While it would be nice to write about something other than yet another tech company looking to list via a SPAC, the deals keep dropping, so our more traditional fare of covering startup trends will remain on hold for at least one day more.

This morning, we’re looking at the Jam City deal to merge with DPCM Capital. Jam City is a bit like Zynga, but unless you are a mobile-gaming aficionado, you might not have heard of it.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

You likely have not heard of DPCM Capital, either, but you know more about it than you’d think.

As Jam City notes in a release, the SPAC is “led by Emil Michael.” Michael is most famous for his time at Uber, where he served as chief business officer. He left the firm, as The New York Times wrote in 2014, after a board-called “investigation into [the company’s] culture and business practices” led to a “recommendation for Mr. Michael to exit Uber.”

He’s the gentleman who floated the idea of funding a team to “dig up dirt” on Uber’s “critics in the media,” as BuzzFeed News reported in late 2014.

Regardless, we’re not here to go back through Uber and its various cultural messes. We’re here to dig into the Jam City SPAC deck to see if the company is similar to Zynga. Why do we want to know that? Because Zynga has done great in recent quarters, including posting record revenue and bookings in the first three months of 2021.

Regardless, we’re not here to go back through Uber and its various cultural messes. We’re here to dig into the Jam City SPAC deck to see if the company is similar to Zynga. Why do we want to know that? Because Zynga has done great in recent quarters, including posting record revenue and bookings in the first three months of 2021.

With lots of folks stuck at home in the last year, gaming has done well in aggregate. And mobile gaming is a huge chunk of the larger gaming world.

More broadly, why do we care about Jam City’s SPAC transaction? Because the mobile gaming concern has raised more than $300 million, including a $145 million round in 2019 that TechCrunch covered here.

The company attracted capital from Austin Ventures, Netmarble, Bank of America Merrill Lynch and JP Morgan Chase while private, per Crunchbase, so we’re very curious if Jam City has enjoyed a Zynga-like last few years and how it’s being valued as part of the SPAC deal. Let’s find out.

Jam City’s SPAC transaction

When Jam City raised that huge 2019 round, co-founder and CEO Chris DeWolfe said that the “global mobile games market [is] consolidating.” At the time, the company intended to use some of its new funding to acquire other mobile gaming companies.

Now, as Jam City looks to list via a SPAC, it intends to use some of the resulting funds to buy yet another mobile gaming rival. This time it’s Ludia, a gaming shop the company claims will bring “compelling new intellectual property and gaming genres to [its] catalog.”

The IP point is key. IP can form the core of a popular, enduring mobile game. You can see this in Pokemon Go perhaps most famously, but the concept applies to other titles and franchises as well. Zynga, for example, considers its well-known, enduring titles like Zynga Poker and Words with Friends to be “forever franchises.” Jam City uses the same terminology in its SPAC investor deck, describing the group of titles as “includ[ing] [its] most enduring games with $100 million+ LTB and continued Jam City investment.”

LTB refers to lifetime bookings, of course. And IP can lead to more forever franchises, and, perhaps, long-term growth.

In more financial terms, DPCM Capital is bringing $300 million to the table as part of the deal. The combination also includes $100 million in PIPE funds, or private investment in public equity funding. Some $175 million of the capital will go to Ludia shareholders as part of that deal, while $88 million will go to venture backer Austin Ventures. Another $88 million is set to cover certain debts, it appears.

Jam City will retain $115 million on its balance sheet after the transaction closes and will sport an enterprise value of around $1.2 billion when it is completed. What do we think of that valuation? Let’s talk about what we know, and don’t.

A lesson in un-disclosures

We went through the Jam City investor deck (here), the Jam City-DPCM press release (here), and its investor call (audio, transcript), and after all of that, we are not sure how much GAAP revenue the company generated in 2020 or before. Nor are we sure how much GAAP revenue it expects in 2021. What we do know — unless we missed something — is a lot about Jam City bookings and its future growth expectations.

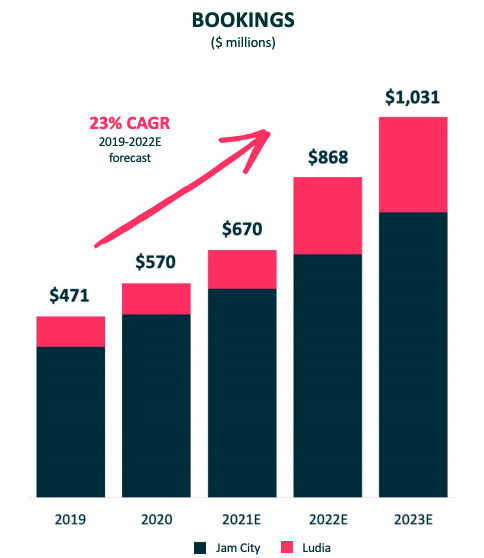

The company does provide a chart of its historical and anticipated bookings in its investor deck, which is useful to a degree. The company defines quarterly bookings, for example, as its monthly paying users, or MPU, multiplied by its average bookings per monthly paying user, or ABMPU, multiplied by three. More broadly, Jam City defines bookings as “revenue recognized in the period, excluding related-party revenue, excluding acquired deferred revenue, plus the change in deferred revenue during the period.”

So we have bookings, not revenue, even though Jam City is, per its above definition, tying the two closely together. Here’s the chart that we have:

Image Credits: Jam City

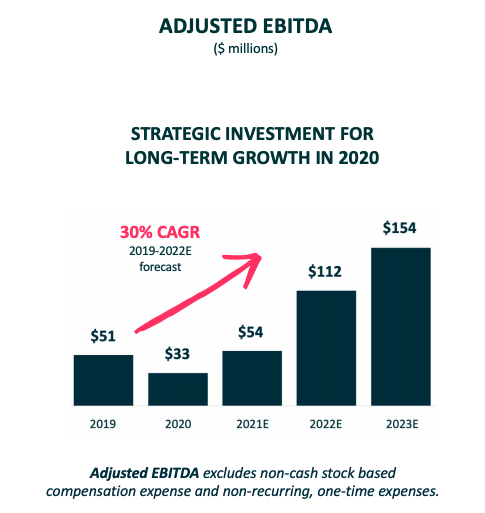

That set of results has generated, and is anticipated to earn, the following non-GAAP, adjusted earnings before various costs:

Image Credits: Jam City

Jam City also discloses in its deck that it had “net losses of $4.6 million and $4.0 million in years ended December 31, 2019 and 2020, respectively.” Its modest, anticipated 2021 adjusted EBITDA is similar to its 2019 result, a year in which it posted a net loss. So, don’t bet the house on the company generating GAAP net income this year.

Turning away from its general dearth of hard metrics, the Jam City SPAC deal is effectively a bet on its ability to juice Ludia for growth. Scroll up to the revenue chart and observe how much growth the company expects from Ludia in 2022. Jam City, per its deck, forecasts a “2.5x” increase in bookings at the company from 2020 to 2022.

In fairness, Jam City has a history of boosting bookings at acquired companies. Investors, however, are being asked to anticipate strong operating gains from Ludia as part of its 2022 value calculations. Vet that as you will.

All told, the Jam City SPAC deal could be rather neat. Zynga just kicked the hell out of its Q1 results, warming the waters for its smaller rival to make a notable splash. But instead of leaving our work today convinced that Jam City is healthy and hale, we’re stuck mostly annoyed by a lack of transparency from it. A dig through recent SEC filings from DPCM didn’t help.

Not to harp on the Emil Michael point too much, but I suppose that I am not entirely shocked that a person who has a known bias against the press isn’t big on sharing details.