Facebook may have a new name, but a rebrand won’t erase the multiple recent disclosures illustrating how destructive the company is for society — and how harmful it is for its own investors.

The revelations from Facebook whistleblower Frances Haugen were shocking but not surprising. According to Haugen, who worked for the tech giant on election security matters before leaving and turning over a large cache of documents to the press, lawmakers and regulators, Facebook consistently knew that its algorithms were harming society and the vulnerable, with reprehensible actions like pushing so-called “thin-spiration” to teenage girls, which can increase the likelihood of anorexia.

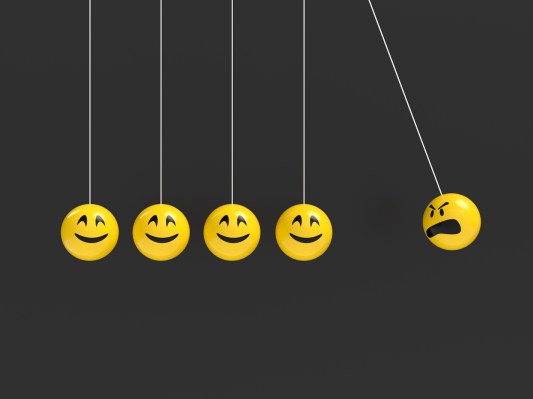

A recent analysis of internal Facebook documents showed that Facebook engineers treated emoji reactions — including the “angry” emoji — as five times more valuable than “likes,” favoring controversial posts to keep users engaged — and profits flowing.

This isn’t just a story of a company acting against the public interest and harming its own consumers; it is also a story about one acting against its investors. According to Haugen, the company misled its shareholders about basic business facts, from how it addresses safety to the size of its user base.

By serially failing to tell investors this kind of critical information, Facebook may have violated our securities laws and regulations. And Haugen has filed at least eight complaints with the Securities and Exchange Commission alleging that Facebook has broken the law for withholding material information related to the company’s internal research.

Meanwhile, a second unnamed whistleblower provided an affidavit to the SEC alleging that Facebook prioritizes growth and profits over hate speech and misinformation.

As notable as whistleblower allegations are, it is surprising that the role the SEC could play in regulating and containing Facebook hasn’t received top billing. While Facebook is a tech company, it is first and foremost a publicly traded company, and therefore subject to SEC regulations and oversight.

It was the Obama-era SEC that originally approved Facebook’s 2012 initial public offering although the process included a strange special class of shares that continued to give Mark Zuckerberg total effective control over the company even after it became public. Additionally, it was the Trump-era SEC that settled with Facebook over its failure to properly disclose to investors that it knew the scandalous data company Cambridge Analytica had accessed and misused the Facebook data of approximately 30 million Americans.

Asking the SEC to take a closer look at Facebook, a company that has settled with the commission within the last two and a half years over securities law violations, should be ordinary, reasonable and what we expect of our securities regulator.

Americans are lucky that the Biden administration has placed strong regulators in charge of the SEC and Federal Trade Commission by appointing Gary Gensler and Lina Khan their respective chairs. But just as Facebook and the other Big Tech behemoths have come to touch all aspects of our economy, politics and everyday life, the task of properly regulating and containing these firms is larger than any one or two agencies.

What we need to truly tackle the questions and threats posed by large tech firms is a whole-of-government approach. The Biden administration has made a good first step with its Council on Competition, but this must represent the first cut rather than a final product. It also means refusing to give large tech firms access to new markets to dominate, from fintech to currency to special government contracts, understanding that these companies would almost certainly use these opportunities to grow even more powerful at the expense of smaller firms and consumers.

We also need the engagement of Congress on these critical questions. On the same day that Haugen was testifying before a Senate subcommittee, the House Financial Services Committee held a hearing on SEC oversight. Despite several days of coverage of Haugen’s incendiary claims, the hearing went for hours without a single comment or question about the SEC’s role in holding Facebook accountable to its investors.

The failure of this key oversight opportunity represents a lack of imagination and coordination. To truly address the dangers of Big Tech, we need every member to be thinking about remedies for dealing with these gigantic companies, including pushing the Biden administration to do more.

Haugen is not the first whistleblower to emerge from Facebook, nor will she be the last. The time has passed for the U.S. federal government to meekly watch as Big Tech employees, shareholders, contractors and even the founders lay out the dangers these companies pose to Americans.

As the companies grow in size, power and danger, now is the time for the Biden administration to act boldly, aggressively and cohesively, beginning with the SEC taking up the cause and thoroughly investigating Facebook and fully enforcing our laws.