What happens to hot fintech startups that have benefited from a rise in consumer trading activity if regular folks lose interest in financial wagers?

That’s the question facing Robinhood, Coinbase and other trading platforms that have ridden an upward cycle. Each has performed well in recent quarters: Robinhood by securing huge payment-for-order-flow revenues, while Coinbase’s trading fees have proven incredibly lucrative, something we learned when it filed to go public.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

According to recent reporting, the consumer trading frenzy could be slowing: Bloomberg recently noted that options trading volume is slipping, Robinhood’s app store ranking is falling, and some alternative assets are also losing steam. Other reporting from the publication notes that many SPAC shares are underwater while Google trends data indicates falling consumer trading interest, perhaps limiting the inflow of new users for equities-focused apps.

There are other indications that the red-hot speculative consumer market is cooling. Bitcoin is off around 10% in the last week after a blistering rise in recent quarters. Hot stocks like Peloton, once a darling of traders, fell more than 10% yesterday alone.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

There’s a historical precedent for such declines. Coinbase’s historical revenues, to pick an example, have proved variable based on consumer interest in cryptocurrencies, with the company benefiting from rising demand and trading activity and seeing its top line decline in periods of restrained enthusiasm.

Robinhood and its fellow free trading apps have yet to undergo a similar rise-and-fall in trading volume, I’d reckon. At least of the sort of extreme up-and-down that Coinbase endured after the 2017-2018 bitcoin boom. Our question is, what would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues? Let’s talk about it.

Coinbase’s historical revenue declines, and the Robinhood example

Coinbase was a famously lucrative organization during the 2017-2018 bitcoin boom.

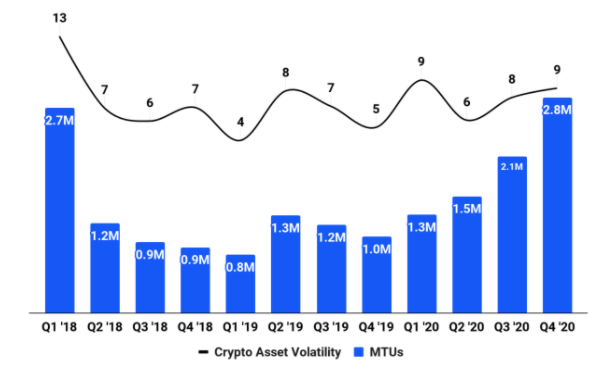

Indeed, we can see from the following chart from its S-1 filing that the company’s monthly transacting users (MTUs) dropped sharply into 2018. The percentage decline from 2.7 million to 800,000 is just over 70%.

Image Credits: Coinbase

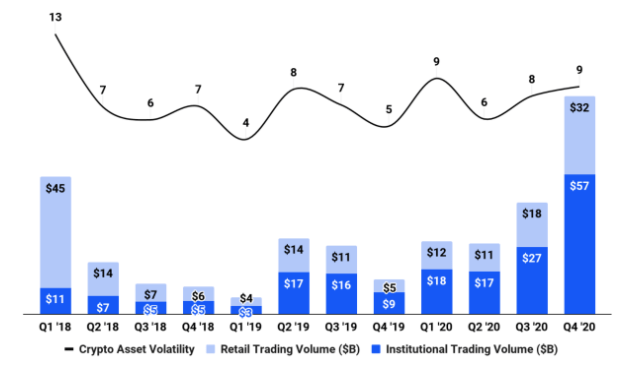

And in case you think we’re being rude, we have a related chart from the same SEC filing that shows trading volume falling over the same period, not merely MTUs. We’re not picking a loose proxy to merely infer that trading revenue dipped at Coinbase. We can show it:

Image Credits: Coinbase

From $56 billion in Q1 2018 to $7 billion in Q1 2019. That’s steep.

None of this is to mock Coinbase, mind; it’s a trading business based on an asset class that has greatly appreciated in market value over the last year or so. That’s a great spot to be in! And the startup has capitalized on its moment well, recording huge revenue gains as it has worked on its product stack. Well done.

But Coinbase is more boat-on-the-tide than Poseidon-god-of-the-sea, so while it can be commended in financial terms for its recent performance, the unicorn isn’t driving bitcoin’s larger macro-fortunes. A point that brings us to Robinhood.

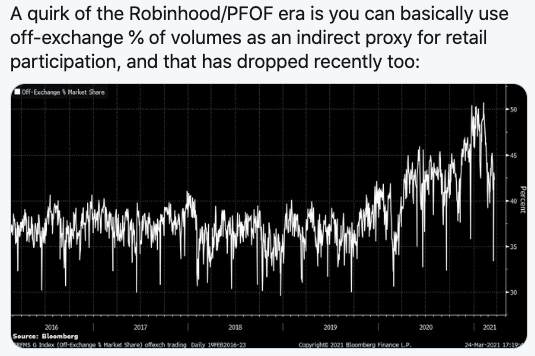

Bloomberg’s Justina Lee noted the following data in a Twitter thread concerning her aforementioned column:

Image Credits: Justina Lee/Bloomberg

That’s not the sort of trend you want to have while you are working to go public, though I doubt heartily that any recent declines in consumer trading intensity will truly show up in Robinhood’s numbers until Q2 2021, provided that the cooling we’re seeing actually continues. It may not.

If the above chart isn’t great for Robinhood’s implied future growth prospects, we can gin up a similar graph for Coinbase. Bitcoinity data shows that weekly bitcoin trading volume on Coinbase has fallen from a high of around 351,000 bitcoin in the week ending January 10, 2021, to just over 150,000 in the week ending March 24, 2021. That’s steep.

And it could go right back up! That’s the nature of speculation, trading, consumer interest, fads and the like.

But thematically the idea of a reset makes sense. Software multiples couldn’t just keep expanding forever. Bitcoin going from $50,000 to $100,000 overnight was, well, not in the cards. The pandemic trade in companies like Peloton is fading, for now at least, as the virus starts to abate in the face of rising vaccinations. And consumers may find something else to do with their money than use it to trade. All of that just sounds reasonable.

Hell, my friends are even telling me about their options plays with declining frequency. Data hints to a cooling speculative environment among consumers, which matches my anecdotal experience, and perhaps yours.

So, what’s ahead for our two trading giants? We know that Coinbase and Robinhood had hot starts to the year. The question is what happens to their revenues in coming quarters if both see consumer trading slow. The good news for their existing backers is that each has nontrading incomes to fall back on. The bad news is that while that’s true, if Coinbase proves to be the rule rather than the exception, such revenues are minute compared to aggregate trading fees.

From Coinbase’s S-1 filing: “For the year ended December 31, 2020, transaction revenue represented over 96% of our net revenue.” That’s as near as spitting to 100%, or a business that is completely trading-dependent. If Robinhood is similarly balanced, we’re looking at two companies for whom sequential-quarter revenue declines are not out of the question.

A question that we can now ask before Coinbase direct lists and Robinhood approaches the public markets as well.

Fun times ahead. Stay tuned.