Welcome back to the working week. Are you ready to get our hands a little dirty this morning?

Good. We have an IPO to catch up on, one I should have kept up with in the past few weeks. Regardless, today we’re looking at Zeta Global’s latest IPO filing ahead of its eventual pricing.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Zeta Global is not a firm that I am very familiar with, but because Crunchbase notes that the New York-based startup has raised north of $600 million in private capital in the form of both equity financing and debt, it’s a unicorn worth understanding.

The gist is that Zeta ingests and crunches lots of data, helping its users market to their customers on a targeted basis throughout their individual buying lifecycles. In simpler terms, Zeta helps companies pitch customers in varied manners depending on their own characteristics.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know. We’ll also poke around its final private valuation so that we can see how much that number matches up — or doesn’t — to its recent financial results.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know. We’ll also poke around its final private valuation so that we can see how much that number matches up — or doesn’t — to its recent financial results.

Sound good? Let’s find out why Staley Capital, GCP Capital Partners, Franklin Square Group, GPI Capital and others backed the firm.

Zeta Global’s business in brief

It can be useful to dissect a company’s marketing materials not just to see how well they describe themselves, but also to grok how they want to be perceived in the marketplace. Zeta is one such case.

Via its S-1 filings, here’s how it wants you to understand its business:

Zeta is a leading omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software. We empower our customers to target, connect and engage consumers through software that delivers personalized marketing across all addressable channels, including email, social media, web, chat, connected TV (“CTV”) and video, among others.

If that didn’t make a lot of sense, it’s OK.

Translating: Zeta is a hosted, data-focused service sold to large customers, providing them with tools to better understand consumers and improve their marketing results through automated software. Zeta helps its clients find, connect and deal with their own customers on a nearly individual basis across a host of mediums.

That’s easier to understand, I hope. We can file Zeta, then, in the marketing tech category.

Now, how has the martech world treated Zeta?

Modest growth, strong adjusted profitability

We have 2019, 2020 and Q1 2021 data to parse. Looking at Zeta’s last two full years of results, the company managed to expand its revenues from $306.1 million to $368.1 million, posting growth of just over 20%. That’s modest.

However, from the first quarter of 2020 to the first quarter of 2021, Zeta grew its revenues from $81.3 million to $101.5 million. That works out to growth of just under 25%. That’s better.

As a general point, growth rates are graded in both absolute terms and by how quickly they are changing. A high growth rate that is decaying rapidly, for example, will be discounted compared to a quick growth rate that is stable. And a slower growth rate that is accelerating could be valued more richly than its similarly growing peers that are posting flat results.

Zeta is in the second group. Its Q1 2021 growth rate is superior to its 2020 growth rate. That could prove useful as the company looks to list because a 20% pace of expansion in 2020 is only so-so for a richly backed technology company.

Turning to profitability, on a GAAP basis — GAAP means inclusive of all costs, in this case — Zeta Global is increasingly unprofitable. Its 2019 net loss of $38.5 million grew to $53.2 million in 2020. And its Q1 2020 net loss of $16.4 million grew to $24.3 million by Q1 2021.

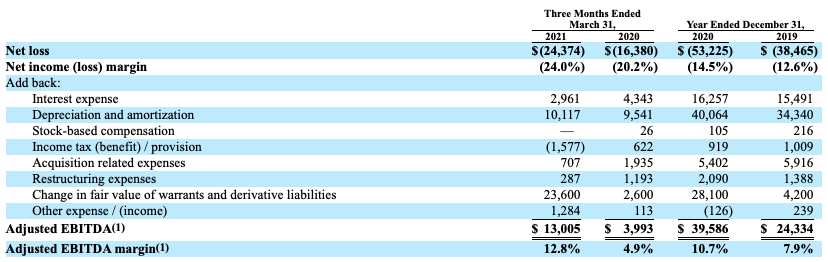

But if we turn to adjusted profitability, the picture flips somewhat neatly. Here’s the data we need:

Image Credits: Zeta Global S-1

Do note that time flows right to left in this table, not left to right.

What does the table tell us? That as a percentage of revenue, Zeta is increasingly profitable on a heavily adjusted basis.

In this case, I don’t hate giving adjusted metrics some due, as the costs from “change in fair value of warrants and derivative liabilities” are somewhat non-operating, as far as expenses go. And for companies with a growth focus, I don’t spend too much time worrying about depreciation and amortization line items.

So, its adjusted profits are a bit more material than they might be among other companies’ own results, if that makes sense.

With a rising adjusted EBITDA result and improving adjusted EBITDA margins, Zeta has a profit story to tell investors along with possibly accelerating revenue growth. The combination should allow the company to post a healthy revenue multiple when it does list.

Speaking of multiples, at what price was Zeta last valued? PitchBook data indicates that Zeta was worth an estimated $1.3 billion back in 2017 when it raised a growth round. But we lack more recent valuation data from when Zeta raised more equity capital in 2018.

All we can ask ourselves, then, is whether the company is worth at least $1.3 billion. Because it’s operating on a run rate of more than $400 million, the answer feels like an obvious yes. Surely the software company can manage a better multiple than 3x. So, it has a somewhat low bar to cross, provided that its final private equity valuation wasn’t steeply higher than the round we know a bit about.

Got all that? Add Zeta to your list of unicorn debuts to watch. There are going to be more in short order.