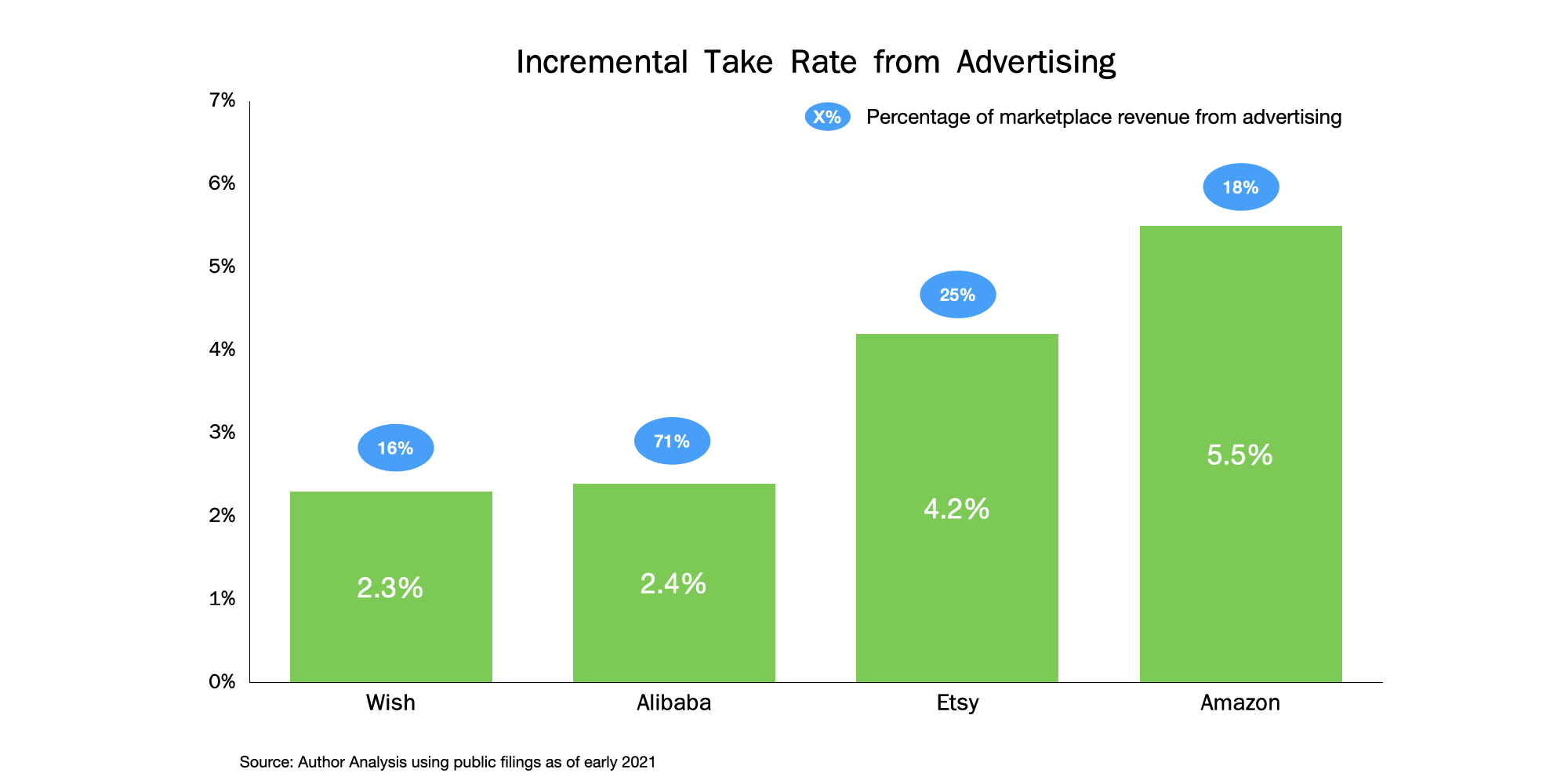

Advertising

Advertising is often one of the best ways for marketplaces with aggregated customers to grow take rates. Marketplaces can sell ad inventory to suppliers who want more sales without raising take rates for suppliers who don’t.

Image Credits: Tanay Jaipuria

While the benefit from advertising varies depending on its effectiveness, companies such as Alibaba and Amazon have been able to grow their advertising businesses to drive an incremental 2% to 5% of take rates.