Angle Labs, the company behind the Angle Protocol, has raised a $5 million funding round led by Andreessen Horowitz. The small team has been working on a euro stablecoin on the Ethereum blockchain.

Other investors in the round include Fabric VC, Wintermute, Divergence Ventures, Global Founders Capital, Alven, Julien Bouteloup and Frédéric Montagnon.

“I was playing around with Compound and I realized that I was exposing myself to a huge euro/dollar foreign exchange risk. Basically, the euro lost 10% in value against the dollar in 2020,” Angle Labs co-founder Pablo Veyrat told me.

There are a handful of euro-based stablecoins already, but their market capitalization is ridiculously small when you compare those stablecoins against USD-based stablecoins, such as USD Coin (USDC), Tether (USDT) or DAI.

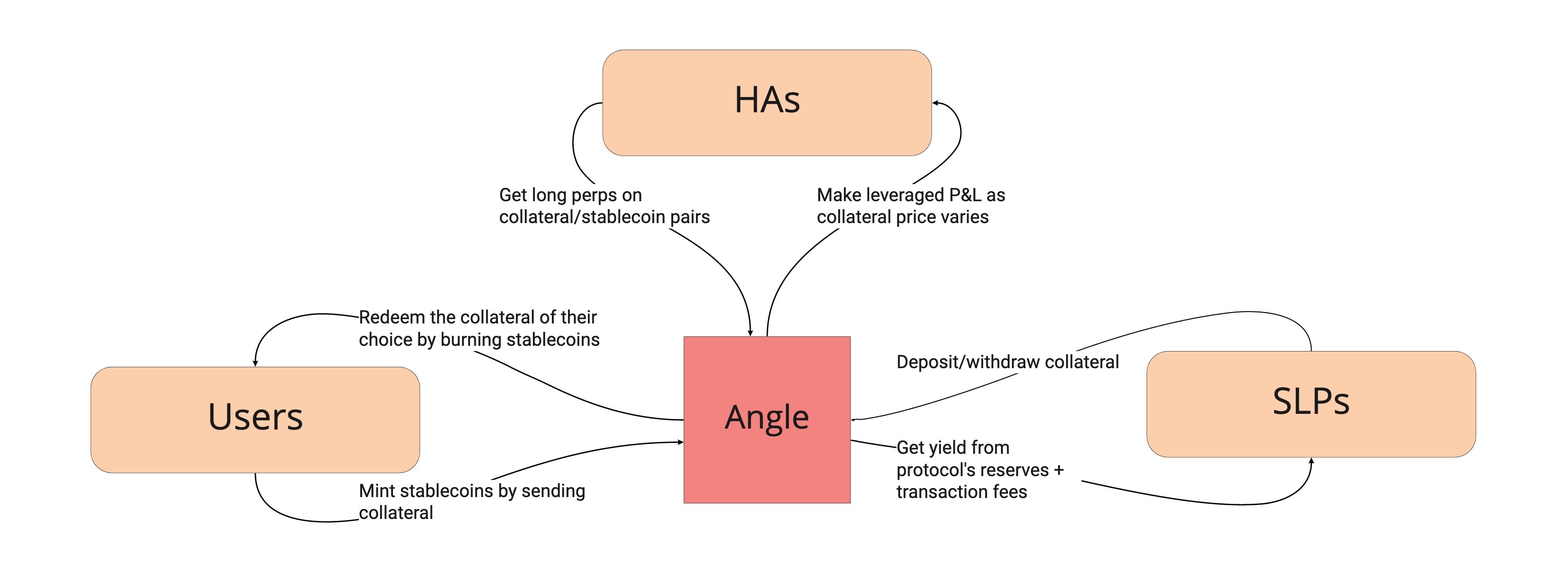

Instead of opening a bank account and storing a ton of EUR on this bank account, the team of engineers have designed a new protocol with three different stakeholders that are looking for three different things.

People who want a digital euro will be able to buy agEUR. At any point in time, one agEUR should be worth one EUR. In order to guarantee the value of Angle’s stablecoins over time, the protocol is designed to accept collateral against stablecoins, such as (wrapped) bitcoins, ethers and more (wBTC, wETH, etc.).

As an incentive, the protocol issues perpetual futures. This way, some traders will open leveraged positions expecting to generate returns on their investments. Traders cover the capital gains or losses for other protocol users.

But that’s not necessarily enough to make sure that the Angle protocol remains over-collaterized. That’s why there is a third type of agent in the Angle protocol. People will be able to provide liquidity and accumulate interests on their deposits. Those deposits also act as collateral assets for the protocol.

The result is a sophisticated over-collaterized protocol that isn’t limited to EUR stablecoins — it could work with many different kinds of underlying assets. The team will be starting with two new crypto assets, a EUR stablecoin and a USD stablecoin — agEUR and agUSD. They’ll be redeemable against a handful of collaterals and you can expect to see support for those assets in other DeFi protocols.

But Angle Labs already has plans to launch other stablecoins pegged to the Swiss Franc, the British Pound, the Japanese Yen or the Korean Won. The protocol is currently being tested and has been audited by Chainsecurity and Sigma Prime. If things go well, Angle should go live on the mainnet in October.

Image Credits: Angle Labs