Every once in a meme-ified blue moon, the wildly irrational cryptocurrency ecosystem gives birth to something that might outlive the hype.

The crypto art hype may be silly and expensive, but it might also empower artists from emerging economies and underrepresented groups to access the global art market in ways that they couldn’t before.

On March 5, Twitter CEO Jack Dorsey auctioned off a blockchain receipt, called a non-fungible token (NFT), for a screenshot of his first tweet in 2006, and bids for it promptly exceeded $2.5 million. Since 2018, people have spent roughly $237 million on NFTs, with the vast majority of those funds spent since the trend exploded in January 2021.

The crypto art hype may be silly and expensive, but it might also empower artists from emerging economies and underrepresented groups to access the global art market in ways that they couldn’t before.

Bryana Kortendick, VP of operations and communications at the NFT startup Enjin, said the platform is now tallying more than 47,426 registered users, and the corresponding NFT wallet’s growth is up 100% since December 2020. Her company was funded by a token sale in 2017 that amassed 75,041 ether (ETH), worth more than $130 million today. Kortendick declined to comment on how the cryptocurrency treasury is managed, other than to say they have enough runway for the startup’s continued growth because “Enjin has retained a portion of the funds raised through our ICO in ETH.”

As of 2021, Kortendick said the wallet app’s fastest-growing markets include the United States, Korea, the United Kingdom, Iran, Germany, Canada, India, Indonesia, Turkey and Australia. In sanctioned countries like Cuba, Iran and Venezuela, NFTs provide one of the only ways for up-and-coming artists to transact with global art collectors. It can also be a way for dancers to make money by selling NFTs with GIFs showcasing specific moves or NFTs that allow video game characters to dance a specific move.

“There has been an influx of new [app] users in countries like Iran, and we are working to localize the app accordingly to make it more accessible for these growing markets,” Kortendick said. “We recently saw a surge of [web] users in Cuba too, which prompted us to translate our entire website into Spanish.”

A new world coming under compliance

It remains to be seen if that type of market activity is sustainable, with regard to compliance across jurisdictions.

The U.S. Treasury penalized the crypto company BitGo in 2020 for allowing users to transact with people in sanctioned countries. Maintaining financial sanctions appears to be one of the regulator’s priorities in 2021. In any case, companies can delist artists and pieces, which means anyone who isn’t fluent in command-line Ethereum tricks can lose access to their NFTs. It will still exist “on the blockchain,” yet it would be quite a stretch to call NFTs “permissionless” art, as many blockchain advocates do.

In the meantime, emerging market artists sometimes make a few hundred or few thousand dollars a month, a potentially life-changing amount that is still a pittance compared to celebrity NFT sales. Just like with most art and collectibles selling for millions of dollars each, as Bloomberg reporter Tracy Alloway put it, “People keep describing NFTs as digital collectibles but they’re really digital bragging rights.”

By the time Dorsey hopped on the NFT train in March, thousands of people were already trading Ethereum-based NBA cards and video game assets and Mirror tickets to crowdfunding campaigns for independent writers. If you can imagine it, there’s probably already an NFT of it, somewhere.

Building wealth

Many of the lucrative celebrity sales are happening on the Winklevoss-owned NFT marketplace Nifty Gateway.

According to Nifty Gateway spokeswoman Carolyn Vadino, the platform now serves more than 150 NFT creators and 24,000 NFT users. Some people buy NFTs to collect them, while others trade them via the platform’s secondary market. Nifty Gateway charges a little more than 5% for every secondary sale and allows the artist to charge up to 50% for secondary sales as well.

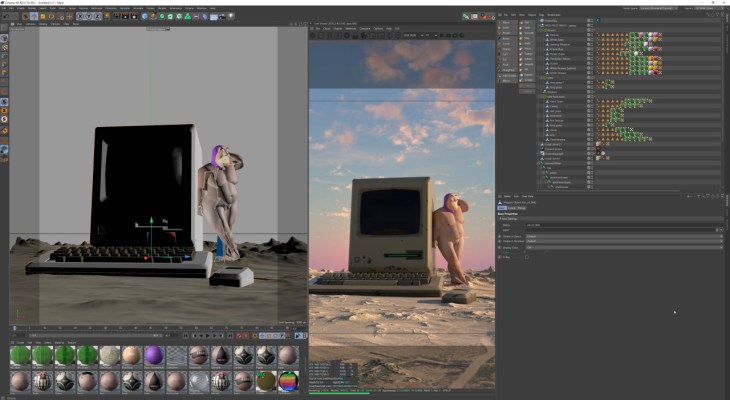

Some of the top artists emerging from the NFT boom include painter Trevor Jones, video game creator Marguerite deCourcelle, and digital art veteran Mike Winkelmann (aka Beeple). Beeple has been making NFTs since October 2020, when he started transforming freely available Instagram posts into Ethereum-based collectibles in order to monetize his audience.

“Sometimes, if you buy the NFT you get this physical object. Also, the Instagram post is a still image. The NFT can be more like a video, panning around the image, showing the details,” Beeple said. “It’s one of the easiest ways to add additional value to the work you’ve already released.”

He has been making digital art for nearly 20 years, usually in the form of corporate projects for companies like Louis Vuitton and Apple. Beeple said that before he earned nearly $6 million selling NFTs in the past few months, he didn’t really have fans or collectors. He’d only sold a few prints from his own website and showcased hobby art projects on platforms like Instagram to attract freelance advertising clients. Beeple said NFTs propelled his career from that of a designer to an independent artist. Now, his work is displayed in virtual galleries and museum collections.

“The everyday work I did on my own, it wasn’t something I could sell before. It got my awesome freelance gigs like Louis Vuitton and Apple. This is a huge difference,” he said about how NFTs changed his life. “I’m not looking for any more client work unless it’s a super cool project.”

Influencers and building the NFT economy

The NFT trend can arguably be seen as a positive development in North American art markets, where the top galleries and museums often have collections made primarily by white male artists.

Major league baseball player turned artist Micah Johnson said Black artists, in particular, have already developed a vibrant NFT community with fewer barriers to entry than the traditional art world. In Johnson’s case, he said he makes roughly 10% on royalties anytime someone resells his NFTs on Nifty Gateway.

“Some artists have a community behind them that is really strong and active in supporting the NFT artist,” Johnson said. “With NFTs, you also have more liquidity in the secondary market than in the physical world.”

These NFTs aren’t mere images. Johnson’s Black astronaut character named Aku, for example, is a multimedia storytelling production by a team of creatives. As such, the collectible NFTs depict pivotal moments in the character’s story arc. He plans to release 10 Aku NFTs this year and has already garnered more than $2 million for this series.

“We’re using NFTs for people to collect pieces from a bigger picture,” Johnson said. “We’re going to have an Aku social page because for a couple years it will be fun for people to follow. I won’t be running it, though. I’m not good at social media.”

On the other hand, there are many social-media-savvy artists that have managed to rise from obscurity to earn a living wage from the NFT economy. Such is the case with the London-based street artist Vector Meldrew, who makes NFTs that correspond with multimedia pieces. If you scan a QR code on the street art and view it in your camera via the Instagram app, the character dances.

“Street art is about getting the message out there and giving something to the community. That’s what I was doing … especially during the London lockdown,” Meldrew said, “offering AR experiences that people could engage with and have a fun experience with even though all the art galleries are shut down.”

Meldrew released his first NFT in October 2020 and was able to support himself by selling NFTs full time by January 2021. He plans to make a multiplatform story with these characters, using mediums like film and video games. He plans to follow a decentralized storytelling model, which he kicked off by giving away more than 120 NFTs via Lindsay Lohan’s favorite NFT platform, Rarible.

“I figured the collectibles were a way to engage more people with the stories and wider community I wanted to build. That led to sales of the bigger and more unique pieces with a higher price tag,” Meldrew said. “It’s not actually about begging studios and gatekeepers for a few million pounds; it’s about building this organically through NFTs. … It will be similar to Patreon except that the people who pay a subscription are essentially token holders.”

A world of blockchains and NFTs

It’s clear that some independent artists can earn income from creative NFT sales, even beyond the speculative mania.

Likewise, celebrities can sell pretty much any digital product, even screenshots of their own public tweets. (Dorsey tweeted that his NFT auction ends March 21 and proceeds will be donated to charity.) It’s unclear how long the NFT mania will last, considering most NFT users rely on platforms like Rarible and Nifty Gateway. A minority of users may learn software tricks to manage these blockchain assets directly, without relying on any platforms.

Historically, as with HTML and blogging, it seems most creators and consumers rely on platforms that simplify distribution and search. At least for the near future, the NFT market depends on Ethereum companies like Infura and MetaMask, both owned by Ethereum co-founder Joe Lubin. In the years to come, the corporate service providers that eventually dominate the NFT market might not be Ethereum companies at all.

There are many technologists working on bridges to help NFT users transfer their assets across other blockchains, beyond the Ethereum ecosystem. There are already some bitcoin-based NFTs, although they haven’t garnered millions of dollars (yet) because celebrities and influencers are flocking to Ethereum in 2021.

Yet another up-and-coming alternative blockchain in the NFT economy is called Flow. Kraken CEO Jesse Powell, who co-founded the Verge Center for the Arts in 2008 and listed the Flow token in January 2021, said Kraken has seen more than $514 million in cumulative trading volume for Flow. Clients have also staked a total of 20 million Flow with Kraken, he said, worth more than $715 million. The future of NFTs might be a bitcoin ecosystem or a world of many competing blockchains. Only time will tell.

Stay tuned

In this Extra Crunch series, we’ll explore the sustainability of the NFT phenomena, from compliance issues and technical challenges to which sectors of this oversaturated market still have white space for brands and creators to grow.

From Beeple’s perspective, he likened the NFT craze to the dot-com bubble.

“When the dot-com bubble burst, people didn’t stop using the internet,” Beeple said. “If you provided a website with actual utility, real value, it survived … eventually you won’t need to know anything about crypto. That will just be the back end.”

To that end, Beeple said there’s ample room for NFTs to proliferate across creative industries, from movies and music to fashion and fine art. Indeed, Kings of Leon recently made a small fortune selling NFTs that can be redeemed for front-row concert tickets in perpetuity.

“Each of these categories has huge room for growth, a lot of them we haven’t seen really play out yet because of COVID. When you’re able to have big events, with ticketing and things like that, you’re going to see even more use cases for NFTs,” Beeple said. “It’s like asking what is a use case for the internet? There’s a billion different things.”

Stay tuned next week for an edition about NFTs and the fashion industry. There’s lots of money to be made in the NFT world, beyond temporal bull markets. This is only the beginning.

“We’re really excited about interoperability,” Kortendick added. “Fashion brands are finding unique ways to engage their customers. … We also have ongoing conversations with people in the entertainment industry, such as dancers and other performers. We’re looking to make a standard for dance NFTs.”

Update March 17, 2021: Clarified language regarding Enjin’s growth.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.