2021 is going to be another glorious year for e-commerce.

It is that time of the year when most of us are looking back at the “total addressable market” estimates to plan for specific campaigns. Unlike us, if you had your 2021 kick off in Q3, bless your soul. You are an enlightened being.

For the rest of you, for whom e-commerce is a strategic market, I have a question — have you built your total addressable market (TAM) and serviceable addressable market (SAM) estimates for 2021 considering how things evolved in 2020?

It’s important to understand the underlying business model dynamics of companies and visualize TAM from those perspectives.

For most of us, research is a mind-numbing, repetitive exercise of clicking through links on Google until they all turn purple — at which point we start seeking the simplest possible explanation. For e-commerce, addressable market estimates come in the form of headlines from platforms like Shopify. The company quotes a merchant count number in its earnings calls and that becomes the basis for guesstimating the current TAM of e-commerce companies.

The other, rather simplistic approach is to look at the user-base count from several databases that publish tech platform-level user stats.

In reality, the simplest answer is not the right answer.

Mind the gap

Let’s take e-commerce shopping cart installations. Shopify, Magento, WooCommerce, BigCommerce and others publish installation numbers that run into millions.

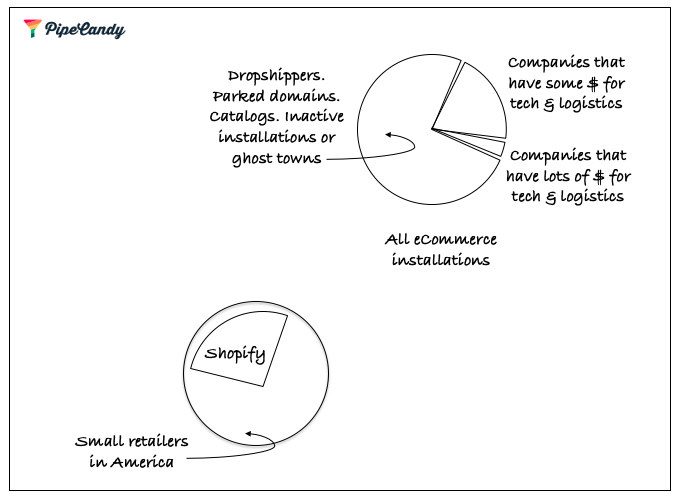

Here is the dichotomy that should frame your TAM discussions.

E-commerce is long-tail heavy. Yes, there are millions of merchants, but e-commerce revenue is a fat-tail phenomenon — meaning, a disproportionate amount of e-commerce revenue comes from a few tens of thousands of companies.

PipeCandy publishes bottom-up TAM estimates with detailed data cuts by technology, logistics and payment system adoptions by firms across revenue tiers across all major markets. One of the common misconceptions we see in how firms misinterpret TAM estimates is that they equate revenue to spend potential.

A multichain retailer’s spend potential, even if they fall under a low e-commerce revenue segment, could be more than a pure-play e-commerce company in an even higher revenue tier. So it’s important to understand the underlying business model dynamics of companies and visualize TAM from those perspectives.

Another case in point: There are about 1.4 million live Shopify installations PipeCandy counted as of early Q4. But the pie shrinks quite a bit when you look at only those companies that have the money to spend.

Here’s some quick math:

Image Credits: PipeCandy (opens in a new window)

Shopify’s entire active installed base (including all those companies that have less than $100,000 in revenue) is about 40% smaller when compared to the total TAM available for e-commerce enablers if you make a case that all retailers will adopt e-commerce. I will buy that argument.

Opening a store at the corner of the block is how America imagined entrepreneurship. Now, that corner is Shopify, Amazon and e-commerce. I am inclined to say Shopify will take U.S. small retailers online more than Amazon because of Shop App, which enables local discovery. They will facilitate more local commerce than Amazon in the coming years.

Amazon.com has always had more Chinese sellers than American sellers if you look at the top 10,000, 50,000 or 100,000 sellers, according to Marketplace Pulse. While they are trying to represent local businesses, Amazon’s philosophy is of best value to the consumer means that they cannot focus on local if they have to offer the best price.

Post-vaccine e-commerce

There will be an impact on e-commerce growth rates after vaccination. Usually, we point to consumer behavior changes, the familiarity that baby boomers have gained during the pandemic with online grocery shopping, and such. Will the behavior stick? It’s anybody’s guess.

But if I were to be deciding the budgets as a retailer in 2021, a significant portion would go to e-commerce and automation. Take the case of grocery. Microfulfillment and last-mile delivery/locker infrastructure will have to fall in place before consumers get close-to-date delivery slots. Massive investments are going into these areas already. Even as we vaccinate, it will be Q3 or even Q4 before we have near-complete vaccination — making e-commerce an even more ingrained habit.

If you are a demand-gen manager or corporate planning executive in a large e-commerce enabler (logistics, tech, finance, insurance, etc.), I would recommend a comprehensive scan of the market beyond e-commerce (e.g., small retailers, grocers), so that you don’t miss out on the upcoming expansion of the pie.

We wish you all an amazing year of growth in 2021. When you trust data, it’s no longer mere “hope!”