It’s been a heady 12-18 months for Zoom, the decade-old company that experienced monster 2020 growth and more recently, a mega-acquisition with the $14.7 billion Five9 deal in July. That addition is part of a broader strategy the company has been undertaking the last couple of years to move beyond its core video conferencing market into adjacencies like phone, meeting management and messaging, among other things. Here’s a closer look at how the plan is unfolding.

As the pandemic took hold in March 2020, everyone from businesses to schools to doctors and and places of worship moved online. As they did, Zoom video conferencing became central to this cultural shift and the revenue began pouring in, ushering in a period of sustained triple-digit growth for the company that only recently abated.

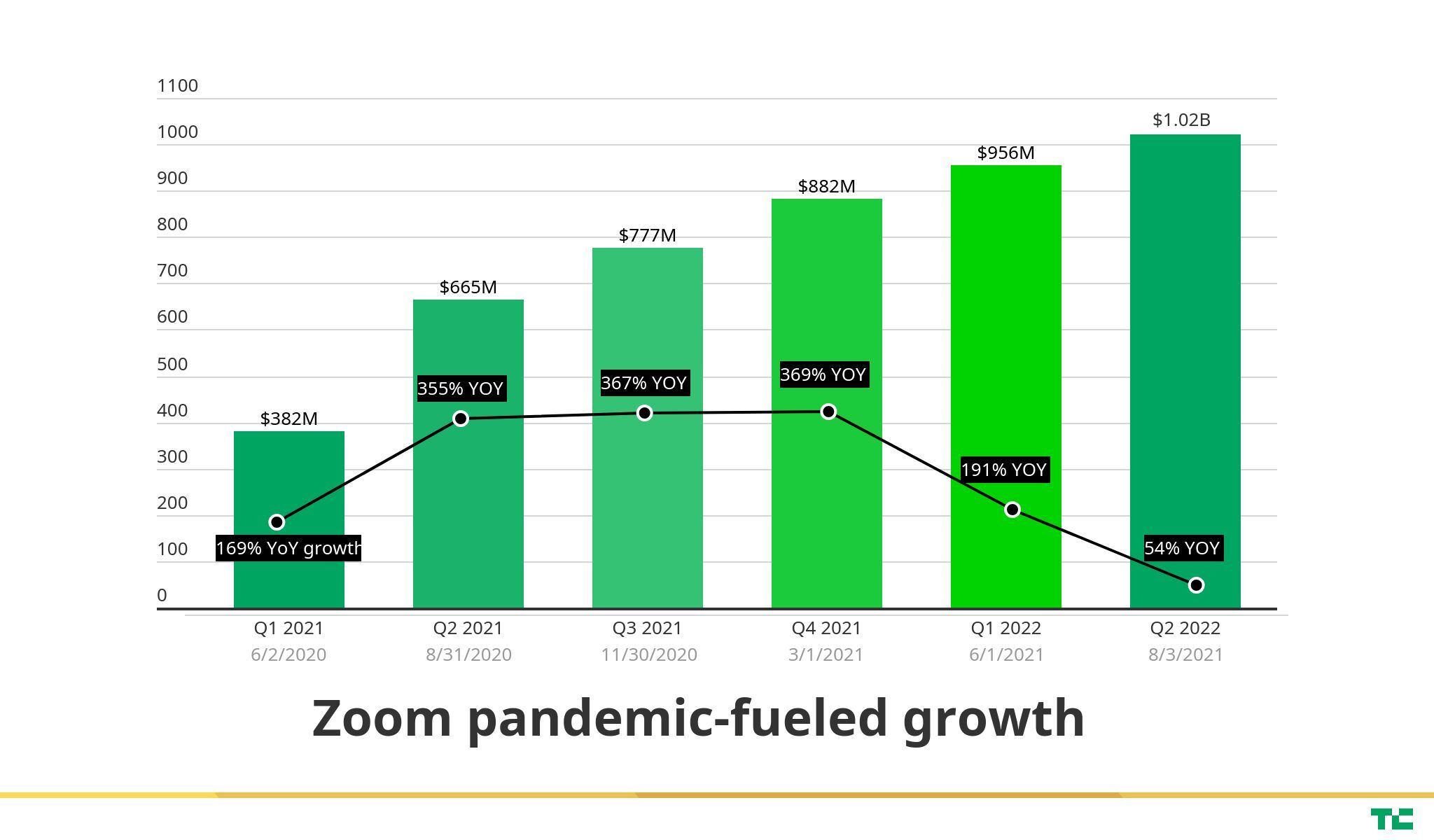

Growth slowed pretty dramatically to 54% in the most recent quarter, still good by most standards, but a vast slow down compared to what the company experienced in FY2021, which corresponded to the 2020 pandemic-fueled revenue surge. In case you’re wondering, revenue grew 78% in Q4 2020, the quarter reported on March 4, 2020, just prior to the pandemic taking hold.

Zoom experienced five straight quarters of triple-digit growth. Image Credits: TechCrunch

Mike Fasciani, a Gartner analyst, who specializes in the digital workplace, says that in order to keep the financial momentum going, Zoom has recognized that it must expand into other areas.

“It is critical that Zoom expand beyond its core video conferencing market dominance because that market has stabilized and we will not see a repeat of the astounding growth rates experienced during 2020 and the first half of 2021 (due to the COVID-19 pandemic). So in order for Zoom to build sustainable growth for the long run, it needs to expand its footprint into large, commercially viable market segments,” he said.

To a large extent it has been working on that for some time, says Oded Gal, the company’s chief product officer, whose time with Zoom CEO and founder Eric Yuan extends back to when they both worked at WebEx, prior to the Cisco acquisition in 2007. “The idea behind our evolution is how do we move from a meeting app that everybody likes to use, a killer app, to more of a platform play where we provide that communication modality as part of an overall workflow,” Gal said.

He says that the company has taken a multipronged approach, starting with building a platform of services that includes calls, meetings, webinars and messaging, as well as pushing to become an integral part of the future of work, one that is increasingly digital and online, while finally expanding use cases to provide solutions for specific vertical applications.

Certainly the Five9 acquisition is part of that last point, and the company could be expanding into the contact center in a major way with that deal. While Gal couldn’t talk about Five9’s future role because the transaction hasn’t closed, Gartner’s Fasciani sees the acquisition as an avenue for expanding Zoom’s growing phone business. The company announced this week that it has sold 2 million licenses since it launched Zoom Phone in 2019, giving Zoom a hefty additional business beyond video conferencing.

“For companies that have a significant customer service operation, the Five9 acquisition allows Zoom to sell a more complete integrated suite of communications services for both internal back-office employees and the customer service team,” Fasciani told me.

He sees the company moving beyond the contact center itself into other areas, as well. “The opportunity ahead is for specific scenarios in my opinion where video brings value-add through more trustful engagement. Scenarios like telehealth, remote banking and perhaps public sector settings like virtual courtrooms come to mind,” he said.

To some extent, the company is bringing this vision together, even before the close of that deal with the Zoom Video Engagement Center (VEC), announced this week at Zoomtopia, the company’s customer conference. As Zoom’s Heidi Elmore wrote in a blog post announcing the new feature, which will be available next year, it provides a set of templates as building blocks and enables customers to build video-based solutions for specific kinds of use cases like a telehealth visit or a financial services consultation.

“With Zoom VEC, your business units can stand up video-optimized workflows in days with our end-to-end templates, which make those workflows more accessible and available to drop into your existing web and mobile applications,” Elmore wrote.

The company has also been hard at work on the back end building a platform for developers to take advantage of Zoom functionality. Last year Zoom launched a video SDK to help developers build apps with video, audio and other Zoom features built in. The company later launched a marketplace to sell what it has dubbed Zoom Apps, and this year it announced a $100 million investment fund to put money behind the startups building apps on the Zoom platform.

COVID clearly caused enormous human misery and upheaval across the world, but also accelerated businesses (and other parts of society) to shift online. While Zoom benefited greatly from this trend, even pre-COVID it had ideas for moving beyond video. This week’s announcements at Zoomtopia are focused on continuing to expand that vision and finding ways to keep the momentum from 2020 going well into the future.

As Fasciani says there is no way of knowing if these adjacent tools will have the same impact as the video app, but they have to look for ways to expand the platform regardless. “It remains to be seen whether their success will carry over into these new endeavors, but we can plainly see Zoom’s desire to aggressively expand into adjacent markets to their core video conferencing offerings.”