Battery Ventures released its State of the OpenCloud report today, providing a set of data points that clearly outline the accelerated growth of cloud services in recent quarters.

The report helps explain the race to invest capital into startups that we’ve been observing over the past 18 months.

The pandemic pushed companies to start using cloud services — infrastructure, platform or SaaS — earlier and quicker than they might have otherwise. That resulted in big investments, eye-popping IPOs and tremendous revenue growth for software companies of all stripes, especially those built atop open source code.

Consider this tidbit from the report: “The average infrastructure-software IPO valuation has increased 10 times over the last 10 years, and there are more infrastructure-software companies valued at $10 billion or more than ever before.” What’s more, the data implies a healthy pipeline of major cloud IPOs.

Battery believes that the cloud market could eventually be worth $1 trillion. When you consider that the vast majority of work, development and computing will be done in the cloud at some point, the investment group’s round-number projection may prove modest.

This report makes it clear that despite the tremendous growth numbers we have seen recently, we are still just scratching the surface of the cloud’s potential.

That’s our takeaway. While the digital transformation is evident and startling, this report makes it clear that despite the nigh-incredible growth numbers we have seen recently, we are still just scratching the surface of the cloud’s potential.

Public cloud acceleration

Amazon’s AWS public cloud platform is big business. Amazon breaks out its results on a quarterly basis, showing the world exactly how much cloud revenue it generates, as well as the resulting operating profit. Microsoft also breaks out growth for its Azure service, but with other services included in the reporting category, the exact number is harder to nail down.

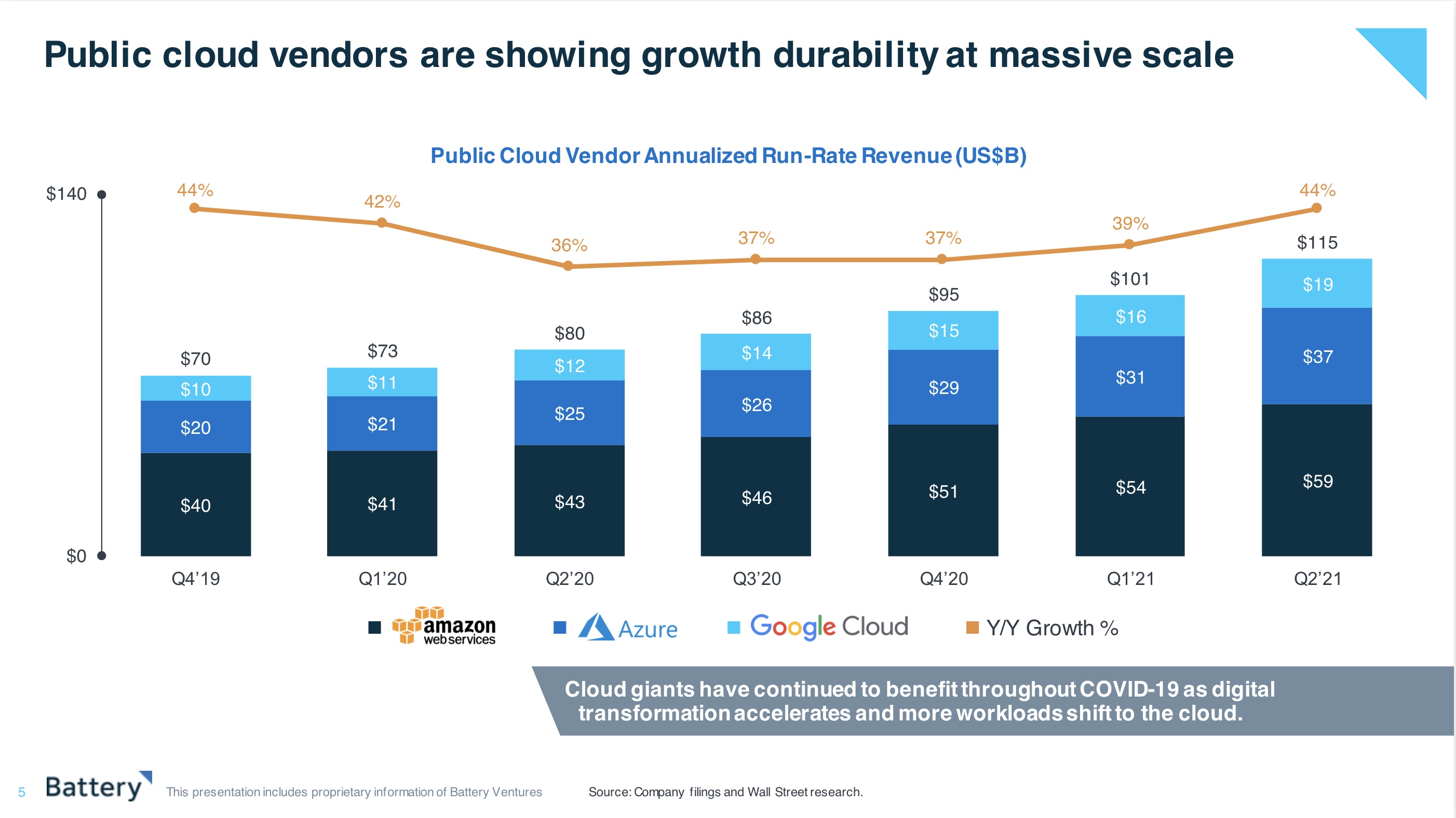

Battery’s report gives us per-platform data. In Q2 2021, the venture capital firm reckons that AWS reached a $59 billion run rate, while Azure hit $37 billion and Google Cloud reached $19 billion — and this was before the companies reported Q3 results.

Image Credits: Battery Ventures

Critically, Battery’s Q2 figures were up an aggregate 44% compared to a year earlier — the growth has accelerated from an early-pandemic low of 36% in Q2 of last year. Indeed, since the second quarter of 2020, public cloud growth has either held steady or risen.

Given the sheer amount of dollars involved in these figures, the acceleration of growth from 36% to 44% is incredibly material: The three cloud platforms closed Q2 2021 on a combined run rate of $115 billion.

It’s worth noting that in the most recent quarter, AWS generated more than $16 billion in revenue, up from $11.6 billion in the year-ago period. The service, in spite of being at this since 2006, is still experiencing public cloud growth of close to 40%. Google and Microsoft also did well, and the market is on a $180 billion run rate, growing at a remarkable 37% based on Q3 numbers. Battery is not wrong here.

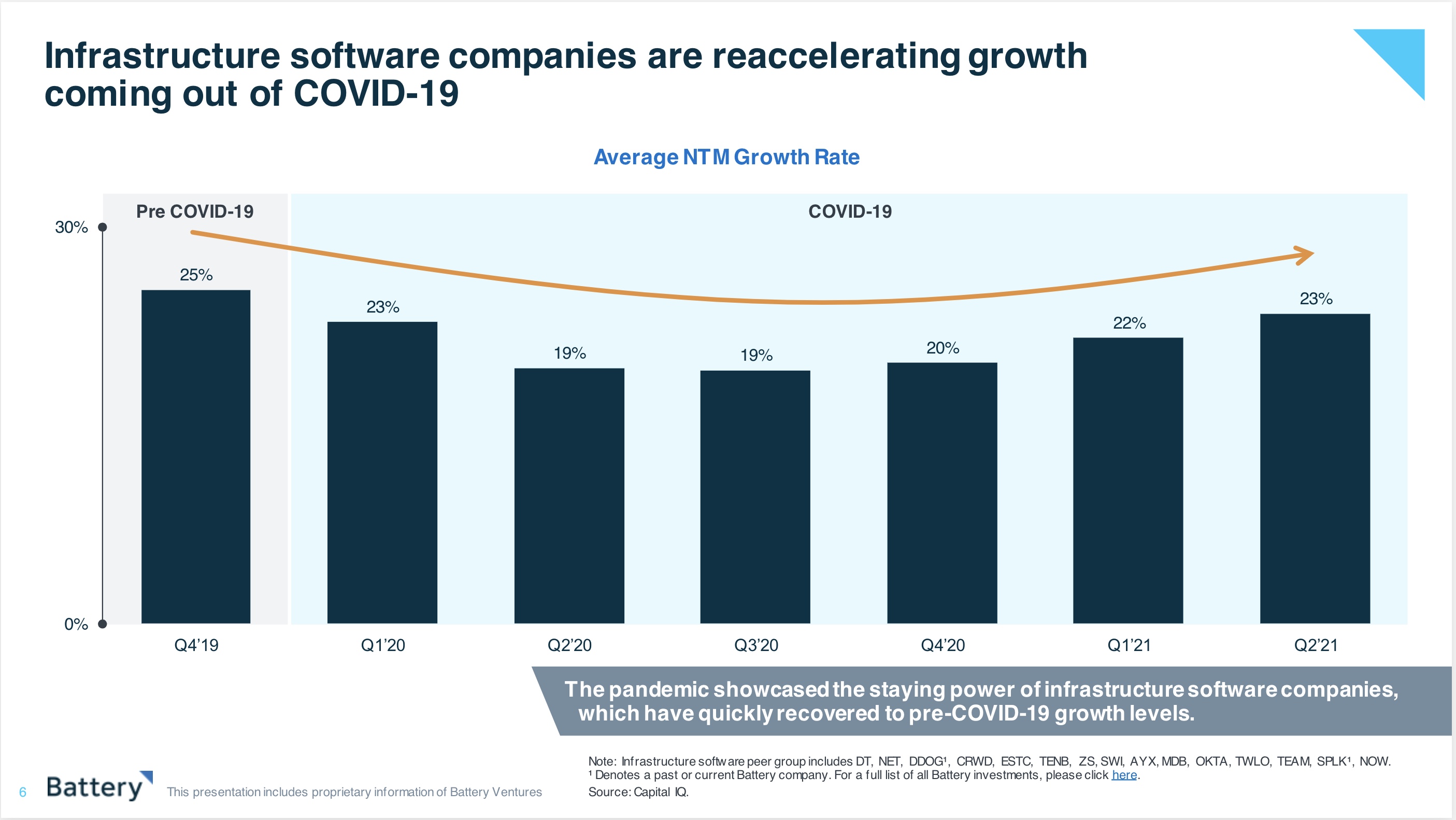

Public cloud platforms aren’t the only ones seeing growth rates accelerate from early-pandemic lows. Battery notes that infrastructure software companies are showing similar gains. A cohort of companies including ZScaler, Okta, DataDog and CrowdStrike saw growth also bottom out in Q2 2020, reaching a nadir of just 19% average next twelve months revenue growth, or NTM revenue expansion.

Image Credits: Battery Ventures

That figure has since recovered to an average of 23%. The early months of COVID-19 were not kind to cloud software and services writ large, but the pandemic’s economic changes have helped drive growth back up.

Building software in the cloud

As we saw last year, UIPath’s final private valuation before it went public was a massive $35 billion. Databricks just raised $1.2 billion at a $38 billion valuation. Such companies are beginning to generate massive value. UIPath’s market cap is down on the public market, but it’s still above $28 billion.

As Battery points out, cloud native offerings are taking off in a big way with huge valuations, massive IPOs and bright futures as sustainable public companies. If you’re primarily on-premises, you are operating on an obsolete playbook.

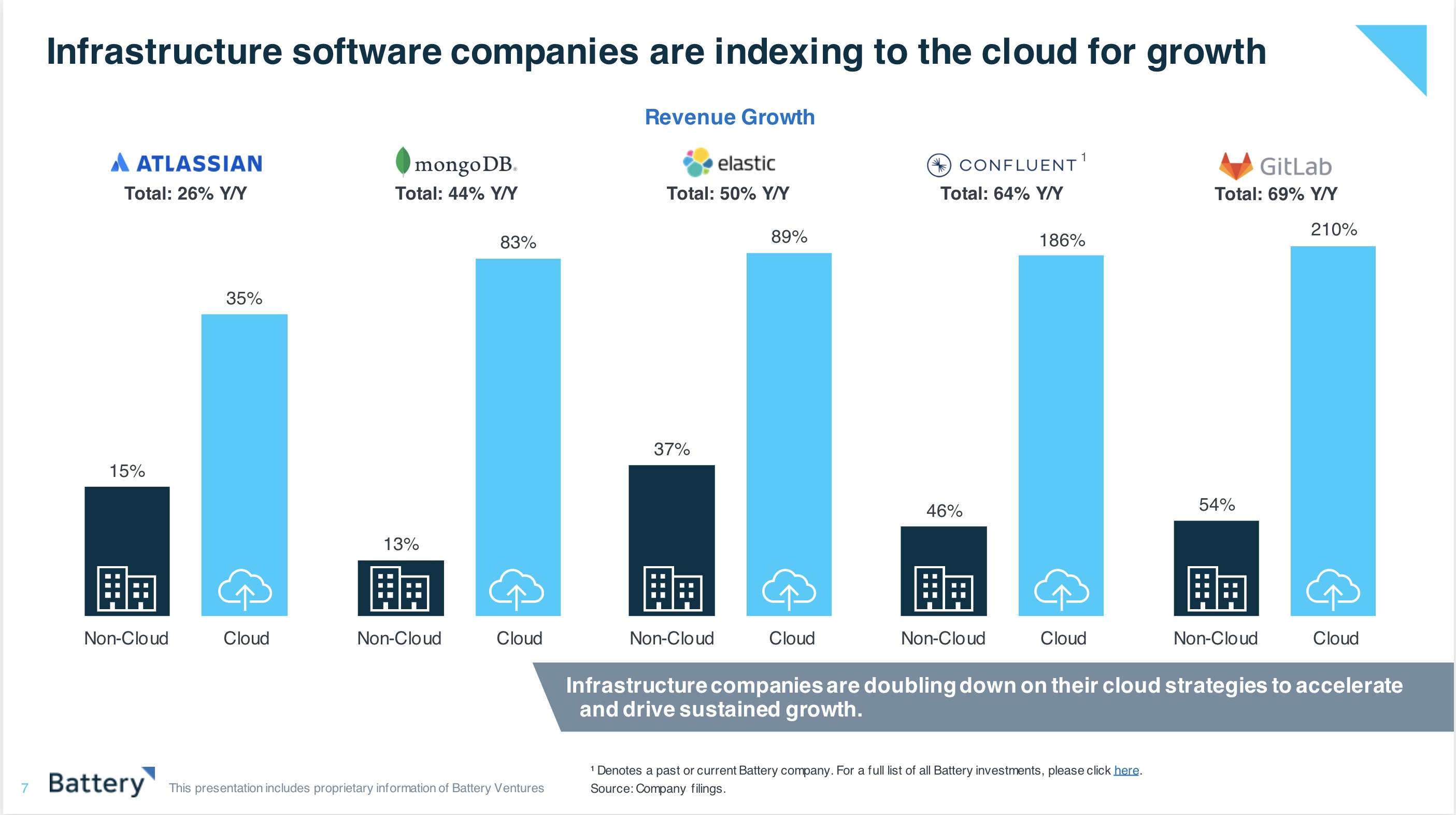

“Infrastructure software companies are doubling down on their cloud-native offerings, which are growing faster than their on-premise counterparts and are directly tied to higher company valuation multiples. MongoDB’s cloud product Atlas is growing at 83% versus its on-premise business (13%), driving most of the company’s value creation,” Dharmesh Thakker, general partner at Battery told us.

Image Credits: Battery Ventures

Further, according to Battery, when it comes to recent IPOs, cloud revenue is growing two to three times faster than on-premise businesses and is tied directly to these companies’ valuation hikes. Battery data finds: “The average cloud-infrastructure software IPO is now valued at $12.8 billion, over 10x the average valuation just five years ago.”

Customer size and business model notes

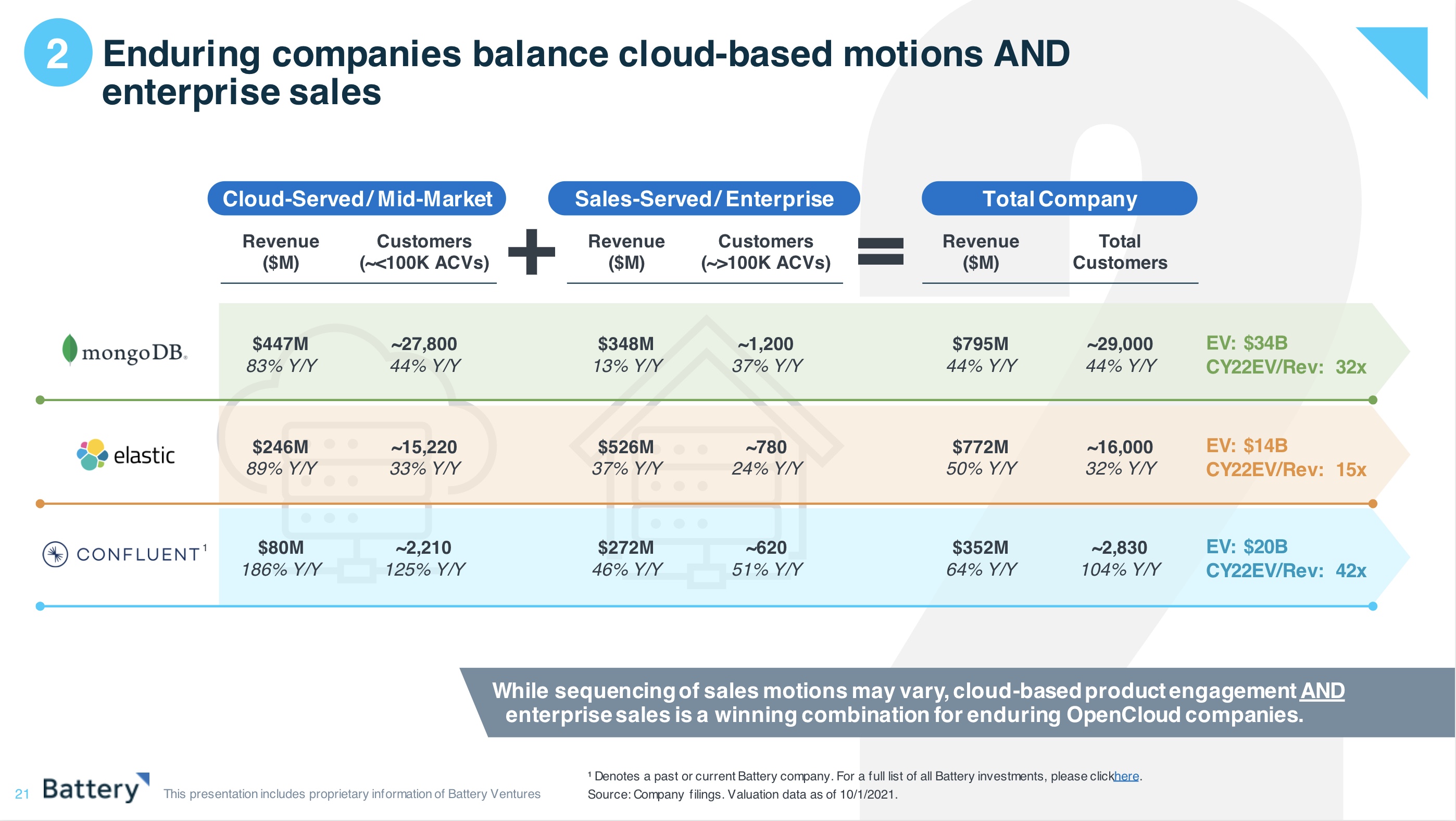

Perhaps the most interesting argument presented in Battery’s report is that customer size specialization could be more hindrance than help. Noting that, by its analysis, “enduring companies” take on both small customers and larger accounts, the investing group pointed to mongoDB, Elastic and Confluent as examples of cloud concerns that have both self-serve capabilities for SMB and midmarket firms and more hands-on sales approaches for enterprise-scale customers.

Image Credits: Battery Ventures

“Enduring” is, of course, a flexible term, but the argument appears to be that to be a more durable and wider customer mix is the way forward.

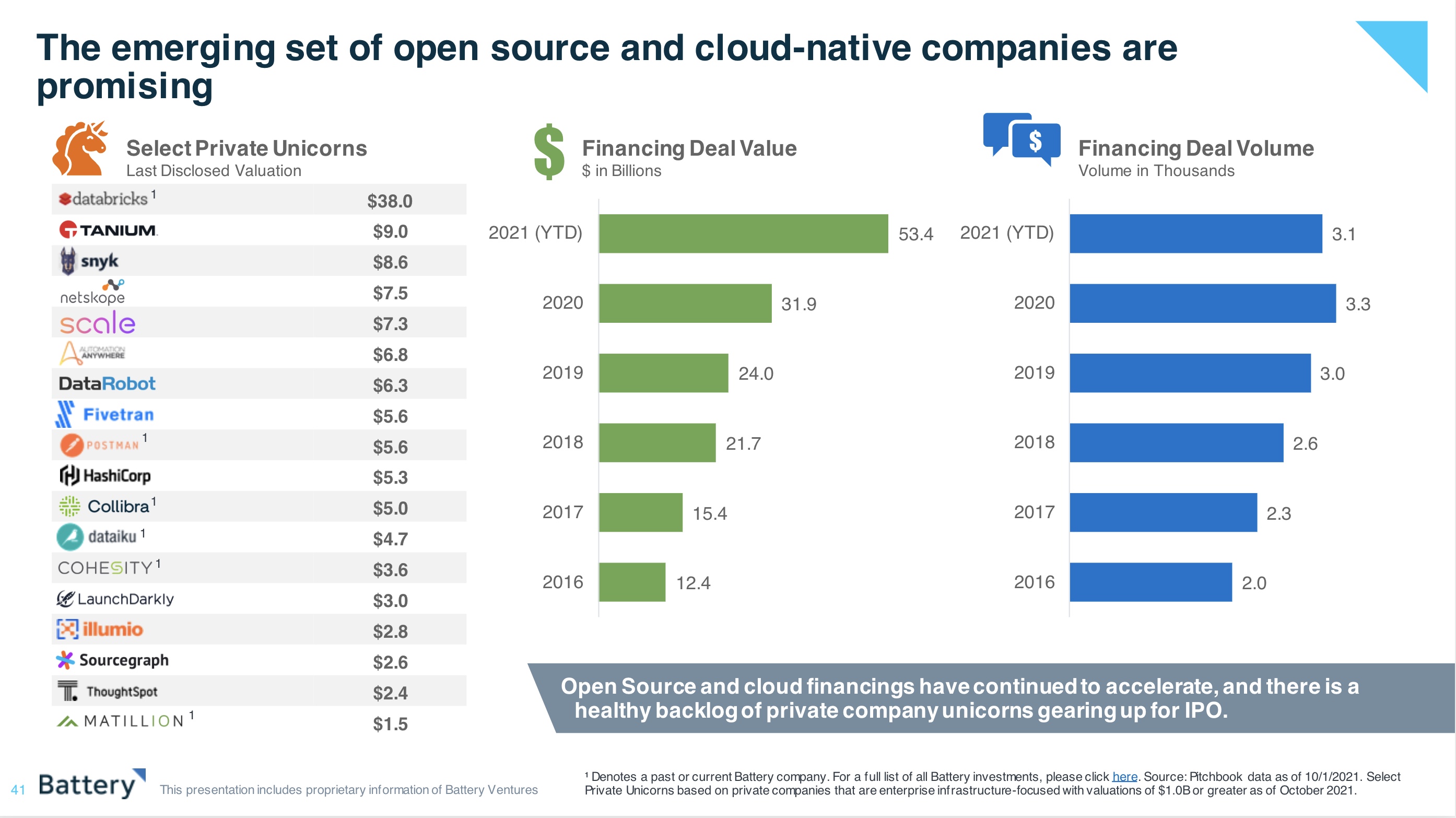

The report also details rising venture capital interest in open source startups, a trend that TechCrunch has written about in recent months.

Specifically, the report indicated that investments in open source and cloud-native companies grew to $53.4 billion thus far in 2021 from $12.4 billion in 2016. The scale of capital ingested by tech companies is staggering, but this data point underscores just how much money is flowing into open source-based tech companies.

Image Credits: Battery Ventures

Why? Precisely what we discussed in the beginning of this post. Demand for cloud products is accelerating. That tailwind is the foundation for many venture capital investing theses. And when we consider that Battery views businesses of every size as potential sales targets for more durable cloud companies, we can infer that demand for cloud products won’t merely be the playground of the giant corporation. Every company is going to need software, and investors are paying big bucks to own a piece of their future tool set.

Battery’s report points to a world where startups, for the most part, are going to go cloud or go home. While you could argue that the growth could slow once we reach a mostly post-pandemic state, it seems clear that companies are only going to accelerate their shift to the cloud now that they’ve begun the journey.

If that’s the case, there might not be any slow down in sight for some years to come.