Zoom, a well-known video conferencing company, will buy Five9, a company that sells software allowing users to reach customers across platforms and record notes on their interactions. As TechCrunch noted this morning, the deal is merely “Zoom’s latest attempt to expand its offerings,” having “added several office collaboration products, a cloud phone system, and an all-in-one home communications appliance” to its larger software stack in recent quarters. Both companies are publicly traded.

Why would Zoom buy slower growth for so very much money? One thing to consider is that Five9’s most recent quarterly growth rate is quicker than the growth rate that it posted over the last 12 months.

But the Five9 deal is in a different league than its previous purchases. Indeed, the $14.7 billion transaction represents a material percentage of Zoom’s own value. That tells us that the company is not simply making a purchase in Five9, but is instead making a large bet that the combination of its business and that of the smaller company will prove rather accretive.

Zoom is worth $101.8 billion as of the time of writing, with the company’s shares slipping just over 4% today; the stock market is largely off this morning, making Zoom’s share price movements less indicative of investor reaction to the deal that we might think. Still, it doesn’t appear that the street is excessively thrilled by news of Zoom’s purchase.

That perspective may be reasonable, given that the Five9 transaction is worth nearly 15% of Zoom’s total market cap; the company is betting a little less than a sixth of its value on a single wager.

Not that Five9 doesn’t bring a lot to the table. In its most recent quarter, Five9 posted $138 million in total revenue, growth of 45% on a year-over-year basis.

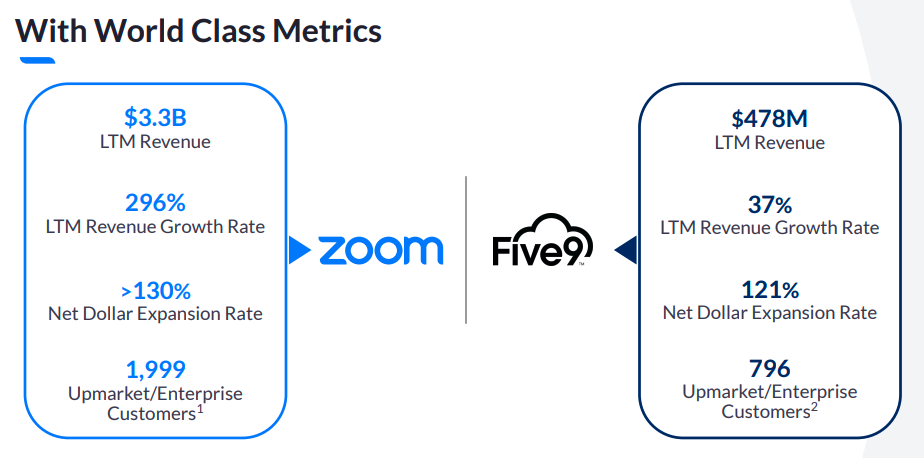

Still, as Zoom reported in an investor deck concerning the transaction, the smaller company’s growth rate pales compared to its own:

Image Credits: Zoom investor deck

This is where the deal gets interesting. Note that Five9’s revenue growth rate is a fraction of Zoom’s. The larger company, then, is buying a piece of revenue that is growing slower than its core business. That’s a bit of a flip from many transactions that we see, in which the smaller company being acquired is growing faster than the acquiring entity’s own operations.

Why would Zoom buy slower growth for so very much money? One thing to consider is that Five9’s most recent quarterly growth rate is quicker than the growth rate that it posted over the last 12 months. That implies that Five9 has room to accelerate growth compared to its historical pace, bringing its total pace of top-line expansion closer to what Zoom itself manages.

Five9 is in no danger of besting Zoom’s epic pace of revenue growth, but it could get closer. And Zoom reckons that as a pair they can both get more done. Here’s the pertinent slide:

Image Credits: Zoom investor deck

That’s a lot of corporate-speak, so let’s boil down the bullets to something more digestible:

- Zoom expects to sell its products to Five9 customers, and vice versa; this could unlock further net dollar retention at both companies, making them more attractive as a pair than they were individually.

- Zoom wants a bigger market to sell into; Five9 provides that. More total addressable market (TAM) means a higher ceiling for future growth, and Zoom expects the Five9 deal to open some $24 billion worth of TAM. That’s a big jump from the implied pre-Five9 TAM of $62 billion that Zoom considered its pre-transaction market opportunity.

How well will those ideas translate into reality? We’ll have to wait and see. Zoom’s 8-K filing, which may detail expected long-term impacts of the deal, has yet to be released, and with the deal closing in the first half of 2022, we’re some ways away from the companies starting their life as a pair.

The deal reminds me somewhat of what Hopin is doing. The online events unicorn has a history of near-vertical revenue growth, and, as a result, has seen torrid valuation rise in the last year. What has it done with that pile of recently created equity value? Bought other companies. For example:

- StreamYard for $250 million — the deal brought material ARR and new streaming capabilities to Hopin, likely boosting its TAM;

- Jamm and Streamable — deals that brought video collaboration tooling and video uploading capacity, respectively, to Hopin.

Hopin is using its epic private-market valuation and fundraising results to snap up companies large and small to bolster its revenue base and gross revenue growth while also expanding its toolset and TAM. Sound familiar?

The method works at companies that have enjoyed a strong upsurge in their worth. Zoom is one such company. It was worth around $66 per share back in April 2019; today, it’s worth $349 per share. Why not break off a chunk of that value and use it to quickly bolt on new products and markets? It’s as free as money gets.

We do not know at this moment when Five9 will next report earnings, but the eventual set of numbers could help Zoom investors better understand what their company sees in the smaller firm. Zoom won’t report for some time yet.

Still, who doesn’t love to kick off the week with a huge deal?