Twitter is abuzz with the news that Topps, a company perhaps best known for making collectible trading cards, is going public via a SPAC.

The reverse merger with its chosen blank-check company values the combination on an equity basis at $1.163 billion. That makes Topps some sort of unicorn. And because it has both e-commerce and digital angles, Topps is technically a fruit tech company.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Why do we care? We care because Topps and its products are popular with the same set of folks who are very excited about creating rare digital items on particular blockchains. Yes, the baseball card company is going public in a debut that could easily be read as a way to put money into the NFT craze without actually having to buy cryptocurrencies and go speculating itself.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

So let’s have a small giggle as we go through the Topps deck and then ask if the company is being valued on its actual, and modestly attractive, present-day business or on possible revenues from future NFT-related activities.

So, trading cards

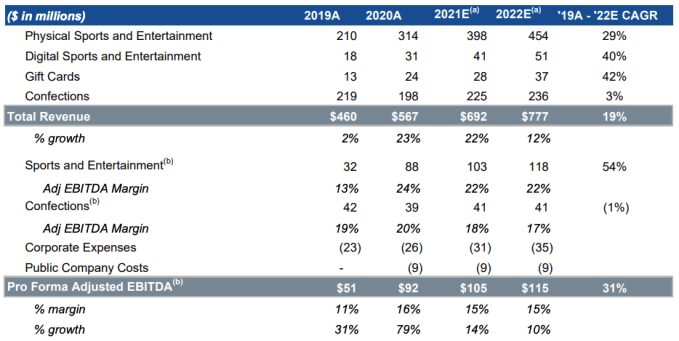

What is Topps? A mix of business units that it breaks down into four categories: Physical Sports and Entertainment (trading cards), Digital Sports and Entertainment (digital collectibles, apps and games), Gift Cards (gift cards for external brands) and Confections (candy).

In terms of scale, the company’s physical goods and confection businesses are by far its leading revenue drivers. Here’s the data:

Image Credits: Topps investor presentation

First, observe that the company’s pro forma adjusted EBITDA nearly doubled from 2019 to 2020. That’s an aggressive expansion in hyperadjusted profitability. Note how much the company’s physical sports business grew from 2019 to 2020; a nearly 50% gain helped the company grow nicely last year.

Looking to the 2021E column, a set of estimates, it is clear that Topps expects the collectibles craze we’ve seen in recent quarters to continue. To understand the collectibles boom, simply impute the same mania that has led bored capital and overactive minds to pump meme stocks and apply it to baseball cards and other such items.

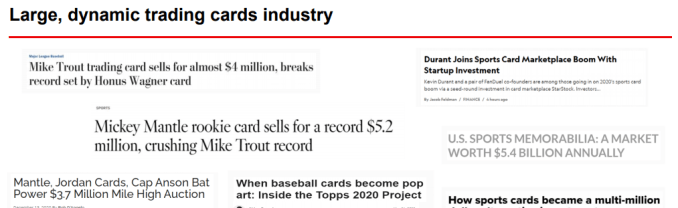

Topps wants you to believe that the speculative mania in rare trading cards will persist, as such a situation could help lead to more general market interest in its products. Here’s a slice of a slide from its SPAC deck that is, if I may, hilarious:

Image Credits: Topps investor presentation

Sure.

There are some good things about Topps. It’s somewhat diversified in that it sells its goods across many channels and is expanding its IP lineup to keep new stuff coming. The company partnered with Marvel in 2018, Disney in 2019 and Formula 1 in 2020, for example.

But I reckon the reason most folks will be interested in Topps isn’t that it anticipates 22% revenue growth in 2021 to $692 million, or that it expects its pro forma adjusted EBITDA margin to fall 100 basis points to 15% this year.

No, I reckon it’s this:

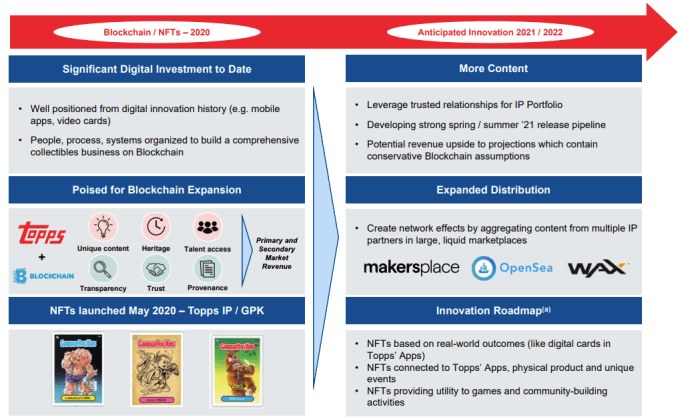

Image Credits: Topps investor presentation

Just look at that blockchain logo.

It turns out that Topps got into the NFT game back in 2020 with its Garbage Pail Kids line of digital items. And in the future the company intends to build “incremental revenue opportunities” by leveraging “other Topps properties and licenses” on blockchains.

Doing so, the company figures, will provide “primary and secondary market revenue.” That means selling new digital items and taking a cut of their resale. Fair enough! Marketplaces are a business, after all, and there is trading going on in the world of NFTs, as we can see here.

But what if you don’t think that Topps is going to rock the NFT game and that its theoretical mining of the digital token world for more revenues from its core remit of turning other people being good at stuff into goods won’t pan out? The bad news is that the company’s growth projections are inclusive of “conservative blockchain assumptions.” There is no escape!

The company expects its digital business to grow from 5.5% of its business, or $31 million in 2020, to 6% of its 2021 estimated revenues, or $41 million. That’s modest. Topps also anticipates its candy business to add 70% more revenue this year than all of its digital efforts will turn in.

So the Topps SPAC is an odd one. You can’t get away from the fact that the company has had reasonable recent revenue growth. Or that some of its business efforts are rather attractive from a margins-and-profit perspective. But I doubt that many investors would be super excited about buying into a legacy card game they best remember from their childhood if it wasn’t for the chance of more upside, likely coming from the NFT game.

If you are an NFT bull, then Topps might be well, tops for you. Otherwise, I can’t imagine picking the company out of the discount bin that is the modern SPAC game.

The Exchange will be on hiatus until Monday, April 12.