Helping power the global boom in startup investment is a huge — and growing — demand for digital products and services. The same tailwinds that are bolstering smaller tech companies, it turns out, are also powering the giants.

On the heels of a weak Q4 growth forecast from social giant Snap and a revenue miss from social titan Facebook, you would have been forgiven if you had low expectations for other Big Tech firms.

Today, however, pushing back against what could have been construed as a budding narrative, both Microsoft and Alphabet — Google’s parent company — smashed revenue expectations.

Here are the numbers:

- Microsoft revenue expectation: $43.97 billion (Yahoo Finance).

- Actual Microsoft revenues: $45.32 billion, +22% year over year.

- Alphabet revenue expectation: $63.45 billion (Yahoo Finance).

- Actual Alphabet revenues: $65.12 billion, +41% year over year.

In after-hours trading, shares of Microsoft are up 1%, while shares of Alphabet are down a fraction.

There’s much more to each report, of course. Alphabet and Microsoft are more akin to corporate empires than mere companies. Let’s take a quick look at each for more context.

Microsoft’s Q1 fiscal 2022

The key number from Microsoft’s blizzard of metrics is the growth of its public cloud business, Azure. That revenue source grew 50% on a year-over-year basis, or 48% in constant-currency terms. More simply, Azure got a modest lift from currency fluctuations that boosted its growth rate by a hair.

Regardless of that nuance, Azure growth has stuck around the 50% mark for some time now, which implies pretty big numbers being added to Microsoft’s aggregate top line from the product.

Other numbers that stood out to us in our perusal of Microsoft’s earnings were search and news advertising revenues rising 40% on a year-over-year basis. That figure is adjusted to remove traffic acquisition costs, something that Alphabet also does and is a pretty fair adjustment. In less good news, Surface revenues fell 17%, though with new hardware on the way, that could be set for a turnaround.

From the subscription side of things, the Microsoft picture is somewhat mixed. Business revenues for Office 365 grew by 23% on a year-over-year basis, while consumer incomes from the same product line were up a smaller 10%. Finally, LinkedIn revenues rose 42%, which feels pretty strong for the Microsoft tuck-in.

Alphabet’s Q3 2021

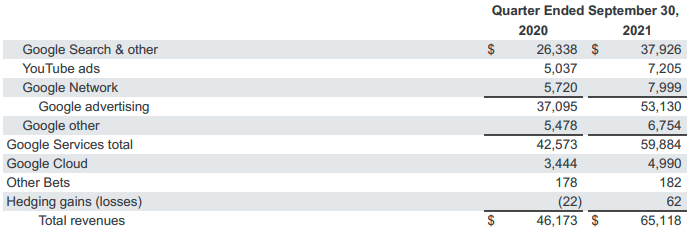

Something nice about Alphabet is that its financial results are short enough to include here. Observe:

Image Credits: Alphabet earnings release

YouTube’s revenue growth remains astounding, now that the company has broken out that particular line item. Recall that Google took more of a hit in 2020 than some tech giants as demand for search ads dipped when everyone suddenly stayed home due to the COVID-19 pandemic; Google was not alone in seeing that drop — other search products were impacted.

Per CNBC’s collection of street estimates, Google Cloud missed growth targets in the quarter: $5.07 billion was expected, meaning that despite its growth rate, Mountain View’s cloud bucket was smaller at the end of Q3 than investors had anticipated.

Other Bets putting up a small revenue gain is nice to see, though the group’s operating losses scaled during the quarter. The skunkworks collective posted an operating loss of $1.29 billion, up from $1.10 billion in the year-ago quarter.

Avoiding showering you in 1,000 more words of financial nuance, the two Big Tech companies put up solid growth numbers, made a zillion dollars between them and spent a collected $23.5 million on shareholder-friendly activities including share buybacks and dividends. It’s a good time to be a tech giant.