In the United States, same-day and next-day Amazon Prime deliveries have become the de facto standard in e-commerce. People want convenience and instant gratification, evidenced by the fact that an astonishing ~45% of U.S. consumers are Amazon Prime members.

Most major retailers are scrambling to catch up to Amazon by partnering with last-mile delivery startups. Walmart has become a major investor in Cruise for autonomous-vehicle deliveries, and Target acquired Shipt and Deliv last-mile delivery startups to increase its delivery speed. Costco partnered with Instacart for same-day deliveries, and even Domino’s Pizza has jumped in by partnering with Nuro for last-mile delivery using autonomous vehicles.

E-commerce in LatAm has taken off at a compound annual industry growth rate of 16% over the past five years.

The holdout: Latin America

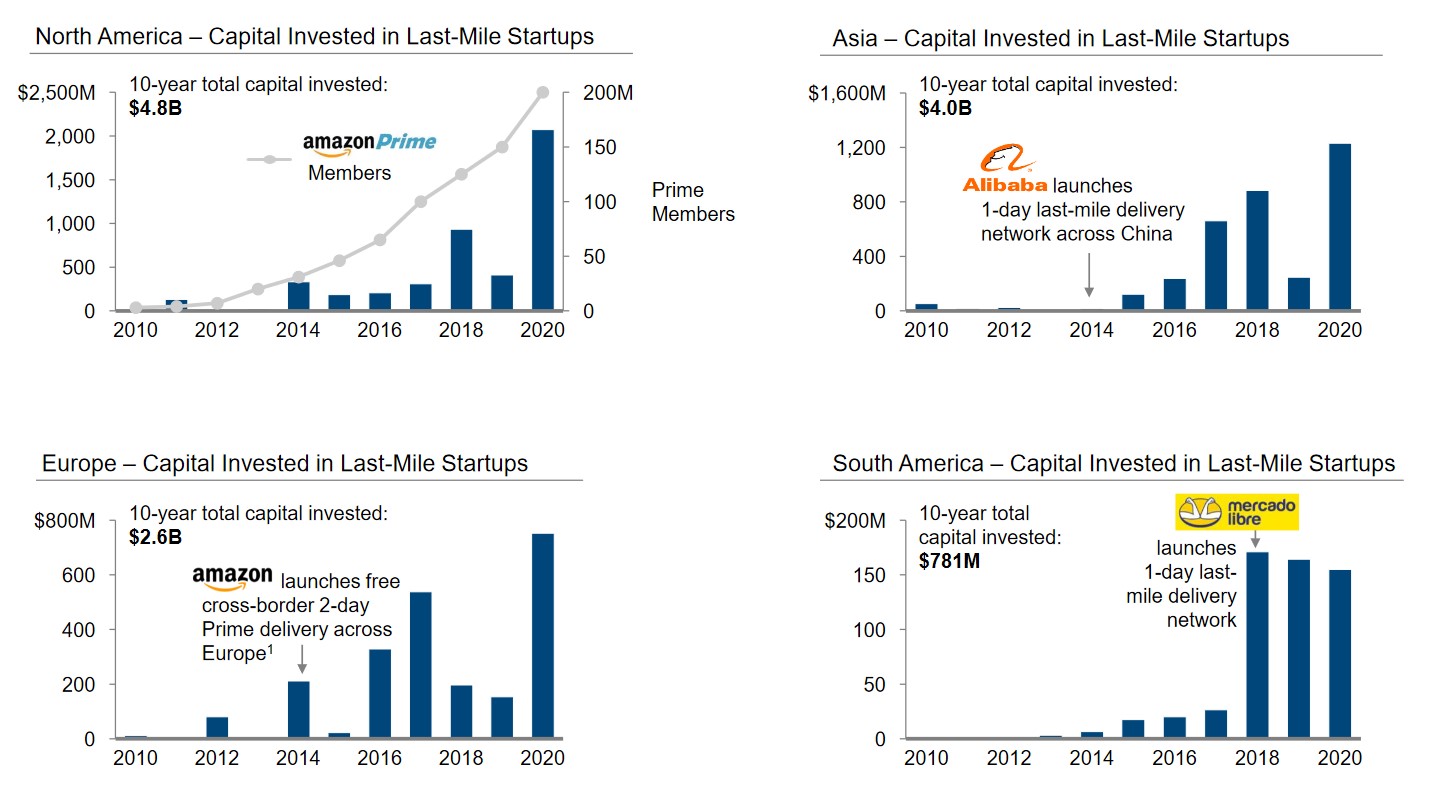

Venture capitalists have been investing heavily in last-mile delivery over the past five years on a global scale, but Latin America (LatAm) has lagged behind. Over $11 billion has been invested globally in last-mile logistics over the past decade, but Latin America only saw about $1 billion over the same period (Source: PitchBook and WIND Ventures research).

Within this, only about $300 million was in Spanish-speaking Latin America — a surprisingly small amount for a region that has 110 million more consumers than in the U.S.

Brazil-based Loggi accounts for about 60% of last-mile VC investment in Latin America, but it only operates in Brazil. That leaves major Spanish countries like Mexico, Colombia, Chile and Argentina without a leading independent last-mile logistics company.

In these countries, about 60% of the last-mile delivery market is dominated by small, informal companies or independent drivers using their own trucks. This results in inefficiencies due to a lack of technologies such as route optimization as well as a lack of operating scale. These issues are quickly becoming more pronounced as e-commerce in LatAm has taken off at a compound annual industry growth rate of 16% over the past five years.

Retailers are missing an opportunity to give customers what they want. Customers today expect free, reliable same- or next-day delivery — on-time, all the time, and without damage or theft. All of these are challenging in LatAm. Theft, in particular, is a significant problem, because unprofessional drivers often steal products out for delivery and then sell them for a profit. Cost is a problem, too, because free same- and next-day deliveries are simply not available in many places.

Operational and technological roadblocks abound

Why does Latin America lag when it comes to the last mile? First, traditional LatAm e-commerce delivery involves multiple time-consuming steps: Products are picked up from the retailer, delivered to a cross-dock, distributed to a warehouse, delivered to a second cross-dock, and then finally delivered to the customer.

By comparison, modern delivery operations are much simpler. Products are picked up from the retailer, delivered to a cross-dock, and then delivered directly to the customer. There’s no need for warehousing and an extra pre-warehouse cross-dock.

And those are just the operational challenges. Lack of technology also plays a significant role. Most delivery coordination and routing in LatAm are still done via a spreadsheet or pen and paper.

Dispatchers have to manually pick up a phone to call drivers and dispatch them. In the U.S., computerized optimization algorithms dramatically cut both delivery cost and time by automatically finding the most efficient route (e.g., packing the most deliveries possible on a truck along the route) and automatically dispatching the driver that can most efficiently complete the route based on current location, capacity and experience with the route. These algorithms are almost unheard of in the Latin America retail logistics sector.

Major retail brands are the last-mile catalyst

In all major global markets (the U.S., Europe and Asia), last-mile delivery took off exponentially after major retail brands launched free same- and next-day delivery services. The availability of fast, free delivery spurred consumer expectations. When large numbers of consumers came to expect free same- and next-day delivery from a major retailer, the rest of the retail and e-commerce industry has had no choice but to follow. Subsequently, VC investment in the sector exploded.

Take a look at how VC investment in last-mile delivery startups increases when major retail brands start offering free same- and next-day delivery:

Image Credits: WIND Ventures and PitchBook data

LatAm is at a turning point

LatAm’s largest e-commerce company, Mercado Libre, launched its same-day delivery network in 2018. Predictably, last-mile delivery VC investment started taking off in the same year. This created a domino effect that will lead to an exponential growth in the last-mile delivery sector in LatAm over the next few years as consumers come to expect free same- and next-day delivery.

Mercado Libre was about four years behind retailers launching similar services in Europe and Asia, and eight years behind Amazon in the U.S. Regardless of the late start, last-mile delivery has become a massive market opportunity for investors, startups and retailers, especially given that LatAm is one of the world’s fastest-growing e-commerce markets.

E-commerce sales in LatAm were expected to grow by around 37% to $85 billion last year. Much of this is driven by the accelerated adoption of mobile shopping, and mobile’s share of e-commerce is pegged to reach 49% in 2021, more than doubling from 21% in 2016.

And there’s significant room for continued growth. LatAm e-commerce sales currently represent only 6% of retail sales — less than half the rate in the United States. Other drivers include a burgeoning middle class that has grown 50% over the last decade; GDP per capita on par with that of the Asia-Pacific region (excluding high-income countries); and widespread internet adoption at more than 65%.

LatAm is also home to one of the world’s largest mobile internet markets with around 250 million people using 4G-enabled smartphones as of 2020. Given these factors, analysts are projecting strong last-mile delivery market growth in LatAm in the coming years.

Which startups are ripe for investment?

Startups that succeed at last-mile delivery in this burgeoning market will have four characteristics. They will need:

- The right technology: Leading route optimization technology will lower delivery costs and time, allowing providers to offer cheaper and more reliable service to customers.

- A sufficiently large fleet: A large and reliable fleet is a minimum to ensure reliable and on-time delivery.

- The ability to successfully acquire and retain drivers: This will require a differentiated, compelling and low-cost driver acquisition and retention strategy.

- Competitive pricing: Pricing — a barrier for many consumers — is a big factor. Effective routing technology, low-cost driver acquisition and retention, and large operating scale are key to achieving competitive pricing.

Successful evolution of the LatAm last-mile delivery startup sector is important to several stakeholders, who all stand to benefit but will need to be strategic to succeed. Any retailer with the exception of Mercado Libre and Amazon will most likely have to rely on third-party last-mile delivery startups to fulfill orders, so they will need to identify the best startup partners.

There is a significant opportunity in LatAm’s Spanish-speaking countries, where the top three last-mile e-commerce delivery startups have only raised around $100 million in total venture capital funding to date (excluding food delivery and ride-sharing startups). This is miniscule compared to other regions, including Brazil, where Loggi has raised around $500 million.

For investors, last-mile retail delivery technology has already produced several unicorns, including Loggi, Nuro and Bringg. This isn’t counting food-delivery unicorns like Rappi and DoorDash, or ride-sharing companies like Uber and Lyft. Last-mile delivery has become a tried-and-true sector for finding venture capital unicorns, and LatAm is one of the best remaining opportunities globally.

There are around 650 million people in LatAm, and they are one of the last groups of consumers to benefit from widespread free same- and next-day delivery. The development of last-mile delivery will have a significant impact on their day-to-day shopping experience.

Latin America is the most important last-mile delivery growth market in the world right now. Although it got a slow start, it is poised for take-off. Smart entrepreneurs, investors and retailers can all benefit from entering the market and making the right strategic decisions. The biggest beneficiary will be consumers, who will at last be able to enjoy the convenience and timeliness of receiving packages on their doorsteps in almost no time, at no extra charge.