Startups are raising record sums around the world, thanks to several contributing factors. As The Exchange explored yesterday, historically low interest rates have helped venture capitalists raise more capital than ever, to pick an example.

Low rates have helped startups in another manner: As yields fell for certain assets, investors chased returns by betting on growth. And in recent years, the investing classes turned their attention to public software companies, bidding up the value of their revenue to record highs.

This raised the worth of startups in general terms, and private tech companies’ comps enjoyed a steady, upward climb in the value of their revenues. If the value of a dollar of SaaS revenue was worth $1 one year and $2 the next, the repricing was good for private companies even if we were tracking the metrics from the perspective of public companies.

The free ride could be ending.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

I’ve held back from covering the value of software (SaaS, largely) revenues for a few months after spending a bit too much time on it in preceding quarters — when VCs begin to point out that you could just swap out numbers quarter to quarter and write the same post, it’s time for a break. But the value of software revenues posted a simply incredible run, and I can’t say “no” to a chart.

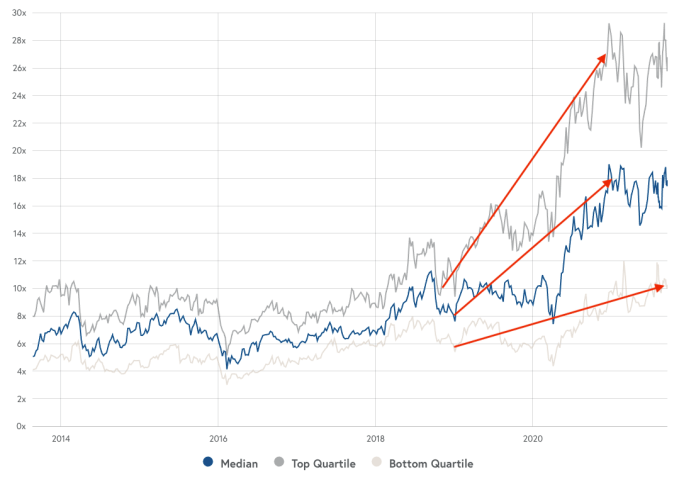

The pace at which software revenues were repriced upwards in the last few years is simply astounding. Per the Bessemer Cloud Index, back in 2016, the median revenue multiple for public SaaS companies was around 5x. When 2018 began, median SaaS multiples had expanded to around 7x.

The pace at which software revenues were repriced upwards in the last few years is simply astounding. Per the Bessemer Cloud Index, back in 2016, the median revenue multiple for public SaaS companies was around 5x. When 2018 began, median SaaS multiples had expanded to around 7x.

That’s a 40% climb in pricing, but it proved to be just a foretaste of the feast to come.

By the end of 2019, the median figure had appreciated to around the 9x mark. And today it has shot to just under 18x. That is why software companies have been able to raise so much money, earlier, and in larger chunks. Every dollar of recurring revenue they sold was worth $5 in market cap in mid-2016. At the end of 2019, that same dollar of revenue was worth $9. And today, for the median public software company, it’s valued at around $18.

There are nuances to the data, but we care less about exacting definitions than the directional change it describes: The median value of SaaS revenues more than tripled from 2016 to 2021. That’s an insane amount of growth.

Lately, however, the upward charge has plateaued. Here’s the history of SaaS multiples (please excuse my Friday morning Chart Crime) with some Very Quality arrows:

Image Credits: Bessemer Cloud Index

As we can see here, the pandemic was a flat-out godsend when it came to the value of software shares, and therefore tech startups in general; software is the most popular startup product, and SaaS is the most popular startup business model. It’s worth noting that in gross terms, the multiples gap between low and high-growth has grown. I haven’t run the math in a more sophisticated fashion.

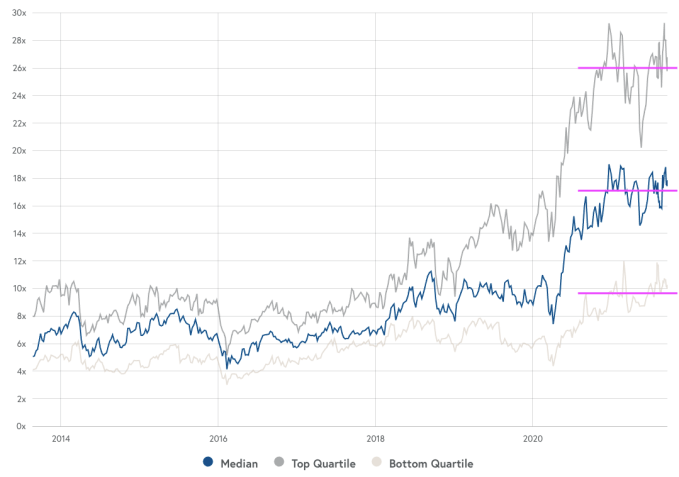

Regardless, here’s how I view the chart today:

Image Credits: Bessemer Cloud Index

Technical analysis folks, I apologize.

We’re seeing the value of low, mid, and high-multiples SaaS companies each find a comfortable trading range after a bull run since early 2016, albeit one with caveats.

What does this mean for startups? It does not mean that the good times are over when it comes to valuations and capital interest in their shares. Instead, it appears that — at least for now — the good times are here to stay, instead of continuing to improve. This is rather bullish, as the valuations being held onto are at record highs for the underlying revenue results. But the updraft may have reached its zenith.

Yesterday we wrote that it would take a somewhat strong market whack to truly change the game for startups. Structural reasons have made technology revenue more attractive than it has proven in historical terms. The fact that we’re seeing multiples gains prove sticky is another data point in favor of our argument. Even material declines to revenue multiples would leave the value of software companies at elevated levels.

Hell, today you pay more for bottom-quartile SaaS revenues than you did for top-quartile back in 2016. So, a decline in these figures wouldn’t be lethal, unless it was a shocking reversal. But given other existing factors, I simply don’t expect that.

The prices that investors are willing to pay for a dollar of recurring revenue are pretty bonkers. Lots of the companies in dataset above are unprofitable, and yet median revenue multiples for public software companies are above the historical median price/earnings ratio for the S&P 500.

That’s probably a bit much.

What’s ahead? I don’t know any better than you. But things have been stable-ish long enough that it seems fair to say that the upward movement of SaaS multiples has concluded for now. These remain startup salad days.