Pakistan, the world’s fifth most populous country, has been slow to adapt to the internet economy. Unlike other emerging economies such as China, India and Indonesia, which have embraced digitization and technology, Pakistan has trailed the region in the adoption of technology and startup formation.

Despite this, investors have dreamed for years of the huge opportunities in unlocking Pakistan’s potential as a digital economy. As a country of 220 million people, almost two-thirds of whom are under the age of 30, Pakistan draws natural comparisons to Indonesia — which has rapidly emerged as one of the most vibrant technology ecosystems outside the U.S. and China.

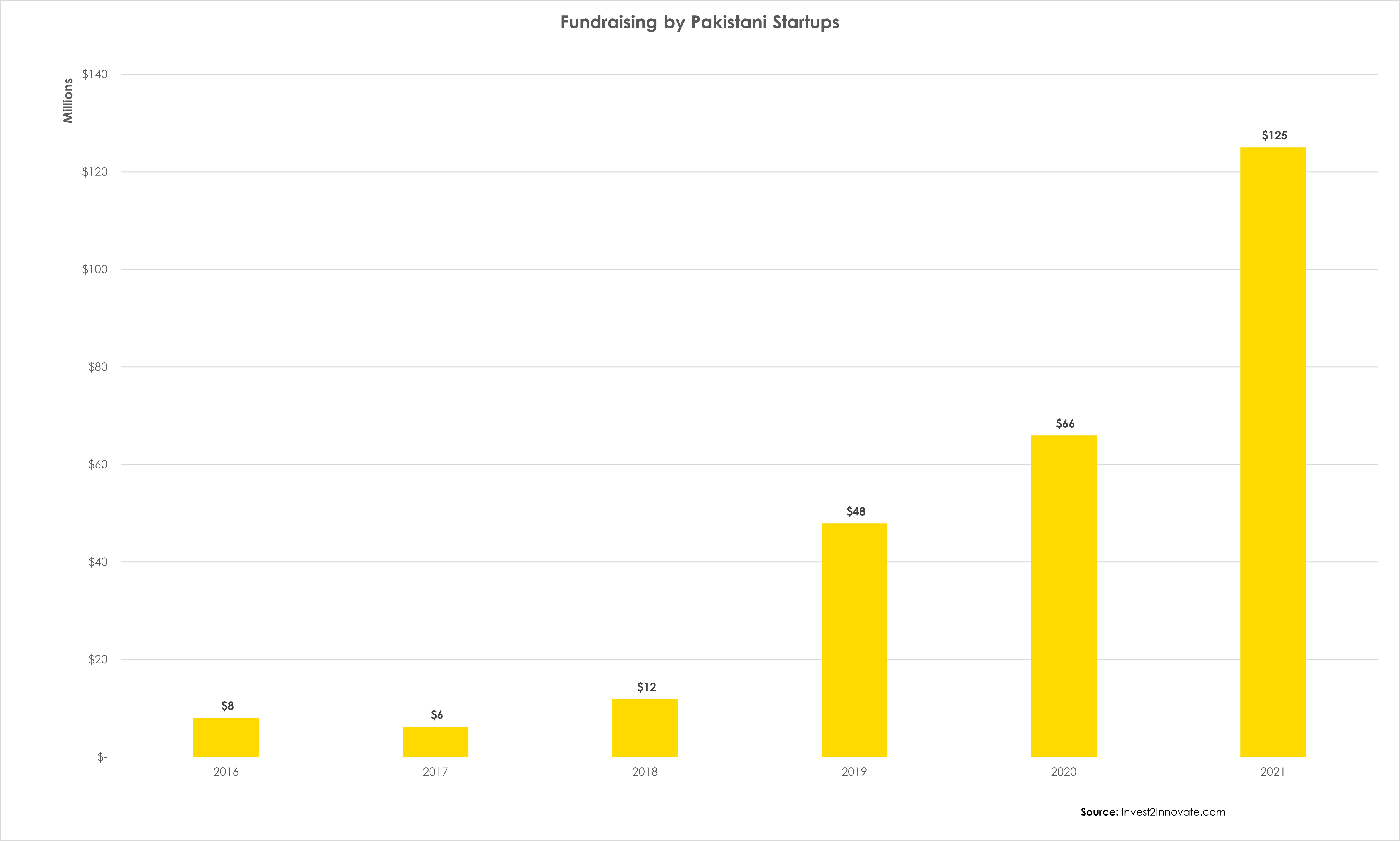

In 2021, Pakistani startups are on track to raise more money than the previous five years combined.

After years of lagging behind, over the course of the past 18 months, Pakistan’s technology ecosystem has come to life in unprecedented fashion. In 2021, Pakistani startups are on track to raise more money than the previous five years combined. Even more excitingly, a large portion of this capital is coming from international investors from across Asia, the Middle East and even famed investors from Silicon Valley.

Image Credits: Mikal Khoso

The rapid emergence of Pakistan’s technology ecosystem on the international stage has been no accident — it’s the result of a confluence of changing facts on the ground and shifting dynamics in the startup and investing world as a result of the pandemic.

Unlocking Pakistan’s potential

The sudden emergence of Pakistan’s tech ecosystem on the international stage has been driven by three major factors: an improving security situation, quickly growing mobile connectivity, and critical legal changes and deregulation.

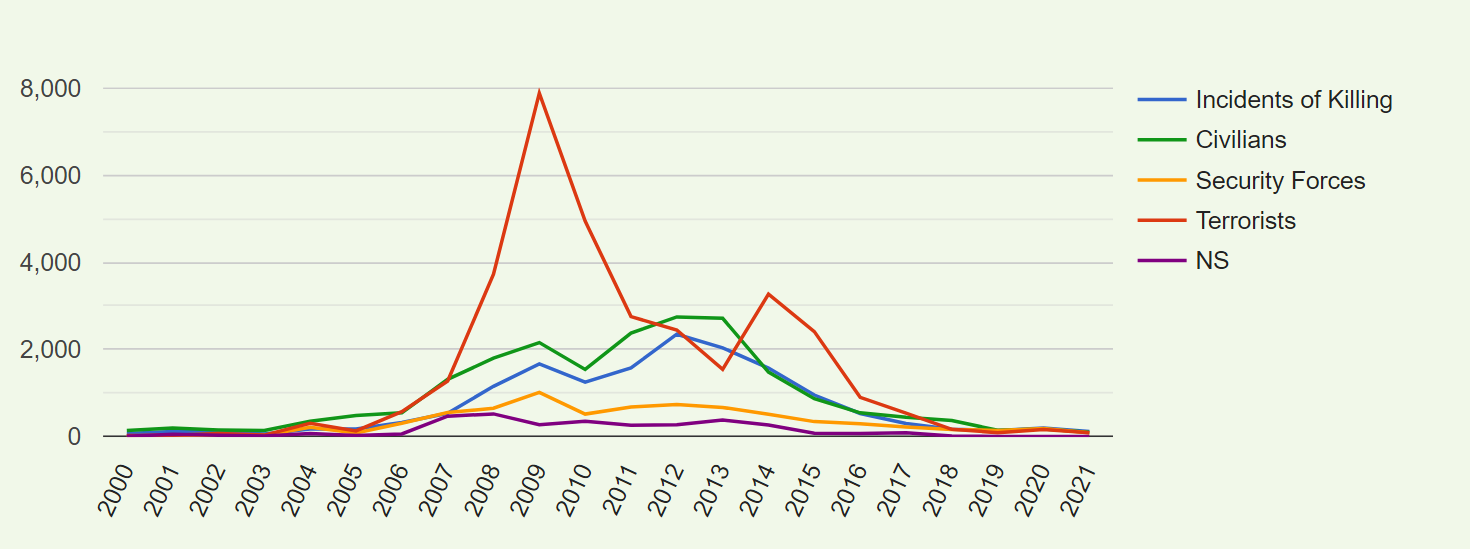

As a frontline state and coalition partner in the United States’ invasion of Afghanistan, Pakistan saw fatalities from terrorist violence soar from 295 in 2001 to a peak of over 11,000 in 2009. This climate of instability and violence scared away international business and investors from Pakistan for much of the first two decades of the 21st century.

Image Credits: Mikal Khoso

However, after a series of military campaigns, the construction of a fence along the Afghan border and better policing in urban areas, the frequency and scale of terrorist violence dropped significantly in Pakistan, with 506 recorded fatalities in 2020. The improving security situation opened the doors again to international investors and businesses, including major investment from China as part of its Belt and Road Initiative.

In addition to an improving security situation, Pakistan’s rapidly rising mobile connectivity has created a fertile foundation for a technology revolution. The number of mobile phone users in Pakistan has ballooned from 114 million in 2014 to over 180 million today, with more than 80% of Pakistan’s 215 million people now mobile users. More importantly, of these mobile users, almost 100 million have access to 3G or 4G data.

The final critical factor that has enabled Pakistan’s tech ecosystem is legal and regulatory changes pushed by forward-thinking regulators in Pakistan’s Securities and Exchange Commission and State Bank, as well as careful lobbying by local leaders in the tech ecosystem.

Historically, Pakistani law has not permitted local companies to be owned by foreign holding companies. Holding companies based in international financial hubs like Dubai, Singapore and Hong Kong are typical across emerging markets as a method for securing investment from international investors. These companies and the strong legal and financial protections afforded by these hubs help investors get comfortable investing in companies doing business in markets with weaker legal systems or in where they do not fully understand the nuances of the local legal system.

These restrictions on holding companies have discouraged investment in Pakistan from international investors for years. However, in February 2020, the State Bank of Pakistan issued new regulations specifically targeted at supporting local startups in raising foreign capital by permitting the establishment of holding companies for local startups. Startups in Pakistan can now establish overseas holding companies with ownership stakes in a Pakistan-based subsidiary. These new regulations have helped unlock a flood of international investor capital from storied venture capital firms including Kleiner Perkins and First Round Capital.

The copycats and most exciting sectors

Like tech ecosystems in other emerging markets, the current crop of Pakistani startups is primarily copycats of tried-and-tested models in other emerging markets, including:

- B2B wholesale marketplaces: Bazaar, Tajir, Dastgyr, Retailo

- SMB accounting products: CreditBook, Easy Khata (by Bazaar)

- Grocery delivery: Bykea, GrocerApp, 24Seven

- Ride-hailing and travel: Bykea, Sastaticket, Bookme

- E-commerce marketplaces: Daraz, PriceOye

- Digital banking: SadaPay, Tag, Oraan

These companies localized these business models to Pakistan’s regulatory environment and designed their products to fit local consumer behavior. These tried-and-tested models have scaled rapidly in Pakistan given the relatively untapped market for such products and the high number of mobile phone users today.

The impressive user and revenue numbers for many of these copycats have attracted the lion’s share of international investment. Valuations have soared rapidly in Pakistan and startups are raising funding at valuations that match the valuations of some of the most competitive seed deals in the U.S. The sizes of funding rounds are also growing rapidly. For example, Tag, a digital bank, recently raised a $5.5 million pre-seed round, Pakistan’s largest pre-seed round to date.

The segments in Pakistan that are likely to attract the best entrepreneurs and most investor capital in the years to come will be fintech, e-commerce and edtech.

Pakistan remains one of the most underbanked countries in the world, and women, in particular, are heavily underbanked (93% of Pakistan’s adult women lack bank accounts). The rise of mobile money wallets like Easypaisa and JazzCash, a new regulatory sandbox for fintech startups launched by the Securities and Exchange Commission of Pakistan, and a government focus on financial inclusion are huge tailwinds for fintech innovation in the country.

Image Credits: Mikal Khoso

E-commerce is a huge opportunity in Pakistan, estimated to have grown to be a $1.5 billion market in 2020. This pales in comparison to Indonesia’s e-commerce market, which was estimated to be worth $45 billion in 2020 and is set to soar to $125 billion by 2025.

Aside from fintech and e-commerce, the edtech sector in Pakistan is ripe for innovation. Pakistan’s ailing public education system has struggled to educate a rapidly growing young population. Pakistan’s literacy rate for adults over 15 remains an abysmal 60%. However, with a school-age population of over 80 million students, the potential market for educational services is a lucrative opportunity.

Challenges and the road ahead

Despite the positive momentum over the past year, Pakistan’s tech ecosystem continues to face a few challenges. First and foremost, investors question the depth of the market and the country’s ability to produce companies that generate hundreds of millions of dollars in revenue. Pakistan’s low GDP per capita of $1,200 is far lower than Indonesia’s $4,100 or Nigeria’s $2,200. This reduced purchasing power raises important questions about the breadth and depth of purchasing power in Pakistan, especially for consumer services.

Fundraising continues to be difficult for Pakistani startups. While raising a seed or Series A round in Pakistan has become much easier in the last year, raising growth rounds in Pakistan remains challenging. Global growth investors, who typically have lower risk tolerance than early-stage investors, have not yet developed comfort with Pakistan as a market for investments.

Despite these challenges, a new generation of Pakistani entrepreneurs has launched startups that are working hard to digitize Pakistan’s economy from logistics to e-commerce and fintech. As Pakistan’s economy continues to grow and the flow of investor capital accelerates, the technology ecosystem in Pakistan will blossom in the years to come.