It’s that time again! Today is Demo Day for Y Combinator’s latest accelerator batch — its largest to date, with more than 300 teams getting a minute each to pitch their companies to an audience of investors.

This is the third time YC has held its Demo Day via a Zoom livestream and the second time the entire program was entirely virtual. YC president Geoff Ralston outlined their thinking for this latest batch — and how/why they’ve expanded the program to over 300 companies — in a post this morning.

Want to see all of the companies? YC has a catalog of the entire Winter 2021 batch here (minus those that haven’t publicly launched), filterable by industry and region.

If you don’t have time to skim through it all, we’ve aggregated some of the companies that really managed to catch our eye. This is part one of two, covering our favorites from the companies that launched in the first half of the day.

As Alex Wilhelm put it last time we did one of these, “we’re not investors, so we’re not pretending to sort the unicorns from the goats.” But we do spend a lot of time talking with startups, hearing pitches and telling their stories; if you’re curious about which companies stood out, read on.

Prospa

Prospa is building a neobank for small companies in Nigeria. The startup charges customers $7 per month and has reached $50,000 in monthly recurring revenue. That’s some pretty darn good traction. We found Prospa notable because Nigeria’s economy and population are rapidly growing, neobanks have succeeded in a number of markets thus far, and the company’s clear business model and early traction stood out.

And Prospa isn’t targeting a small market. It said during its presentation that there are 37 million so-called “microbusinesses” in its target country. That’s a lot of scale to grow into, and it’s really nice to hear from a neobank that isn’t going to merely pray that interchange revenues will eventually stack to the moon.

— Alex

Blushh

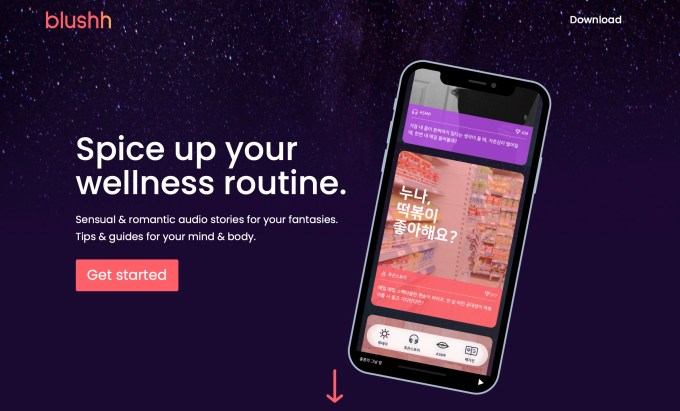

Image Credits: Blushh

Blushh, built by a team of ex-Google, Amazon, Harvard and BCG professionals, is creating a directory of short, sensual audio stories for women in Asia. The startup believes that there is a massive unmet need for adult content created for women, instead of men, signing up 100 paying subscribers within its first month on the market.

During their pitch, co-founder Soy Hwang said Blushh wants to do for sexual wellness what “Spotify and Audible did for music and audio books.” This startup stands out because it is taking on an untapped market ridden with stigma and lack of innovation. It’s a risk on several levels, and considering the fact that many venture capitalists today still have a “vice” clause that prevents them from investing in sex tech, it will be key to see how Blushh funds itself to keep growing.

— Natasha

BrioHR

TechCrunch caught up with BrioHR a few weeks ago when the startup announced that it had closed a $1.3 million round. During its presentation, the company announced that it had reached $13,000 in monthly recurring revenue (MRR), or $156,000 in annual recurring revenue (ARR).

The company is building human resources software for companies in Southeast Asia, a market it considers fraught with old software and outdated business processes. The company is doing two things. First, building software to help manage and pay workers. The latter part of its work requires lots of localization, so it’s rolling out more slowly than the rest of its software.

If Southeast Asia is as fertile ground for modern HR software as the United States has been shown to be, BrioHR could find more than enough room to grow. I’m excited to see how far the company can scale its ARR with the round that we recently covered.

— Alex

Charge Running

Strava walked so Charge Running could, well, run. The startup, founded by a former Navy SEAL, app connoisseur and kinesiology specialist, is an app that offers live virtual running classes. The consumer play is being framed by the team as a “Peloton for running” with motivation and social engagement during the run.

To date, Charge Running has brought in over 1,300 paying subscribers at $30 monthly subscription, about a $39,000 monthly recurring revenue. Features include group chats, a running DJ, as well as stats and notifications. There’s even a tool to build and hold virtual live races.

The pandemic has revitalized consumer interest in running as people head outdoors to exercise. In 2020, for example, running app Strava added 2 million new users to its platform. To me, that screams room for more apps that ride the same type of social suaveness of Peloton. In Charge Running’s case, it’s in a great spot because it doesn’t require users to buy an expensive heap of hardware either — just some sneakers.

— Natasha

ClipDrop

Creating clean product shots for a small business is harder than it should be, generally requiring a trip into Photoshop and the knowledge/time required to manually mask out backgrounds.

ClipDrop automates that workflow, tapping computer vision to handle the lasso’ing legwork. Users snap a photo on their phones (or send it into the desktop app), it instantly masks and clips out the background, then passes them an image ready to be dropped right in wherever they need it, be it Photoshop or a retail site.

Built by a bunch of ex-Googlers, ClipDrop began life as a research-project-gone-viral when co-founder Cyril Diagne first showed off the tool’s ability to “copy and paste” from the real world. They’ve spun those algorithms into a cross-platform suite of tools and are currently charging around $50 per year to process unlimited images. The company says they’re seeing $24,000 in monthly recurring revenue five months after launch.

— Greg

Emerge

Mobile apps naturally tend to get bigger and bigger over time. More features tend to mean more frameworks to integrate, more code to keep track of, and more bugs to iron out … and less dev time spent on just keeping downloads and updates as small as possible.

For users with limited bandwidth or slow download speeds, these overly large updates can be frustrating and/or costly — which, of course, can turn into negative reviews.

Emerge automatically monitors and analyzes the size of iOS apps from build to build, automatically suggesting ways to make an app smaller (like optimizing images, removing duplicate files or stripping binary symbols) with each pull request.

It might not seem like the shiniest of problems to tackle, but a few megabytes saved here and there compounded across your entire user base can be huge. Co-founder Noah Martin previously spent five years focused on reducing app size at Airbnb.

— Greg

Kodo

Taking an idea that works and putting it to work elsewhere in the world is a quick way to scale a startup. Kodo, in its own words, wants to build the Brex for India. But what’s good for Kodo is that the United States’ market for Brex, and other corporate spend-management startups, has proven to be so large that many players are thriving (Ramp! Airbase! Divvy! It’s a long list.) The Indian market could be similarly deep.

Kodo co-founder Deepti Sanghi said during her presentation that the issues that led to Brex and other corp-card startups to thrive in the United States are even more acute in India; I wonder if that could lower her company’s customer acquisition costs over time, perhaps making the economics of Kodo attractive.

So far traction looks reasonably good, with the company stating that it is “on track” for $10,000 in monthly revenue in March along with an anticipated gross transaction volume of $680,000 for the same time period.

American investors have found Kodo’s domestic comps to be so attractive that they have showered them with funds. Let’s see if Kodo can tap similar sentiment to keep scaling its similar product in India.

— Alex

Alba Orbital

Satellite imagery is obviously a large and growing market, and it is fast dividing into a number of distinct niches, from hyperspectral imagery to super accurate height maps. Alba Orbital is taking on a niche that was really only recently proven to be a possibility at all by Planet: high-frequency orbital snapshots.

The company has been around for a few years, but many companies with orbital ambitions fizzle out before they get there. Not so with Alba: The company has now put six muffin-sized satellites in orbit to prove out its pitch of imaging the planet every 15 minutes.

You may wonder why we need every 15 minutes rather than every hour or two, as Planet has reliably provided with its huge constellation. In the contest of agriculture, it may not make a difference. But for the purposes of search and rescue, traffic monitoring, crowd evaluation, and other tasks, every minute counts.

With a low BOM of around $10,000 per satellite and launch costs dropping on ever more frequent rides to orbit, Alba has a real chance to provide a competing service to Planet and others.

— Devin

Djamo

Financial inclusion remains a major hurdle in developing economies, but the last few years have seen a growing guard of startups that are leveraging the rise in smartphone penetration, cheaper data services and innovations in fintech to address that, building not just an interesting wave of new businesses, but bringing up society along with it.

In one of the latest turns, Djamo, founded out of the Ivory Coast, is building a challenger bank aimed at the French-speaking market in the region.

Djamo is using a playbook that is now familiar to many people in developed markets — taking basic banking services that have largely become commoditized, and building a more dynamic and user-friendly interface and set of services around that, which in turn get accessed via a smartphone app — but one that is just starting to gain steam on the continent. (Another interesting player, Kuda, out of Nigeria, is building an English-language app that is growing quickly). In Djamo’s case, its first services are focused on building a way to manage pre-paid Visa cards and the money people load up and spend on them.

Notably, Djamo is targeting one of the poorest and most underserved populations on the continent, but also a very sizable one: francophonic Africans are estimated to number 141 million, with only 25% holding traditional bank accounts. This means that if challenger banks can crack that nut, Djamo might really take off.

One detail that might signal a strong next chapter for the startup is its founders. Hassan Bourgi, the CEO, previously found and sold a bus ticketing platform in Latin America to Naspers; Regis Bamba, the CTO, has spent years working for one of the biggest telcos in the region, MTN, building mobile money services.

You can read more about them here.

– Ingrid