The Honest Company, a heavily venture-backed consumer goods company, announced an IPO price range this morning, telling investors that it expects to sell shares in its debut at $14 to $17 apiece. The former startup is selling 6,451,613 shares in its debut, while existing shareholders are letting 19,355,387 shares go.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Honest’s IPO is not very large. The company’s own offered shares are worth $109.7 million at the top end of its range. Furthermore, because the company’s final private raise was worth $200 million back in 2018, it’s a comparatively modest sum.

Today, we’re digging into the Honest Company’s IPO pricing: We’ll calculate its IPO valuation range across a few different share counts, bring to bear its final private valuations and compare the entire dataset to its preliminary Q1 2021 numbers.

We care because IVP and Fidelity, Lightspeed and General Catalyst, ICONIQ and M13, Dragoneer and others put capital into the Jessica Alba-founded company worth just over $500 million while private, according to Crunchbase. That’s an enormous bet.

We care because IVP and Fidelity, Lightspeed and General Catalyst, ICONIQ and M13, Dragoneer and others put capital into the Jessica Alba-founded company worth just over $500 million while private, according to Crunchbase. That’s an enormous bet.

Per its filings, Alba remains the company’s chief creative officer and chairs its board.

We owe it to our general understanding of the venture market to better understand what Honest is worth and why. Is this a company going public while markets are hot so it can try to limp across the finish line? Or is Honest something honestly more exciting? Let’s find out.

Honest Company’s IPO worth

Using a simple share count of 90,518,137 outstanding after its IPO, Honest is worth $1.27 billion to $1.54 billion at $14 to $17 per share. On a fully diluted basis, Renaissance Capital calculates that the former startup is worth $1.6 billion at its midpoint value, a figure that we estimate rises to around $1.75 billion at the top end of its anticipated price range.

Are those strong numbers? There are two ways to measure; against the company’s final private price, or we can use its recent financial performance as a yardstick.

On the first count, the answer appears to be yes, though not to an incredibly strong extent. Honest Company’s 2018-era private equity round was raised at a valuation that no one appears to have, though we can compare share prices to get an idea. Per the company’s S-1/A filing, that round was raised, in part, at a per-share price of $9.8024 for Series F preferred stock and $5.7500 for common stock.

At $14 to $17 per share, investor L Catterton did fine in its investment, provided that Honest prices inside its proposed interval, or higher.

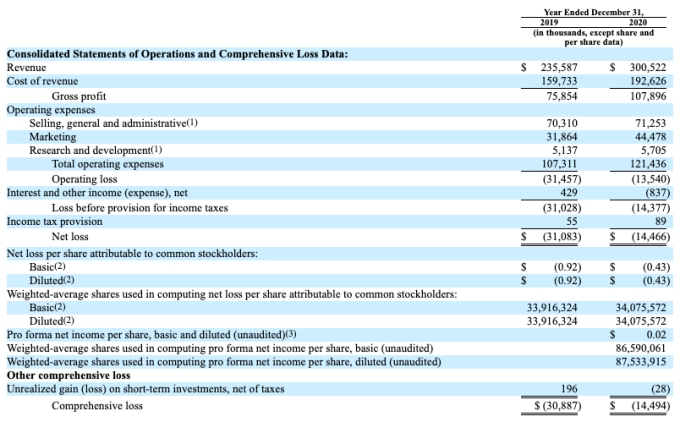

Do I expect it to? A brief financial rundown will provide the answer. The company’s income statement paints the picture of a company that managed to grow during the pandemic while reducing its deficits:

Image Credits: Honest Company S-1/A

Not too bad, yeah?

Observe how the company’s operating loss fell by more than 50% in 2020. Even more interesting, the company swung from adjusted losses in 2019 of $9.7 million to a 2020 adjusted EBITDA result of $11.2 million. That’s encouraging, even if adjusted EBITDA is about as real as mid-2010s reality TV.

In less good news, Honest still consumes cash to run, burning $12.1 million in 2020 to fund its operations. That figure was an improvement from its 2019 result, but the company’s mid-30s gross margin doesn’t create enough room for the company to self-fund. At least yet.

And the company’s historical growth is only so impressive. In each of the first two quarters of 2020, Honest Company had revenues between $72 million and $73 million. In the final two quarters of the year, those figures rose to $77 million and $78 million. In the first quarter of 2021, the company thinks that it posted revenues of $78 million to $80 million. That’s at best 11% year-over-year growth during the same quarter that the company expects to have fallen to at most adjusted EBITDA breakeven, a decline from year-ago Q1 adjusted profitability.

Hmm.

At the top end of its Q1 2021 revenue range, Honest Company closed March on a $320 million run rate. That means that its $1.75 billion diluted valuation is worth 5.5x its current run rate. That’s not strong compared to most venture-backed companies we’ve covered in recent weeks. But unlike, say, a high-margin SaaS business, Honest doesn’t have similar gross margins or revenue stickiness. It’s a fundamentally different business, and that explains why it is shooting for a single-digit multiple.

I do not know how to value the company. It’s outside our normal remit, but that Honest Company is getting out the door at what appears to be a workable price gain to its final private round implies that investors earlier in its cap table are set to do just fine in its debut. Snowflake it is not, but at its current IPO price interval, it is hard to not call Honest a success of sorts — though we also anticipate that its investors had higher hopes.

Returning to our question, do we expect the company to reprice higher? No, but if it did, The Exchange crew would not fall over in shock. Hell, a final IPO price anywhere from $12 to $20 per share would not be a shock. More when we get a final price or a new range.