Aside from billions of dollars of personal wealth and historically impressive levels of corporate control, what’s the point of being a successful tech CEO these days?

I’m not asking in the abstract. There are tweets.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

It’s easy to forget how lucky we are to have Twitter in the world. The company’s social media service has handed a digital megaphone to anyone who wants one, allowing you and me the chance to not only be expressive on a regular — obsessive, in my case, I know — basis, but also the opportunity to hear directly from folks who are otherwise ensconced behind walls of minders and communications professionals.

Not that I agree with what everyone says on Twitter, of course; I just like the chance to listen a bit, because it can be rather illustrative.

I enjoy the occasional Twitter threads from Coinbase CEO Brian Armstrong because they provide a neat, clear window into his thinking — not only what’s on his mind, but what he thinks could be solutions to the issues he sees. It’s useful as someone who writes about the business world where he holds influence.

I enjoy the occasional Twitter threads from Coinbase CEO Brian Armstrong because they provide a neat, clear window into his thinking — not only what’s on his mind, but what he thinks could be solutions to the issues he sees. It’s useful as someone who writes about the business world where he holds influence.

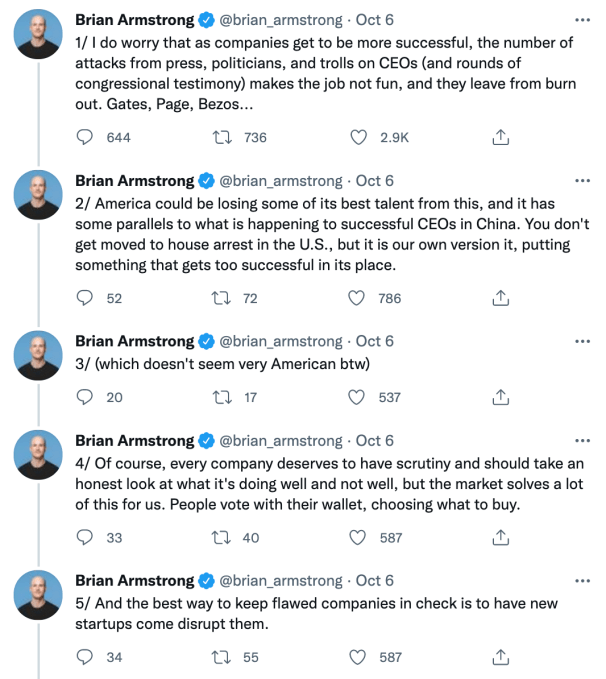

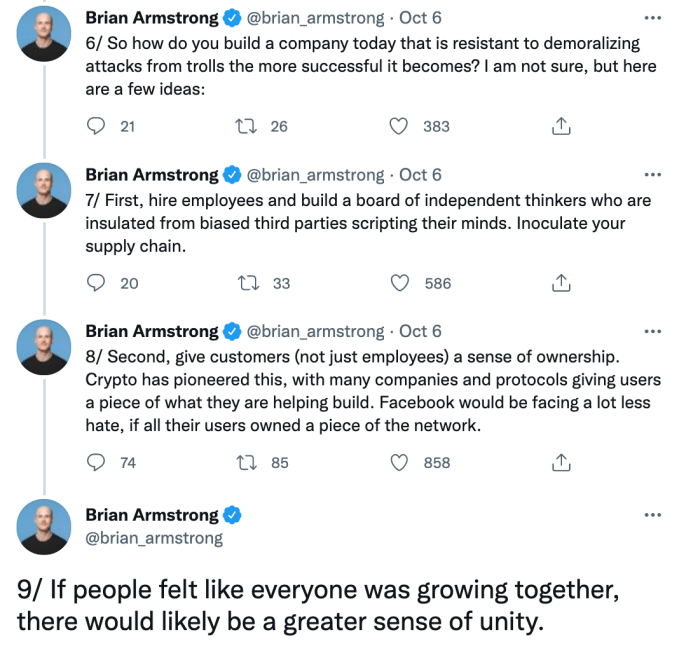

And the crypto-focused exec had quite the thread earlier this week, digging into how large companies are treated in the United States.

To prevent criticism that I am misquoting the man, here’s the thread in its entirety:

There are a great many things to discuss in the above. As far as hot takes go, this is a collection of scorchers.

But let’s avoid low-hanging fruit and limit our attention to the following:

- The treatment of U.S. technology CEOs.

- Having “fun” as a requirement for working.

Sound good? Let’s talk.

Pity for the beleaguered billionaire

I don’t lose a lot of sleep worrying about how the average CEO in the U.S. is doing. From where I sit, domestic corporate chiefs are doing rather well. The data back up my perspective. CNBC noted back in 2019 that since the year 1978, “CEO compensation [has risen] 1,007.5% for CEOs, compared with 11.9% for average workers, according to the Economic Policy Institute.” That’s a pretty good run, frankly.

The same data set notes that back in 2019, CEOs “now make 278 times the average worker.” Sign me up.

Armstrong, for example, is hardly suffering in his current gig. In the Coinbase fiscal year 2020, per his company’s final S-1 filing, he was paid a $1 million salary and took down a compensation package worth $59,472,256 in total. Not only did he get $56,670,000 worth of options awards in that 12-month period, but the company also provided him with $1,802,256 in “other” compensation, which included “$17,165 in reimbursed legal fees incurred in connection with the negotiation of certain employment matters related to Mr. Armstrong” and $1,785,091 in reimbursed personal security costs.

I too would like a company to pay me back the money I spent figuring out how much money that company should pay me.

But not all power is money, and not all compensation is cash. U.S. corporate leaders are enjoying a sort of power that was at least a bit less common when I was first learning about corporate finance and the economics behind building and backing technology startups. Namely voting control.

For example, Coinbase set up its corporate structure to ensure that its present-day leaders and owners enjoy complete control of its operations, even after it began to trade publicly. From the company’s filings:

We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to twenty votes and is convertible at any time into one share of Class A common stock. The holders of our outstanding Class B common stock hold approximately 99.2% of the voting power of our outstanding capital stock, with our directors, executive officers, and 5% stockholders, and their respective affiliates, holding approximately 60.5% of the voting power of our outstanding capital stock.

Again, not a bad overall gig.

But Armstrong is not talking about money — he’s talking about personal pleasure. He notes that “attacks from press, politicians, and trolls [attacking] CEOs,” along with regular attendance in front of our national legislative bodies, make the CEO job “not fun,” which leads to “burn out.” He then cites Bill Gates, Larry Page and Jeff Bezos as examples of this phenomenon.

Placing aside the implicit arrogance that Armstrong is talking about himself in that somewhat rarified company, I don’t really get the argument. Each of those folks made so much money that they got to, respectively, take on a suite of global challenges with a foundation bearing their name, present the most boring LinkedIn profile of all time and build a sexist space company. They do not lack options! And Gates got to hang around Microsoft as much as he wanted even after he retired as its leader, though that may have been a mistake.

If having money, power, influence, respect and the pocket change to take on literally whatever project your heart desires at macro-scale is not fun, I don’t know what is.

Will no one think of the billionaires?

Lots of folks don’t get paid infinite money and still have to work, burnout be damned, including the folks that Armstrong finds so deleterious to CEO pleasure. Most folks in the media are far from wealthy and most political staffers are comically underpaid. I can’t comment on trolls per se, but I don’t think that the gig pays very well. Armstrong is effectively irked that the poors are making the lives of the wealthy less enjoyable, leading to those folks taking their billions and going home.

Eh.

In the following two tweets, Armstrong compares how the Chinese government treats powerful corporate leaders to how the aggregated American public does, noting that the two approaches have “some parallels.”

Do they, though? If Armstrong posted a similar thread in China, it would be censored, and he’d lose his business and disappear. Here in the U.S., he’s able to not only post whatever is on his mind without recrimination but also hire a lobbying army and probably get 95% of what he wants in regulatory terms, albeit slightly later than he’d have preferred if he was, in fact, king.

It’s a risible, self-pitying perspective and one that must make some sense from atop a mountain of wealth. But as someone who has labored with my hands for minimum wage, I just can’t give it any credence. (Don’t give me any pity; god knows I love my job and no longer have to carry heavy things for income.)

Working is hard, and it usually isn’t pleasant. Most folks don’t like their jobs, but don’t have any real option other than to keep showing up. If we find ourselves more worried about how much fun the billionaires are having as they add more chips to their stack, we’ve wound up pretty backward.

Thanks to my job, I talk to folks with zero money (founders, for example, bootstrapping a new project into existence) and individuals running public companies who have personal and corporate wealth that I struggle to put into context.

I am in the “makes regular 401(k) contributions” wealth bracket, or about 3,482 rungs down the ladder from Armstrong. I can’t really imagine what it would be like to wake up with 10 figures of wealth. But I tell you what, I would fuck off. Because I would have won capitalism. Fun or not, you would not be able to get me to go to the office to do work.

So, I don’t worry about the billionaires. Instead, I worry about the U.S. creating a permanent underclass fueled by student debt, stagnating wages and rising housing costs. Whether a billionaire shows up to work and has a super fun time doesn’t crack my top 10 million concerns.