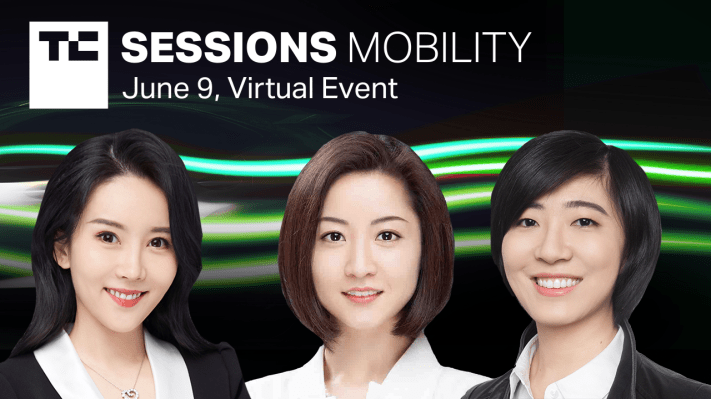

AutoX, Momenta and WeRide took the stage at TC Sessions: Mobility 2021 to discuss the state of robotaxi startups in China and their relationships with local governments in the country.

They also talked about overseas expansion — a common trajectory for China’s top autonomous vehicle startups — and shed light on the challenges and opportunities for foreign AV companies eyeing the massive Chinese market.

Enterprising governments

Worldwide, regulations play a great role in the development of autonomous vehicles. In China, policymaking for autonomous driving is driven from the bottom up rather than a top-down effort by the central government, observed executives from the three Chinese robotaxi startups.

Huan Sun, Europe general manager at Momenta, which is backed by the government of Suzhou, a city near Shanghai, said her company had a “very good experience” working with the municipal governments across multiple cities.

In China, each local government is incentivized to really act like entrepreneurs like us. They are very progressive in developing the local economy… What we feel is that autonomous driving technology can greatly improve and upgrade the [local governments’] economic structure. (Time stamp: 02:56)

Shenzhen, a special economic zone with considerable lawmaking autonomy, is just as progressive in propelling autonomous driving forward, said Jewel Li, chief operation officer at AutoX, which is based in the southern city.

Adjacent to Shenzhen is Guangzhou, home to WeRide and a major global trading hub. Jennifer Li, WeRide’s vice president of corporate finance, said the company chose Guangzhou because it has the most favorable policies for autonomous driving in China.

In the past four years, we’ve been working the Guangzhou government to put autonomous driving robotaxis on the road. [The government has] seen all the progress we’ve made and we’re constantly communicating with them about our progress, so that they know that this is really safe. (Time stamp: 07:45)

Barriers for foreign players

A flurry of Chinese autonomous driving companies has established an international presence, whether it manifests in the form of R&D staff overseas, testing on U.S. roads or supplying solutions to multinational automakers. But the reverse — foreign AV companies entering China — is not happening at a meaningful scale.

The three executives talk about how foreign counterparts can crack open China’s market. Aptiv has been in China for years but is a relatively small player. Li from AutoX laid out the challenges of operating in China.

I think it’s not as simple as opening up an office, right? It’s much more than that, to be able to succeed in the market. You need to build the landscape, you need to build the ecosystem, your own partners. The whole ecosystem chain is quite long. It’s quite complicated, involving government relations. It also involves the data that you have already accumulated. The driving experience has to fit in the local world. Many things comes into play. (Time stamp: 16:13)

Read more on TechCrunch

- Betting on China’s driverless future, Toyota, Bosch, Daimler jump on board Momenta’s $500M round

- China’s WeRide secures more funding, pushing valuation to $3.3 billion

- Tesla will store Chinese user data locally, following Apple’s suit

- Tesla mulls cars tailored to China amid mounting criticism

- Tesla’s China rival Xpeng to use lidar sensors from DJI affiliate Livox

- Xiaomi joins the ranks of Chinese tech giants to work on EVs

RELATED SESSIONS FROM MOBILITY

American companies may have a head start in researching self-driving, but Chinese companies are catching up quickly on the back of hefty funding. Li from WeRide echoed AutoX’s Li, saying that China’s environment is much more complex and newcomers must adapt not just to new road conditions but also to the local culture and different relationships with the government.

But WeRide’s Li was also optimistic that more U.S. peers will try to come to China. It may not be too late for them. “Even for us, we are still getting the test permit, not the operation permit yet,” she said.

Commercializing robotaxis

Despite their international endeavors, the three AV startups still consider China their base and main market to carry out monetization plans. It’s not just because of the sheer size of the Chinese population. At the recent Shanghai Auto Show, Sun observed a whirlwind of enthusiasm among automakers for smart driving technologies.

There are a lot more new EV brands and new brands coming from local automakers. They are equipping their cars with more intelligent features … Many people are buying Tesla. State-owned companies like SAIC are also very fast in the race of putting their high-end new EV brand to the market. (Time stamp: 22:13)

All three startups have raised investments from large multinational automakers. While Momenta and WeRide see their OEM investors as close strategic partners for rapid deployments of their technologies, AutoX opts to work with a broad range of automakers, preferring to keep OEMs as minor shareholders.

AutoX’s Li explained:

The OEM to autonomous driving company ratio is a lot higher [in China] compared to anywhere globally. There are three [major] OEMs in Germany, three in the U.S., one in Korea, three in Japan. All of those global OEMs — the 10 OEMs — have to fight for the China market, plus the 200 Chinese OEMs … So we think the way that autonomous driving companies are going to collaborate with OEMs [in China] are going to be really different compared to the U.S. (Time stamp: 29:19)