Throughout its history as a public company, Box has had a bit of a bumpy ride. The company was founded back in 2005 as a simple consumer file sharing service, but shifted a few years later to focus on enterprise and build a modern content management system for the still-developing cloud and mobile world.

Once a Silicon Valley startup darling, Box fell hard after filing its S-1 to go public in 2015 as people questioned its cash burn rate. That led to its IPO being delayed for months, perhaps a sign of the struggles it would have finding traction in the market in later years. Most recently, Box had a proxy battle with one of its larger shareholders, Starboard Value, which the company eventually won.

It is now a pivotal moment for the cloud content management company. Box has a $500 million investment from KKR, which means it has funds to buy some small companies, fill in the product road map and perhaps fuel some inorganic growth, as it did when it bought e-signature company SignRequest in February.

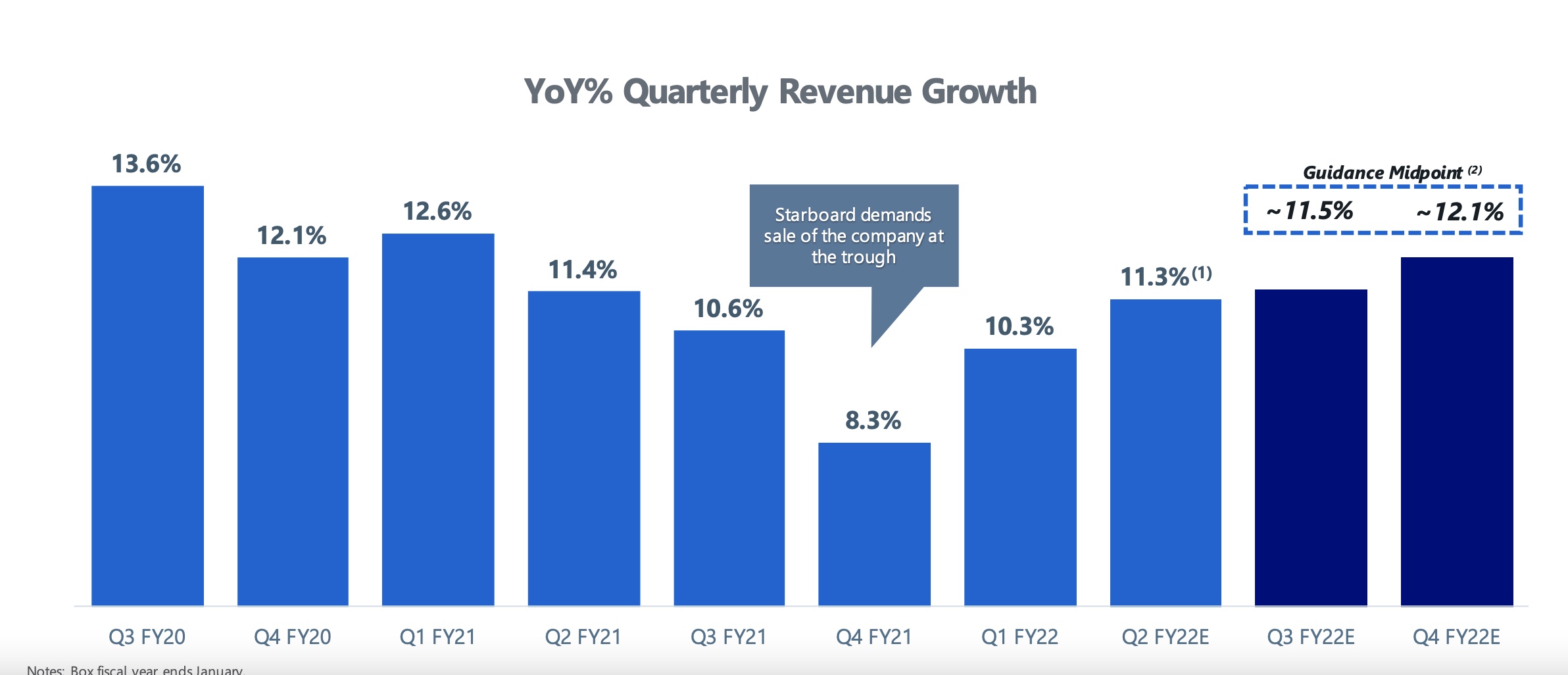

Box has been on a bit of a revenue roll as well, in recent quarters. After posting 13.6% growth in in the third quarter of FY20, it began a downward trend that saw growth drop to 8.3% in the fourth quarter of FY21. That was when Starboard decided to pick its proxy fight. But Box came off the mat from that nadir, beginning a slow upward trajectory that its management is projecting will continue for the next few quarters.

Image Credits: Box

This chart doesn’t detail huge growth, but it shows growth all the same. Co-founder and CEO Aaron Levie has faced down trouble before, and he took a mostly conciliatory tone when it came to his detractors, admitting that there was much to learn and he’s always been about improving the company.

We spoke to Levie about his trials and tribulations and where he expects to take his company from here.

Onward through it all

The last year hasn’t been easy for Levie as leader of a company in the midst of a proxy battle, but the CEO says he has not lost his optimism or his enthusiasm for the job. That is impressive when you consider he started the company in a dorm room at USC in 2005 — he’s been working on Box his entire adult life.

“If there’s one thread that runs through any difficult situation we’ve ever been in, it’s actually just my sheer excitement and optimism for the future. And I have that optimism about technology in general and its impact on the world, and what it can do for us. I have that even more so for Box, specifically, and the opportunity around what we’re building,” Levie told TechCrunch.

That said, Alan Pelz-Sharpe, founder and principal analyst at Deep Analysis, thinks that the company is facing a crucial period in the coming year. “The next year is pivotal for Box,” he said. “It has to prove that it was right to win the proxy fight. To do that, it has to evolve the Box platform and grow steadily but surely and continue to carve out a niche for itself in the market.”

BoxWorks, its customer conference this week, is a chance for the company to let customers know what’s coming next. Pelz-Sharpe, who has watched the company from its earliest days, says that Box has to show investors and customers that it is a full-blown platform, something that it has been trying to do for years.

“File-sharing is a commodity, but highly secure distributed work applications built upon a global file-sharing platform is a strong and nascent niche that Box has a chance to take a leadership position in,” he said.

Growing through its changes

Box has been attempting to build that full-fledged platform for a number of years now. Its announcements at BoxWorks propel the company further in that direction.

At the event, Box announced three major steps to take advantage of the surge of companies moving to online platforms due to COVID-19. For starters, the company is expanding the security layer it began building in 2019, Box Shield, which is intended to protect files stored in Box. As part of that, the company will reveal new malware protection this year at BoxWorks, which will make sure that users aren’t sharing files with a malicious payload.

“How do you make sure that people can protect their systems so they don’t have data leakage, and they are able to better detect various malware in their network that’s being shared by employees or possibly maliciously installed? How do we detect and protect against that, and if you have a ransomware event, how do you then roll back from that type of event?” Levie said.

From a collaboration standpoint, the company is launching an enhanced version of its Notes app and it’s bundling the e-signature capability from the SignRequest acquisition for free in the app, giving it a tool to compete with Dropbox and HelloSign, and to a lesser extent, DocuSign.

“The e-signature functionality, bundled as free, is a stake in the ground particularly against Dropbox and HelloSign, but more than that, it’s another building block for people to build applications. Moving forward, I expect to see more acquisitions (Box has done very few deals) and more of the same,” Pelz-Sharpe said.

Like Zoom, Box also recognizes its ability to help customers navigate the new way of working in 2021. As Levie said in his BoxWorks keynote, that means work is changing in fundamental ways and Box hopes to be at the center of that.

“Our mission is more important than any other point in the history of our company. We want to shape how the world works together, and the trends that are driving work are only accelerating over the last year. We’ve seen the start of a fundamental shift in how people work together,” he said.

Pelz-Sharpe points out that the proxy fight played out recently, so it’s not really fair to expect this event to be a coming out party for the company in that regard. However, he has big expectations for the company to expand its platform in some significant ways in the coming year.

As for those who might think that Box has underachieved, Pelz-Sharpe prefers to see it as playing the long game. For its most recent quarter, the company announced revenue of $214.5 million, putting it on a run-rate of over $858 million on a growth rate of 11.3%.

“Frankly, in Silicon Valley, you grow as fast as possible at any cost to get to a point of critical mass, or you add features to your offering to get acquired. Box has taken a middle path, and though its revenues are not multiple billions, it has a very enviable and surprisingly loyal customer base providing it with substantial volumes of renewable revenue,” he said.

All of that should bode well for the company if it can take the goodwill from the proxy win and parlay that into substantial and consistent growth moving forward.