I was a first-time CEO who had just finished Techstars with my co-founders when the pandemic hit last March. I remember sitting alone in my basement room in Boulder, Colorado, in sweatpants, while connecting with my advisers. They confirmed my biggest fear: Warmly, our startup, had just three months of runway left in the bank.

It was every founder’s nightmare around that time: I’d be forced to fundraise amid a global pandemic.

Of course, venture capital investors weren’t taking in-person meetings then, which meant pitching over Zoom. As opposed to late-night drinks, coffee chats while strolling along the Embarcadero in San Francisco, and Sand Hill boardroom meetings (environments where I thought I could excel), I was stuck in a basement.

You should definitely have two versions of your deck: The pre-meeting deck you send to potential investors and the “Zoom deck” you use during your livestream meeting.

Whether I asked friends, mentors or Google, no one seemed to have any good tips for connecting with investors virtually. But I learned as I went, adopting new technology to assist in the VC fundraising process, and we were able to close a $2.1 million seed round in August. Phew.

While we might have thought virtual fundraising would impossible when the world shut down one year ago, I don’t think anyone believes that anymore. Not only is it more efficient — no expensive trips to San Francisco or trouble fitting investor meetings into one day — virtual fundraising helps democratize access to venture capital.

Founders can raise money from investors based anywhere in the world, and investors can consider startups from anywhere, too. My investors today are from California, Colorado, New York, Massachusetts, Illinois and the U.K. And so far, I haven’t met a single one of them in person.

It was tough to raise a seed round without a lot of guidance or tools. But since then, apps and new technology have emerged to help boost a founder’s chance of getting an investment. I wanted to share how I did it and some of the tools I’ve found most useful — or wished I had — while connecting with investors.

Be intentional about standing out

Imagine you’re a VC taking 10 meetings a day with startup CEOs. It all starts to blur together after a while, doesn’t it? I had to learn to stand out, so I was intentional about connecting with investors on two fronts: First, I used alternative connection platforms like Icebreaker to shake up how I connected with my investors. They expected a generic Zoom link, but instead I asked them to start with an icebreaker. At the earliest stages, venture capitalists invest in the person or the team because your business isn’t fleshed out yet. I thought it was imperative that I helped investors get to know me on a deeper (or quirkier) level to stand out in the area that actually mattered most to them.

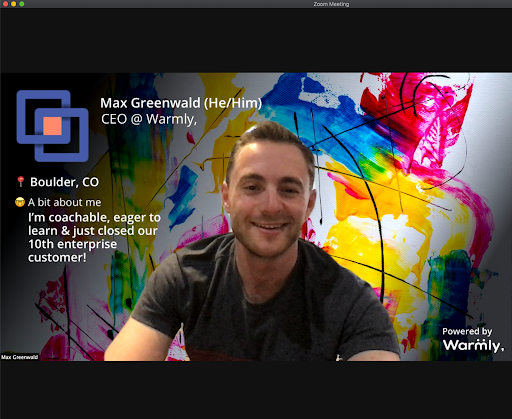

Second, when you do use Zoom, use great virtual backgrounds. I’m a huge proponent of virtual backgrounds like those you can make on Kapwing — or you can steal some of ours that we generated internally. My company’s web application utilizes virtual background “nametags” so participants can easily get (and give) details about everyone they meet. Pretty much every investor I met with couldn’t help but comment on my virtual backgrounds. It’s the easiest possible way to break the ice and be remembered.

Max Greenwald, Warmly CEO. Image Credits: Max Greenwald

Change up your deck to adapt to the virtual medium

You should definitely have two versions of your deck. The first version is the one you send out to investors before a call or as a follow-up, 10 to 15 slides with all your data inside it — the problem you’re solving, the technology, TAM, team, any growth metrics, how you’re going to use their money and so on.

The worst thing you can do is try to present that same deck on Zoom. It’s so easy for an investor to lose focus, start reading slides and stop listening to you. That’s why you need a separate “Zoom deck.”

This deck should be short and sweet, with just four slides and zero reading involved beyond a few words and pictures. That’s what you present to investors so they can focus on you and you alone.

A couple of tools I used to make my virtual decks better? Demoflow helps personalize each and every deck and presentation to the unique investor you’re pitching. If your investor has a question that isn’t in the deck, the app allows you to easily slide in materials that address it.

Another strategy I used was converting my slides into virtual backgrounds on mmhmm while I appeared in front of them. This allowed me to stay front and center and connect with my investors, instead of having my face become a tiny blip in the corner of a screen.

Get to know everyone, even the associates

A really common conundrum in VC pitching? Moments before a virtual meeting, an investor adds several people to the call that you didn’t know would be attending — meaning you don’t have time to stalk them and think of anything interesting to say about their background!

Getting caught cold-footed when the managing partner shows up is never a good feeling. You really need to brush up on the investments they’ve led over the past several years if you want their vote of confidence. Warmly lets you know right away if someone is added to the call and ensures you’re up to speed on who they are and how to pitch them — instantly available right from inside Zoom.

Another critical tip? I’m a big believer in including everyone in the meeting, even if they’re not leading the discussion or making the final decision on an investment.

The VCs who committed the fastest to our seed round were those where I treated the associates and principals as equals by directly asking them questions about what they liked, or didn’t.

If you focus on those relationships, they can be your biggest advocates internally, whether you know it or not. If you want a good way to include everyone, use an app like Macro, which captures the discussion in each meeting and recaps who spoke the most and who spoke the least. On your follow-up call, make sure you acknowledge those who didn’t get much of a word in the meeting before by asking them direct questions.

Take notes

What’s discussed in investor meetings can be pretty high stakes. While you’re trying to present your concept, business plan and competitive landscape, you also have to be listening to the feedback you’re learning along the way and making sure you’re 100% accurate in your numbers.

Let’s say you forget the three doubts the investor had about your company after the call. How can you write a kick-ass follow-up email addressing them head-on? Trust me, they won’t follow up to remind you. Or, in the heat of the moment, if you mess up their willingness to budge a certain amount on the valuation you’re gunning for, it can be a difference of millions of dollars down the road.

Note transcription tools like Docket and Scribe are a nice way to remember what you and your investors talked about while on the call. For follow-ups, second meetings and filing purposes, it’s critical to have documentation of all your investor meetings.

Snippets of your success

I adopted the idea of “snippets” during my fundraise as I was going back and forth with investors. The idea is simple and rooted deeply in human psychology: Every time you interact with a VC, no matter how small the interaction, always include one snippet of information that gets them more excited about you and your business.

These snippets have two key outcomes: They share you or your business in a positive light when a VC may be too busy to track your every move, and they help a VC get to know you faster than if you had to explain all of this in just a meeting every few weeks (you can’t afford to spend six months raising).

A classic mistake is to send an email such as “It was great to meet you, Investor; here’s my schedule, if you’d like to grab another time to chat.” You might not realize it, but every interaction is an excuse to get just a tiny bit more of that VC’s mindshare. Instead, consider writing:

“It was great to meet you, Investor; I’m so happy to report we just closed our 10th customer!” Or, “I’m looking for books on startup leadership. Any recommendations?” This iterative, foot-in-the-door approach allows the recipient to feel like they’re about to get to know you faster.

Snippets show you’re motivated, coachable, personable, and allow you to seize the chance to show at least one more positive thing about yourself in each and every interaction. I used Mixmax’s template and “send later” functionality to ensure I was sending updates and snippets to potential investors on a regular basis.

Even though in-person drinks and coffee walks are on the horizon, virtual fundraising isn’t going away. It’s imperative to ensure your virtual pitch is as effective as your IRL one.