In less than seven days, Lunchclub co-founder Vlad Novakovski had a sizable term sheet in hand from Lightspeed Ventures, despite his startup not looking to raise at the time. How did that happen? A sticky product experience with the customer feedback and growth to back it up made the startup an investment opportunity Lightspeed’s Nicole Quinn just couldn’t pass up.

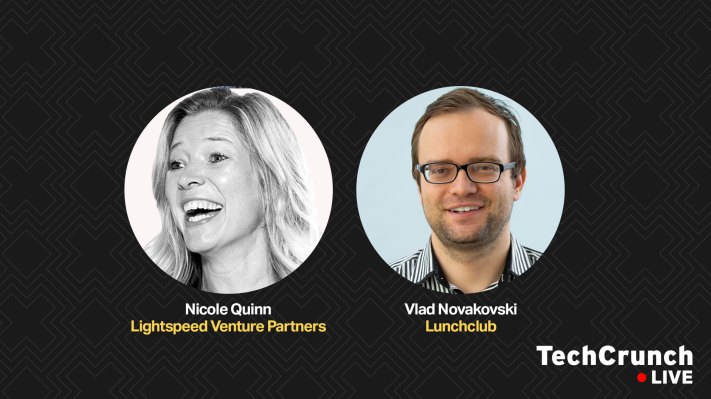

A week ago, Novakovski and Quinn joined us on TechCrunch Live to give a breakdown of Lunchclub’s Series A deck and the details on how they connected toward the beginning of the pandemic. Lunchclub is an AI-driven networking tool virtually connecting professionals across multiple industries and levels.

TechCrunch Live, formerly known as Extra Crunch Live, takes place every Wednesday at noon PDT/3 p.m. EDT. Each week, audiences get to hear the backstory, best practices and should-haves from founders and the investors who led their round. In the second half, founders in the audience get to live-pitch directly to the guests.

Take a look at some key learnings from our chat with Vlad and Nicole below, and check out the full recording of the episode with the live pitch-off.

A well placed intro goes a long way

The impact of your early-stage investors can go a long way. Nicole Quinn discovered Lunchclub through one of the company’s initial investors in the early months of the pandemic in 2020.

“I received an email from an angel investor in Lunchclub, Greg Arrese, saying, ‘Lunchclub just started doing fireside chats,” Nicole recalled. “These fireside chats have really found product-market fit. I mean, we just launched them and they’ve got thousands of people joining them.’”

Initially connecting with Vlad to participate in a fireside chat and learn more about the company on Wednesday, conversations quickly evolved resulting in a term sheet on Monday, less than a week after meeting.

Introductions to investors from other founders are often touted as the best way to get in front of a VC. In Vlad’s case, it was the investor who made a difference.

“I think as a founder … that speaks to [the] kind of value having a strong … angel investor network when you do your seed or your pre-seed,” Vlad added.

Consumer feedback is everything

Founders diligently build products to solve a problem but the true test is with the customers themselves. Novakovski’s Series A deck had customer feedback in the form of social media screenshots but had limited data and case studies — a change he wished he had made before.

“Consumer feedback is everything to us,” said Quinn.“It is the number one most important thing that I’m looking for in a slide deck and a conversation. I want to know, do customers love this?”

Providing metrics and data upfront is key in getting the investors’ interest. Quinn highlighted core data points: customer retention, NPS scores, referral rate, social media.

“We would actually call up a few of the Lunchclub customers as back-channel references,” said Quinn. “I would think you should do twice as many background references as the references that you were given. And everyone we spoke to was just raving about that experience with Lunchclub.”

Building and maintaining strong relationships with customers is a central part of effective product design as well as impact on future investment opportunities. Every touch point with your customers along the way matters.

The COVID-19 pivot and looking ahead

It is important for founders to have flexibility in building their companies. As 2020 demonstrated, founders must have the resilience to pivot their businesses. Lunchclub pivoted to fully virtual at the onset of the pandemic. However, Vlad noted while the deck shown outlined the pivot to virtual, it failed to encompass the company’s vision beyond the pandemic-necessitated changes.

“The future is hybrid,” Vlad said. “So I think that’s certainly the long term plan for us. I do think as far as the pitch deck … if we were doing this again, I would add another slide about what [the] post-COVID strategy would look like. How do we position ourselves in the hybrid world? Which we have a good answer to, but … I think we were kind of focused more on the here now and just executing on video at [that] point.”

Especially in a crowded space, product efficacy matters

AI-based matching platforms and networking startups have tough competition. In a crowded market, two components stuck with Quinn — the team and algorithmic success. The team was one of the top three reasons Lightspeed invested in Lunchclub’s algorithm.

“It’s not just matching you on, you know, experience or what sector you are working in,” Quinn shared. “It’s matching on social status and interesting areas like that, that you wouldn’t even know about yourself. But this algorithm knows about you. And so that really speaks to the team.”

“It’s not just me, the whole of Lightspeed also started taking those meetings,” Quinn said. “My partner Jeremy — he’s done about 40 Lunchclub meetings now. That was the moment for us [to know we wanted to invest], when we really understood how the algorithm works, from a consumer perspective.”