The pandemic has been extremely painful for many. But as lockdowns lifted and people began resuming their outdoor hobbies, mobile-first businesses have seen growth accelerate as consumers turned to digital tools to improve their time outdoors.

The Dyrt, for example, is the top camping app on the Apple and Google Play App Stores. The app sits at the confluence of two trends: An increased interest in outdoor recreation and travel, and an explosion in consumer subscription software (CSS).

The Dyrt launched its premium offering in 2019, The Dyrt PRO, in time to take advantage of the rising number of Americans making the great outdoors part of their lifestyle. A year later, it had a new subscriber every two minutes paying for features like offline maps and detailed camping information.

CSS businesses at the forefront of outdoor activities have closed major deals in recent years such as hunting app OnX (Summit Partners), hiking app Alltrails (Spectrum Equity), Surfline (The Chernin Group) and mountain bike leader Pinkbike (Outside Media). Companies like Netflix and Spotify have trained consumers to pay monthly or annual fees for software that enhances their lives, creating a business model investors view as reliable and poised for growth.

I think of different outdoor activities almost like individual genres on Netflix. Dominating camping or surfing might be like capturing the streaming market for comedy or horror.

Fitness and the outdoor passion space is one of the most exciting CSS categories in a growing landscape that includes everything from family planning/management services to entertainment and education. I believe CSS is still in the early stages of its growth — perhaps where B2B SaaS was a decade ago.

So what sets apart the great CSS businesses from the good ones?

Passion equals profits on the CSS flywheel

The beauty of the CSS model is the complete alignment between the business and its customers. CSS companies don’t have to please advertisers, and they can design purely for their users.

This dynamic is particularly powerful for CSS companies in the outdoors space, which make your favorite outdoor activity better with performance analytics and enhanced information such as maps, reviews, air quality reports and fire warnings. Consumers are happy to spend money on the activities and hobbies they enjoy, and CSS companies are able to make pleasing those consumers their top priority.

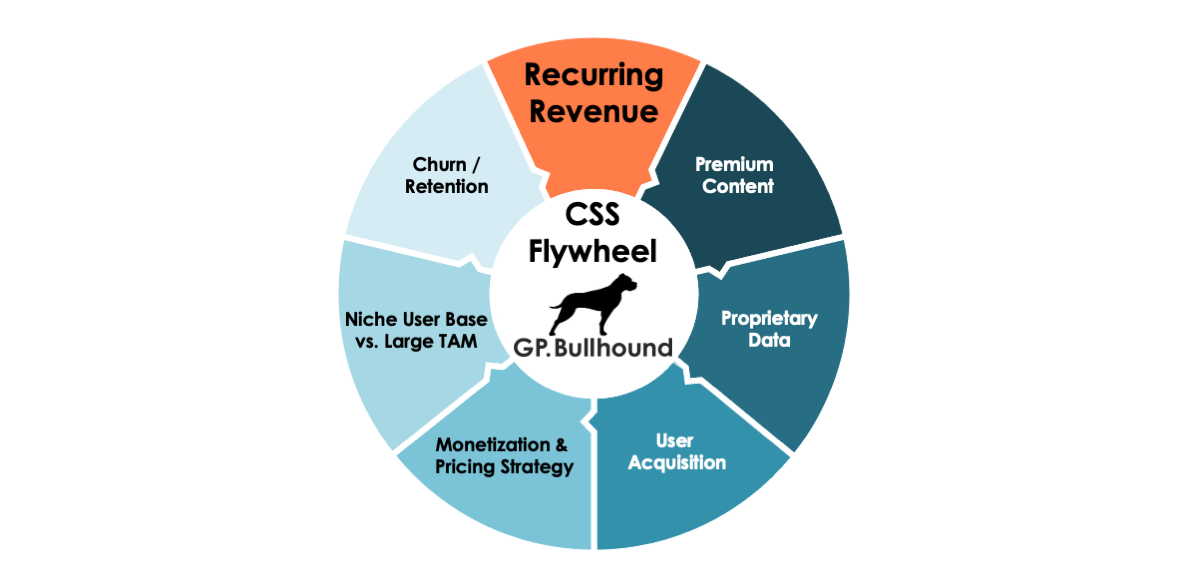

The result is what I call the CSS flywheel, in which a quality CSS product attracts and retains loyal users. Those users contribute their data through posts, photos and reviews, which creates a better product that further attracts new users, and so on.

The CSS flywheel shows the cycle that results when a quality CSS product attracts and retains loyal users. Image Credits: GP Bullhound

When companies get this flywheel right, it’s incredibly appealing to investors, because of the advantages of scale in CSS. Each niche will probably be dominated by one or two players, and a given niche can have tens of millions of consumers.

While an app for cyclists or runners is never going to be as ubiquitous as Netflix, outdoor CSS companies such as Strava have already topped billion-dollar valuations. I think of different outdoor activities almost like individual genres on Netflix. Dominating camping or surfing might be like capturing the streaming market for comedy or horror.

We are beginning to see consolidation in outdoor CSS as well as companies looking to add new services to improve the value of their subscription.

Back-end tools help CSS companies focus on conversion and retention

There are now tools and building blocks that can scale the back end of CSS businesses rapidly, such as payments, subscriptions, user tracking and marketing. B2B companies like RevenueCat exist purely to serve CSS businesses by making it easier to launch an offering.

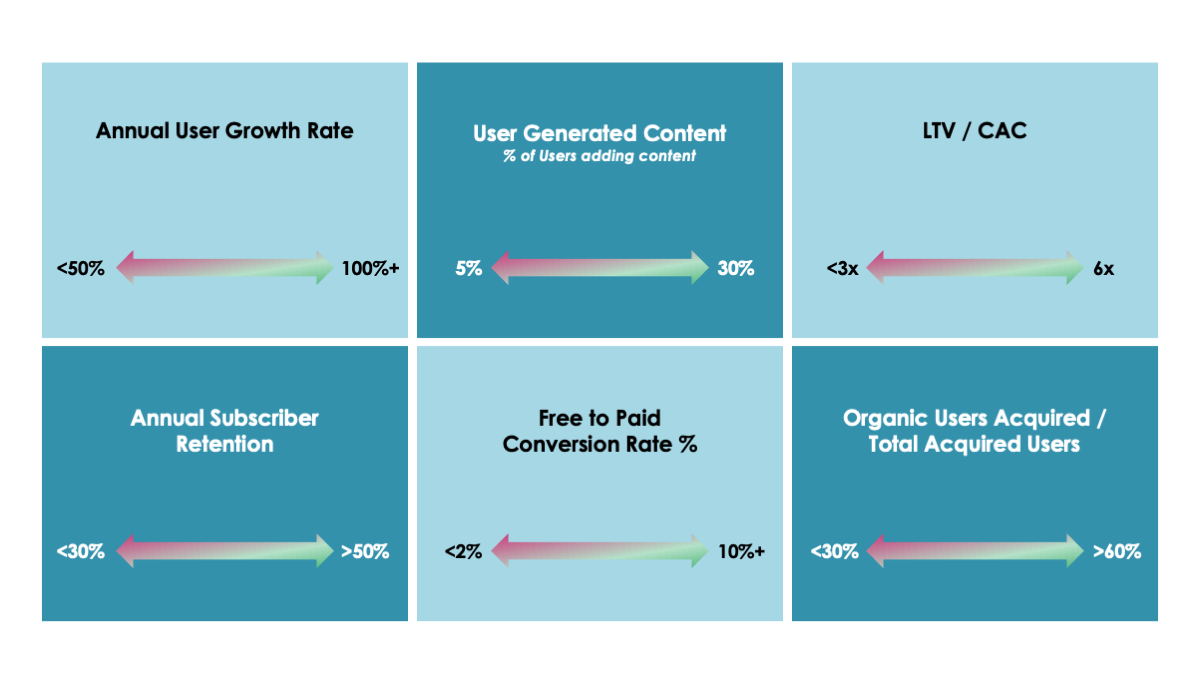

The prevalence of back-end tools levels the playing field. With so many of the basic aspects streamlined, entrepreneurs can focus on creating a product users love and optimizing metrics that investors want to see, such as:

- Annual user growth rate.

- User generated content.

- The ratio of lifetime value (LTV) of a customer versus acquisition cost (CAC).

- Subscriber retention.

- Free-to-paid conversion rates (portion of free users that eventually become paid users).

- Organic customer acquisition versus paid acquisition.

Image Credits: GP Bullhound

In addition to prefab operations tools, readily available sensors in smartphones and watches can now automatically input data into CSS apps to improve their utility. The Dyrt, for instance, has a more reliable map of cell coverage at campgrounds than any of the U.S. wireless carriers thanks to data from thousands of community members at campgrounds across the U.S.

Long-term retention beats hypergrowth

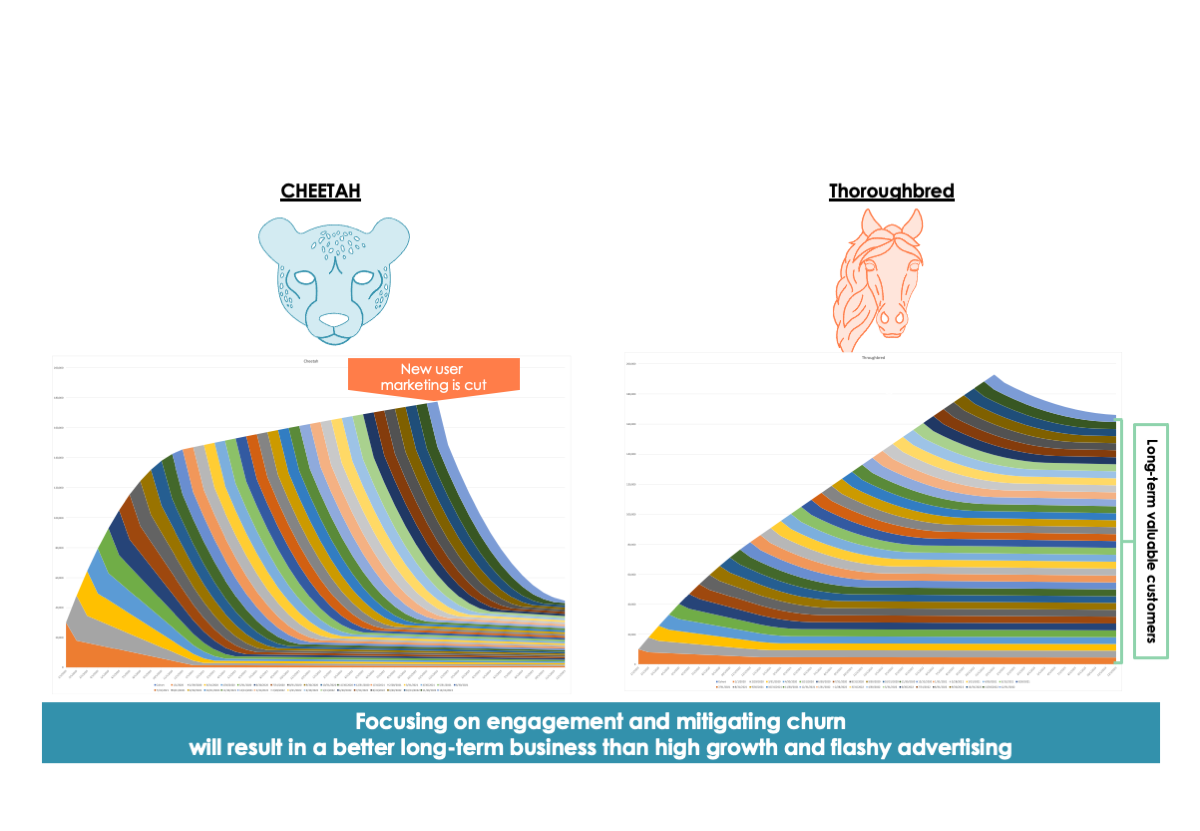

CSS companies often cite rapid growth in paid subscribers — and the cash flow that comes with it — as the No. 1 sign that the business is strong. But that growth is ephemeral if it comes with churn. Investors favor retention, and they want paid subscribers that are likely to stay for years — we call this building for the “locals” rather than the “tourists.”

I call this dynamic the difference between a cheetah and a thoroughbred race horse. Imagine a cheetah (runs fast, but tires quickly) bringing in 30,000 new users a month using a large marketing budget. But if the churn is heavy and the majority of users are dropping the service in less than a year, that’s a problem.

Now imagine a thoroughbred (runs steadily for miles) that loses only a small percentage of paying customers each year and keeps the vast majority for multiple years.

After three years, growth marketing will have run its course for both companies. The marketing budget was never intended to stay sky high forever, so it’s cut. Revenue collapses for the cheetah, while the thoroughbred is almost unaffected.

Image Credits: GP Bullhound

Though the thoroughbred may never post the same peak numbers as the cheetah, it’s ultimately a healthier, more sustainable business.

With the business model, technology support system and proven market opportunity all in place, the last piece of the CSS ecosystem is the widespread excitement of the public and private investors. Fantastic deals like the Zwift/KKR funding and the recent Duolingo and Bumble IPOs illustrate the potential of the sector.

For the next wave of CSS companies liable to make headlines, look for thoroughbreds on the nearest trailhead or campground.