While the technology and business world worked toward the weekend, developer operations (DevOps) firm GitLab filed to go public. Before we get into our time off, we need to pause, digest the company’s S-1 filing, and come to some early conclusions.

GitLab competes with GitHub, which Microsoft purchased for $7.5 billion back in 2018.

The company is notable for its long-held, remote-first stance, and for being more public with its metrics than most unicorns — for some time, GitLab had a November 18, 2020 IPO target in its public plans, to pick an example. We also knew when it crossed the $100 million recurring revenue threshold.

Considering GitLab’s more recent results, a narrowing operating loss in the last two quarters is good news for the company.

The company’s IPO has therefore been long expected. In its last primary transaction, GitLab raised $286 million at a post-money valuation of $2.75 billion, per PitchBook data. The same information source also notes that GitLab executed a secondary transaction earlier this year worth $195 million, which gave the company a $6 billion valuation.

Let’s parse GitLab’s growth rate, its final pre-IPO scale, its SaaS metrics, and then ask if we think it can surpass its most recent private-market price. Sound good? Let’s rock.

The GitLab S-1

GitLab intends to list on the Nasdaq under the symbol “GTLB.” Its IPO filing lists a placeholder $100 million raise estimate, though that figure will change when the company sets an initial price range for its shares. Its fiscal year ends January 31, meaning that its quarters are offset from traditional calendar periods by a single month.

Let’s start with the big numbers.

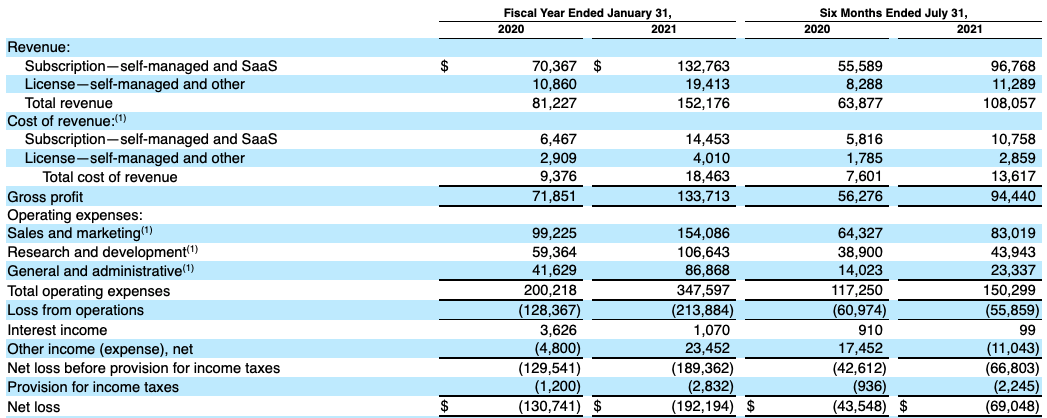

In its fiscal year ended January 2020, GitLab posted revenues of $81.2 million, gross profit of $71.9 million, an operating loss of $128.4 million, and a modestly greater net loss of $130.7 million.

And in the year ended January 31, 2021, GitLab’s revenue rose roughly 87% to $152.2 million from a year earlier. The company’s gross profit rose around 86% to $133.7 million, and operating loss widened nearly 67% to $213.9 million. Its net loss totaled $192.2 million.

This paints a picture of a SaaS company growing quickly at scale, with essentially flat gross margins (88%). Growth has not been inexpensive either — GitLab spent more on sales and marketing than it generated in gross profit in the past two fiscal years.

In the six-month periods ended July 31, 2020 and 2021, GitLab’s revenue rose 69% to $108.1 million from $63.9 million. Over the same time frame, the company’s operating loss narrowed to $55.9 million from $61.0 million. However, its net loss widened to $69.0 million from $43.5 million, due in part to currency conversion costs improving its 2020 figure and dinging its 2021 result.

Here’s the full income statement for everyone out there who wants to fact check my rounding:

Image Credits: GitLab

Considering GitLab’s more recent results, a narrowing operating loss in the last two quarters is good news for the company. It indicates that the time in which the former startup was more focused on investment than profit is behind it, and that it is ready to chart a path toward break-even status.

To that end, in the two quarters ended July 31, 2021, GitLab’s sales and marketing costs were less than its gross profit. A small step to net income, sure, but an important one.

That flip of the company’s spend-viz-gross profit is perhaps why GitLab is going public now. It has strong growth as well as the first step toward stemming red ink under its belt. Investors that might not have been interested in the company without the latter can now be brought aboard.

SaaS

The company says its “primary business activity is to sell subscriptions on both self-managed and SaaS models.” That means we’re dealing with a software company with a modern business model. As such, its losses aren’t as big an issue as they might be at a similar-sized company with a different approach — investors value SaaS revenues richly today, which means that racking up losses to boost recurring software incomes is acceptable.

We therefore need to understand GitLab’s net retention rate. This metric is how much more the company’s existing customers spend on GitLab products over time. Enterprise software companies post net retention figures north of 100%. Figures above 115% are good. Numbers above 125% are exceptional.

Here’s how GitLab defines the metric (bolding: TechCrunch):

We calculate Dollar-Based Net Retention Rate as of a period end by starting with our customers as of the 12 months prior to such period end, or the Prior Period ARR. We then calculate the ARR from these customers as of the current period end, or the Current Period ARR. The calculation of Current Period ARR includes any upsells, price adjustments, user growth within a customer, contraction, and attrition.

That seems sufficiently rigorous as to avoid our censure. And goddamn if the resulting numbers aren’t impressive as hell:

For fiscal 2020 and 2021, our Dollar-Based Net Retention Rate was 179% and 148%, respectively. As of July 31, 2020 and 2021, our Dollar-Based Net Retention Rate was 153% and 152%, respectively.

Seeing some declines in those figures over time is not a surprise; seeing GitLab’s most recent figure above the 150% mark is incredibly impressive, though it’s slightly confusing as to how the company has managed to spend so much on sales and marketing to achieve its historical growth rates given its strong upsell results.

That, along with other nuances of GitLab’s operations and share counts, will have to wait for Monday.

What’s it worth?

Now for the fun stuff. In its most recent quarter, the three months ended July 31, 2021, GitLab generated revenues of $58.1 million, up 69% from its year-ago quarter. That gives it an annualized run rate of $232.5 million.

That means that GitLab is growing around as quickly as Datadog, Twilio and CrowdStrike, per the Bessmer Cloud Index. Those companies sport revenue multiples of 47.2x, 21.2x and 44.0x, respectively. Twilio stands out to the negative mostly, I reckon, due to lower gross margins than its SaaS cousins. Given that GitLab has very strong gross margins, we can discount Twilio’s number and decide that a 45x multiple of the company’s annualized run rate is not insane.

At least per today’s market conditions.

At that multiple, GitLab would be worth $10.46 billion. Which is more than $6.0 billion, so we can see a path for the company to surpass its final private-market valuation. However, we are not saying that the company is worth 11 figures. Investors may decide that the pace of its losses make it less valuable than some of its peers, or that its growth rate is decelerating too quickly to receive a market-leading multiple.

In those cases, GitLab’s public market valuation could drift lower, closer perhaps to its final private price. Still, the company is obviously valuable per today’s market perspective. More on Monday!