A CEO’s fiduciary duties to their company and its shareholders do not end when they are off the clock — they must always act in good faith. However, navigating the boundaries between a company’s official communications and a personal voice can be difficult in today’s social-media-connected environment.

What a CEO posts on Twitter can raise not only serious reputational issues for themselves and their companies but posting the wrong things at the wrong time can also cause breach of fiduciary duties and may even run afoul of securities laws.

Reputation and goodwill take a long time to build and are difficult to maintain, but it only takes one tweet to destroy it all.

Fiduciary duties can be divided into three buckets: (1) duty of care — CEOs must act in good faith with the care of a reasonable person in a like position with a reasonable belief that their decisions are in furtherance of their company’s best interest; (2) duty of loyalty — CEOs must put the interest of shareholders and the company above their own self-interest; and (3) duty of good faith — CEOs must act with honesty and fairness to shareholders and the company.

There is no denying that Twitter can be leveraged as a powerful tool. Used appropriately, it can fortify the reputation of a company and its CEO, forge stronger consumer relationships and drive business profits. For example, Tim Cook’s habit of tweeting about his interactions with Apple customers demonstrates his customer-service values and effort to connect with consumers, which can potentially lead to a bigger and more loyal following.

Lately, more and more CEOs are communicating their stance on issues that are important to their consumer base to exhibit authenticity, relatability and demonstrate their personal and corporate values through social media. Following last year’s murder of George Floyd and rise of the Black Lives Matter movement, nearly 60% of all S&P 100 tech CEOs, unicorn CEOs, and Fortune 500 CEOs tweeted, “Black Lives Matter.” This was the first time CEOs active on Twitter overwhelmingly voiced their position on racial and social justice issues.

Twitter can also be an opportunity to show transparency in policy. CEOs can use social media to announce new management initiatives, capability expansions and new investments in employees (diversity initiatives, new roles for women, organizational changes) that are positive in tone and speak about the future direction of the company. These can have a positive correlation with stock prices.

It wasn’t that long ago that the world was fixated on Donald Trump’s Twitter posts and their correlation with the stock market. Words have permanence and their impact can be catastrophic. Given their elevated role as a leader and representative of the company and the fiduciary duties they owe, CEOs must watch what they say and when they say it. What it all boils down to is awareness, common sense and the law.

Don’t break the law and stick to the facts

For U.S. publicly traded companies, SEC Regulation Fair Disclosure (Reg FD) says that “an issuer may not disclose material nonpublic information to certain groups, either intentionally or unintentionally, without disclosing the same information to the entire marketplace.” If companies use social media to announce key information, to comply, they must alert investors that social media will be used to disseminate such information.

Regardless of whether it is a public or private company, CEOs are corporate officers and owe fiduciary duties to their companies and their shareholders. Fiduciary duty requires CEOs to act in good faith, apply their best business judgment and to act in the best interest of the company. This is true whether they are in the boardroom or on Twitter.

Case in point: Elon Musk’s tweets on August 7, 2018 stated that he had secured funding to take Tesla private at $420 per share when, in fact, funding had not been secured. This ultimately led to the SEC filing a lawsuit against the company and Musk individually for fraud and violation of Reg FD.

The resulting settlement came with a hefty fine, Musk stepping down as Tesla’s chairman for three years, and the requirement that Tesla’s legal counsel pre-approve his tweets before posting. Then, he does it again in 2019. Musk tweeted that Tesla would make 500,000 cars in 2019 but the fact was that Tesla was not expected to make 500,000 cars in 2019. Musk also wrote about Tesla’s solar roof production and stock prices without getting pre-approval. The SEC filed a motion that Musk violated the terms of the settlement.

Read the room; awareness is key

Reputation and goodwill take a long time to build and are difficult to maintain, but it only takes one tweet to destroy it all. CEOs must be aware that anything posted on the internet is permanent, even after deletion. Insensitive and offensive posts will reflect negatively on a CEO and their company.

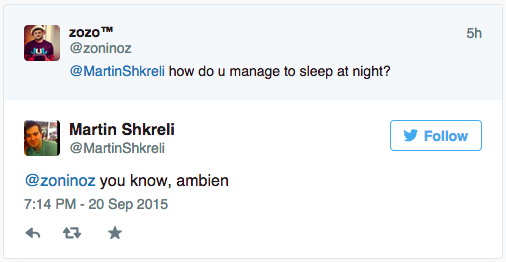

Case in point — The price of Daraprim, a drug used to treat HIV/AIDS patients increased from $13.50 per pill to nearly $750 per pill following the 2015 acquisition by Turing Pharmaceuticals, founded by Martin Shkreli. The New York Times subsequently ran an article looking into reasons for the skyrocketing price. Hilary Clinton, and other politicians, called the price hike “price gouging” and responded to Turing Pharmaceuticals’ founder and chief executive Martin Shkreli’s suggested 10% price cut on Twitter with:

A 10% price reduction is insulting. As I’ve said before, the FDA and FTC need to step in to protect consumers.

— Hillary Clinton (@HillaryClinton) November 5, 2015.

Shkreli responded on Twitter with “lol” and responded to the critics with insensitive tweets.

Image Credits: Twitter

Biotech stocks then fell as investors feared anti-pharma legislation.

When in doubt, do not post

The adage — If you don’t have anything nice to say, don’t say anything at all — applies here. A CEO’s job is ultimately to protect the company and its shareholders. Before tweeting anything, it would be useful to ask:

- Does the post contain material information that would be important to owners and shareholders?

- Does the post violate duty of care?

- Does the post violate duty of loyalty?

- Does the post demonstrate good (business) judgment?

- Is the post in line with the company’s values?

- Is posting acting in the best interest of the company?

If the answer is “I don’t know,” don’t post.

Twitter can be successfully leveraged to communicate directly and effectively with key stakeholders, increase company and CEO profiles, and even increase a company’s profitability and stock prices. However, social media is a double-edged sword. Everything a CEO communicates speaks to the character and values of the company they lead. CEOs must be able to read the room, understand the impact of their words, and must be mindful of what they say.