We’re putting aside the IPO news cycle this morning to check in on the venture capital world and the fintech market in particular.

As we all know, fintech is booming: Between Robinhood and Public and M1 Finance raising competing rounds, payment-tech startup Finix moving to diversify its cap table, and ideas that work in one market finding purchase and capital in others, it’s a damn good time to build financial technology.

But perhaps even with all that recent knowledge, we’re still missing the point.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

A provisional report from data and research group CB Insights indicates that we’re not merely in a warm period for fintech funding — we are in a period of all-time record investment for so-called mega-rounds, or investments of $100 million or more inside the fintech realm.

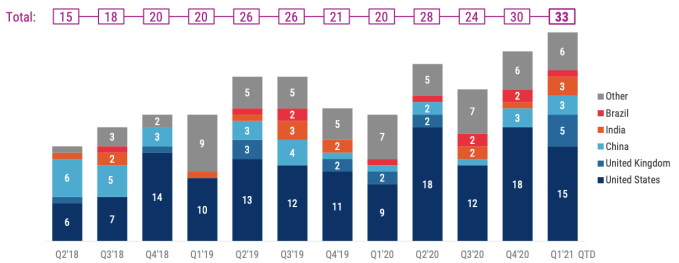

The first quarter of 2020 had stiff competition to overcome to set a mega-round record. The preceding period, Q4 2020, for example, saw 30 fintech rounds across the globe that were worth nine figures. But, to date, Q1 2021 is ahead and is thus guaranteed to set a new record, having already bested the preceding all-time high.

The first quarter of 2020 had stiff competition to overcome to set a mega-round record. The preceding period, Q4 2020, for example, saw 30 fintech rounds across the globe that were worth nine figures. But, to date, Q1 2021 is ahead and is thus guaranteed to set a new record, having already bested the preceding all-time high.

This morning we’re talking big money and fintech, with a splash of early-stage digging. I asked a CB Insights analyst about what appears to be falling fintech seed deal volume. Is this the result of data reporting delays inherent to seed data, the impact of SAFEs and other sorts of notes limiting visibility into the earliest stages of venture, or just a plain-old slowdown? Let’s find out.

Big, bigger, small, fewer

Per the interim CB Insights dataset, there have been some 33 fintech mega-rounds so far in 2021. For context, it’s more than 50% more such rounds in Q1 2020 and Q1 2019. Via the preliminary report, here’s the data:

Image Credits: CBI

We can parse a few key things from the chart. First, there is a general upward trend to the right in the data; this implies that the current quarter’s record is not an aberration, but instead the natural next step in a longer progression. And we can tell from the makeup of the Q1 2021 bar that it was a diverse quarter in terms of where large fintech investments were made.

The United States made up less than half of the number — unlike in prior record-setter Q4 2020 — with the U.K. coming in second, followed by China, India, Brazil, and a number of countries detailed as “Argentina, Australia, Canada, France, Germany, Hong Kong, Indonesia, Israel, Italy, Mexico, Netherlands, Nigeria, Singapore, South Korea, Sweden, Uruguay, and Vietnam” thus far in the first quarter.

Now, not all of those countries raised a $100 million or greater fintech round in the last two months and change. But the number of countries apart from the Fab Fintech Five that did raise a mega-round could set a record in the quarter. At six such investments, it’s tied for the second-best tally ever in a quarter. Three more inside of Q1 and the start of 2021 would have the most $100 million or greater rounds into fintech companies outside the most fintech-y markets ever.

Let’s see where the data winds up when the quarter closes.

But not all money that matters comes in huge checks. There’s a lot of investing activity that comes in far smaller increments that we still care about. Seed investing, for example. However, according to the same report, the percentage of total deal volumes made up of seed and angel deals fell to 31% in Q1 2021. Now, the data could still shake up before the end of the quarter, but that ratio of tiny fintech deals to the category’s total deal volume is the worst since at least 2018.

In that far-past quarter, seed and angel deals made up 45% of total fintech deal volume. The percentage has fallen over time, with declines starting in early 2019. From there it was a somewhat lumpy but regular descent to 35% of fintech deal volume driven by seed and angel rounds in Q4 2020, and the aforementioned 31% thus far in Q1 2021.

What’s going on? Alex Kern, an analyst at CB Insights, has a take. Asked by The Exchange why the percentage of seed fintech deals is in decline and if the falling numbers could be due to deal reporting lag, he had this to say:

More opaque reporting could certainly be a factor, but it’s also true that 2018-2019 were peak years for the fintech industry in terms of funding and deals. Today, there is a greater number of mature fintech companies, so this could be slowing down the pace at which seed- or angel-stage fintech companies are forming or receiving funding.

One possible implication of that statement — and I know that if you are a seed-stage investor, you disagree with it — is that we’re in between fintech innovation waves and that many ideas have matured to the point of record huge rounds, and the inverse when it comes to smaller-deal volume.

We’ve riffed before that the venture capital world — and fintech in particular — is getting later and larger over time. This all points in that direction.