Both as a term and as a financial product, “buy now, pay later” has become mainstream in the past few years. BNPL has evolved to assume various forms today, from small-ticket offerings by fintechs on consumer checkout platforms and marketplaces, to closed-loop products offered on marketplaces such as Amazon Pay Later (which they are now extending for outside use as well). You can also see some variants offered by companies that want to expand the scope of consumption and consumer credit.

Globally, BNPL has seen the most growth in the consumer segment and has driven retail consumption and lending over the past few years. Consumer BNPL offerings are a good alternative to credit cards, especially for people who do not have a credit history and can’t get credit from banks. That said, a specific vertical of BNPL products is gaining traction — one targeted toward small and medium enterprises (SMEs). This new vertical is known as “SME BNPL.”

BNPL can be particularly useful when flow-based underwriting or transaction-based underwriting is used to offer credit to small businesses.

B2B commerce in India is moving online

E-commerce has seen tremendous growth in India over the past decade. Skyrocketing smartphone and internet penetration led to rapid growth in e-commerce across large cities and smaller towns alike. Consumer credit has also taken off in parallel as credit cards and digital lending spurred credit-based consumption across offline and online stores.

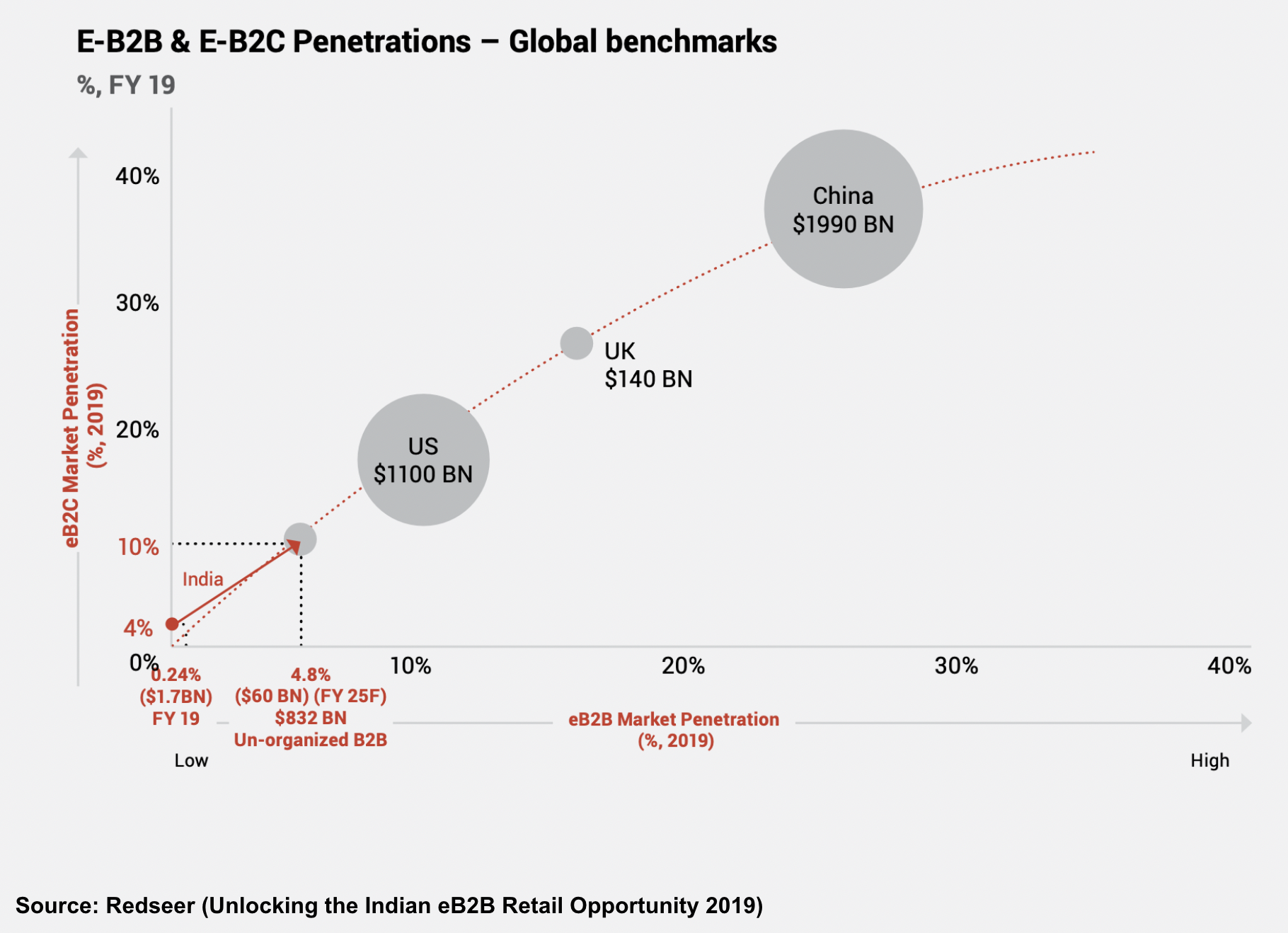

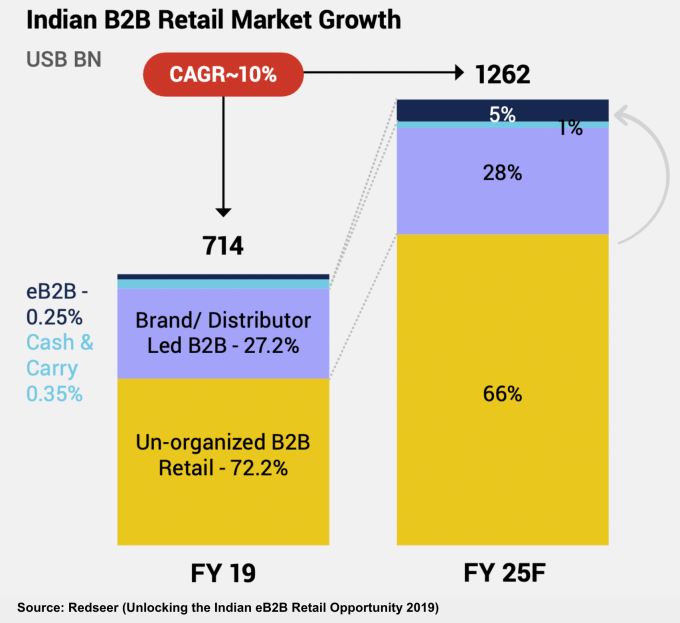

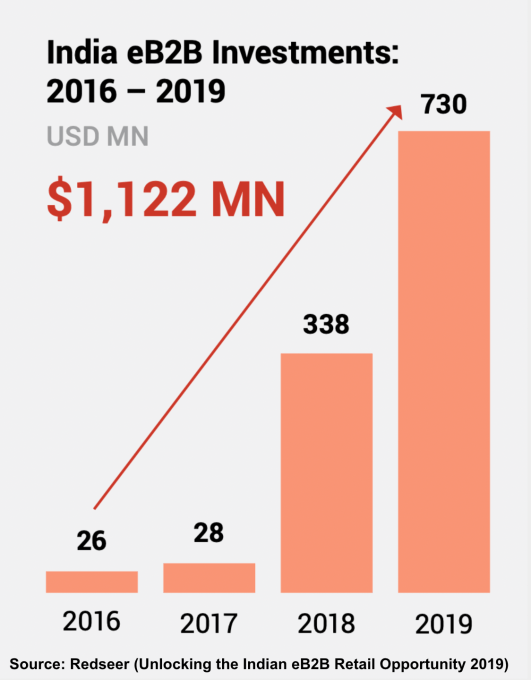

However, the large B2B supply chain enabling the burgeoning retail market was plagued by bottlenecks and inefficiencies because it involved a plethora of intermediaries and streamlining became a big problem. A number of tech players responded by organizing the previously disorganized B2B commerce market at various touch points, inserting convenience, pricing and easier product access through tech-enabled logistics and a modern supply chain.

Image Credits: Redseer

India’s B2B e-commerce space has developed rapidly since 2020. Small businesses have moved from using paper to smartphone apps for running a significant part of their day-to-day business, leading to widespread disruption in how businesses transact today. The COVID-19 pandemic also forced small businesses, which were earlier using physical means to procure goods and services, to try new and online models to conduct their affairs.

Image Credits: Redseer

Moreover, the Indian government’s widespread promotion of an instant payments system in the form of the Unified Payments Interface (UPI) has changed how people send money to each other or pay merchants for their goods and services. The next step for solving the digital B2B puzzle is to embed credit inside every transaction and invoice.

Image Credits: Redseer

If we compare online B2B transactions to the offline world, there is only one missing link: The terms offered to small businesses by their supplier/distributor or vendor. Businesses, unlike consumers, must buy goods and services to eventually trade them, or add value and sell to consumers or others down the value chain. This process is not immediate and has a certain time cycle attached.

The longer sales cycle means many small businesses require credit payment terms when buying inventory. As B2B commerce scales and grows through digital means, a BNPL product that caters to the needs of SMEs can support their growth and alleviate the burden on their cash flows.

How does consumer BNPL differ from SME BNPL?

An SME BNPL product is a purchase financing product for small businesses transacting with suppliers, distributors, aggregator platforms or B2B marketplaces.

Here’s how it works: Let’s say a trader buys 100 lbs. of rice from a distributor (or B2B marketplace) every week and has done so for the past few months. A line of credit sufficient for the purchase of 200 lbs. of rice with a 14-day credit cycle will support the trader in managing their working capital without worrying about liquidity for purchases. The expected risk for the BNPL provider would be lower, too, since the trader would not delay payments, as that would result in their distributor blocking their supply.

Compare this to the traditional approach where the trader was provided a certain credit limit based solely on their bank statement or financials, which they could use for any purchase or business expense.

As the typical customer for this type of BNPL product is a small business — often characterized by volatile cash flows, seasonality and working capital problems — it is critical to provide a credit option that offers flexible usage and repayment terms. In such a case, ideal BNPL options are those where the business can repay their debt when they want and are charged interest only on the amount used and the number of days for which the credit is utilized (almost like an overdraft facility). This flexibility ensures that the business does not have to bear the burden of monthly installments and can plan their funds/cash flow accordingly.

This is one of the most important differences between consumer BNPL and SME BNPL. A salaried individual or consumer can pay their debts monthly due to a fixed expected income (or salary) at the beginning/end of every month, but an SME needs to be given flexibility owing to the nature of their business.

SME BNPL products should also offer control around usage. Most consumer BNPL companies evaluate their customers in terms of their risk and ability to pay, irrespective of the merchant the customer is buying from or using the BNPL product. However, an SME BNPL product can be offered both in closed-loop and open-ended formats.

An open-ended format would require the provider to assess the business as a whole in terms of their risk and ability to pay, while the closed-loop variant would more likely assess the business’ transactions with a particular supplier/distributor/B2B marketplace to establish the likelihood of repayment.

In terms of tenure, different consumer BNPL products offer different terms to the same customer depending on the nature of the purchase. For example, a customer can get 15 days of credit from a BNPL provider for making a purchase on a delivery app like Uber Eats, while they can get three-month or six-month payment options when buying from a platform like Amazon. SME BNPL is different in this respect, as the business is typically offered the same credit terms across providers and merchants, depending on the industry to which the business belongs.

With regard to pricing, an SME BNPL product is characterized by subvention (or an interest-free grace period) provided by the merchant (similar to the offline credit, where the retailer typically gets a certain “free credit” period from the distributor before inventory must be paid for).

Here’s a quick chart laying out the differences between BNPL and SME BNPL:

| Feature of BNPL | Consumer BNPL | SME BNPL |

| Entity underwritten | Consumer | Transactions/invoice(s) of the SME |

| Repayment terms | Fixed — bullet or EMIs | Flexible — per day interest |

| Cost for borrower | Subvented or interest on EMIs | Mostly subvented |

| Tenure | Multiple — customer choice | Fixed — driven by industry/sector |

| Usage | Open-ended, multiple/large number of partners | Closed loop or open-ended (few partners) |

| Liability | Individual | Business only or joint (business and business owner) |

SME BNPL and cash flow-based underwriting

One of the biggest problems facing the SME credit industry is the fact that most incumbents follow balance-sheet-based underwriting models when offering any lending product to small businesses. More than two-thirds of Indian SMEs have low access to, or can’t get, formal credit for this reason — they either do not have a balance sheet (since most small businesses here don’t prepare financials or get them audited) or if they have one, their revenues are underreported since the majority of their income can be in cash.

In both these scenarios, traditional underwriting does not work. BNPL can be particularly useful when flow-based underwriting or transaction-based underwriting is used to offer credit to small businesses. Since the use case here is the purchase of goods by a business, instead of assessing the overall net worth, credit can be offered based only on their short-term cash flow projections and underwriting for that.

The OCEN framework (Open Credit Enablement Network, which lays the rails for standardization of credit) highlights how cash-flow-based underwriting can be used at scale to enable small-ticket and short-term lending for small businesses. By underwriting upcoming invoices using historical transactions, an SME BNPL product can avoid heavy documentation processes — e.g., collecting financial statements or banking transactions — thereby reducing friction and increasing adoption.

At the same time, the lender can assess transactions and ensure that the limits provided are in line with the business’ cash flows.

Sector-specific SME BNPL considerations

The industry a small business belongs to is an important consideration for SME BNPL providers. For example, most consumer goods or grocery retailers sell their products in a seven- or 14-day cycle, and so require a maximum 14-day credit period. Similarly, pharmaceutical retailers typically expect up to a 30-day credit cycle.

The credit terms required for a sector are important when designing a BNPL offering for small businesses, but there are other sector-specific nuances to consider as well. For example, margins in different sectors also determine the terms offered (in terms of subvention by the merchant). Similarly, depending on SKU-level margins, merchants may use credit to buy certain SKUs using the BNPL product, while the SME may buy certain other SKUs by paying cash upfront.

As B2B transactions continue to move online, credit products for SMEs are in dire need of improvement. SME BNPL is an obvious step toward helping small businesses, especially as the pandemic caused credit to dry up even further for SMEs in developing countries and especially in smaller towns in India. As digital B2B continues to see more companies coming in, it won’t be too unrealistic to expect that BNPL can become integral to the functioning of small businesses.