Recently public unicorn Upstart announced earnings that blew the socks off of Wall Street this week. After closing on Wednesday at around $61 per share, Upstart wrapped Thursday worth $115 per share. It turns out that all the blather we’ve had to endure about artificial intelligence (AI) in the past decade is coming true, at least in certain applications for select companies.

But Upstart’s blockbuster guidance for 2021 is just a sliver of the story. The AI-powered fintech is projecting a year so good that its valuation nearly doubled yesterday, but there are other shoots of life in the AI world worth discussing, and investors are taking note.

Per a new data set I spent this morning chewing on, VCs are firing cannons of capital into the AI startup world while exits reach new records.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Real-world financial output coupled to historically strong venture capital activity — and new technologies dripping into the tech upstart world at a record clip — are creating whole cloth new use cases for AI tied to lots of capital access. It’s all very exciting.

This morning, I want to discuss Upstart and its quarterly results. I spoke with CEO Dave Girouard yesterday, which yielded some notes on AI-powered tech adoption rates among more conservative companies. Then, we’ll peek into PitchBook data on global AI-focused startup fundraising and their exit market.

After that, we’ll start to come up with a list of GPT-3 powered startups, my new favorite thing aside from pastries. Sure, we’re not as laser focused today as we are most mornings, but the AI world has me jazzed, so I can’t help but talk about it. Let’s go!

After that, we’ll start to come up with a list of GPT-3 powered startups, my new favorite thing aside from pastries. Sure, we’re not as laser focused today as we are most mornings, but the AI world has me jazzed, so I can’t help but talk about it. Let’s go!

Upstart expects 114% YOY growth in 2021

In its first earnings report as a public company — you can read The Exchange’s coverage of its IPO here and here — Upstart reported Q4 2020 revenues $86.7 million (up 39% on a year-over-year basis), while its 2020 revenues totaled $233.4 million (up 42% on a year-over-year basis).

The quarter was a strong revenue beat, and a beat on adjusted profits. But it’s what the company has coming next that really stuck out. Here’s its CFO:

[F]or Q1 of 2021, we are expecting total revenues of $112 million to $118 million, representing a growth rate at midpoint of 80% year over year [ … ] For the full year of 2021, we now expect revenue of approximately $500 million, representing a growth rate of 114% year over year[.]

The street had expected just under $102 million in revenue for Q1 and $453.5 million for the year. So, up went Upstart’s stock on the back of a good quarter and the promise of an even better year.

How in the flying hell is Upstart projecting so much growth in 2021? In short, AI-powered lending is taking off as its models are “gaining velocity,” Girouard said, adding that the pandemic has proven to be a “transitional time” for his sector. He noted that Quicken Loans saw huge market share gains during the 2008 financial crisis and said the COVID-19 crisis could provide a similar chance for Upstart to snag more share.

Upstart uses AI models to quickly determine creditworthiness; users ask for a rating, which it provides, and then the company earns a fee from banking partners who handle the resulting loan. The company is winding down holding loans on its own books, making it a pure-play software company with a business model heavily tilted toward consumption pricing, though it is building a SaaS product for smaller banks.

If Upstart anticipates big revenue growth in 2021, it’s expecting not only lots of consumers using its service but also a host of banking partners signing up or taking more volume from the former startup. Or both.

On the new customer front, Upstart is sitting between credit-seekers and banks that are “swimming in deposits,” said Girouard. What the company needs is for large, cash-rich banks to adopt its service. And what those banks need is credit volume to put their deposits to use. So today’s market dynamics might provide the AI-powered service a boost. That partially explains its expected growth in 2021.

The other piece is rising comfort with its tech. AI-powered credit decisions are still new to banking, a sector famed for risk aversion. If Upstart hits its 2021 numbers, we will be able to read into them broader adoption of AI among old-guard firms.

All that is as interesting as it is, but what should matter is that in-market AI financial products are operating at scale in a manner that is far beyond experimental. Machine intelligence at scale is now at least as good as humans at determining credit risk among consumer buyers, and I am sure that Upstart would argue it has surpassed its flesh-and-blood rivals.

The Upstart IPO and its monster inaugural earnings report aside, is its success a stand-alone data point, or does it fit into a larger trend?

Rising AI funding

Sticking to my goal of ruining in-column suspense with overly prosaic subheadlines, Upstart’s success in the AI space doesn’t appear to be a fluke. Leaning on a PitchBook report discussing 2020 AI funding and product trends, we can quickly see that in action. Per the data company’s findings, the fourth quarter of 2020 “set a record for quarterly AI and ML VC funding” with some $15.6 million put to work around the globe.

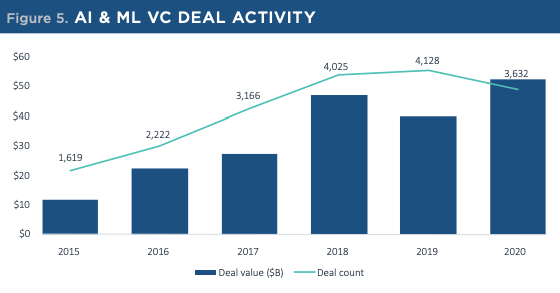

All told, PitchBook counts $52.1 billion in global aggregate AI funding in 2021, also a record. Here’s the venture capital chart:

Image Credits: Pitchbook

Sure, deal volume appears to have dipped in 2020, but the trend there shows what I’d call mature market growth; VCs are still putting more money than ever into AI startups, linearly. Exit trends are even more clear. Per Pitchbook, some 212 AI exits around the world generated $49.6 billion in liquidity. In 2019, 204 exits were worth around $30 billion, eyeballing their chart. In 2018, a far-fewer 108 deals were worth around $12 billion.

Upstart’s performance helps explain the venture capital market, partially because it adds to the exit totals from 2020, but also because I now presume that other, related AI-powered companies are also not full of shit when it comes to what their models can do. Speaking of which:

Look at all these startups leveraging GPT-3!

This week, I covered the Copy.ai funding round. And then I got to play with Headlime. It was all very good fun.

But there are other startups that are messing around with GPT-3, including ShortlyAI, which I tinkered with this morning, and Anyword, which I have not yet played with but sounds cool. The company, in an email to TechCrunch, described its product as using GPT-3 to help “marketers easily optimize the words that they use,” along with writing. And there’s Pencil, among others that I have yet to uncover.

The Exchange is trying to get access to the GPT-3 playground. More if we get in and get to play around. Until then, happy Friday. We’ll see you in the email tomorrow morning.